Hedera and everything to know about the network’s short and long-term outlook

- Hedera is still on a healthy growth trajectory with more than 150 projects on board

- Jorge Pesok gives his short-term and long-term take on the market

The last couple of weeks have been a rollercoaster for Hedera [HBAR] investors and traders. The cryptocurrency has been in free fall, after failed rally attempts. Last week’s FTX black swan was responsible for the market crash. Investor sentiment took a hit but Hedera’s chief legal officer Jorge Pesok’s statements during an interview may offer some solace.

Read Hedera’s [HBAR] price prediction 2023-2024

One of the key takeaways from the legal officer’s interview was that it has already issued grants to more than 150 projects. This meant that more than 150 projects were currently building on the Hedera layer 1 blockchain.

⚖️@HBAR_Foundation Chief Legal Officer @JPesok sat down with @craigdbarrett of @Crowell_Moring last week, sharing his insight on #Hedera, regulations, exciting use-cases, and more as a seasoned veteran of both #Web3 and the legal industry.

Read more⬇️https://t.co/4U5xYKg4EY

— Hedera (@hedera) November 12, 2022

Building towards organic utility, regulation and long-term growth

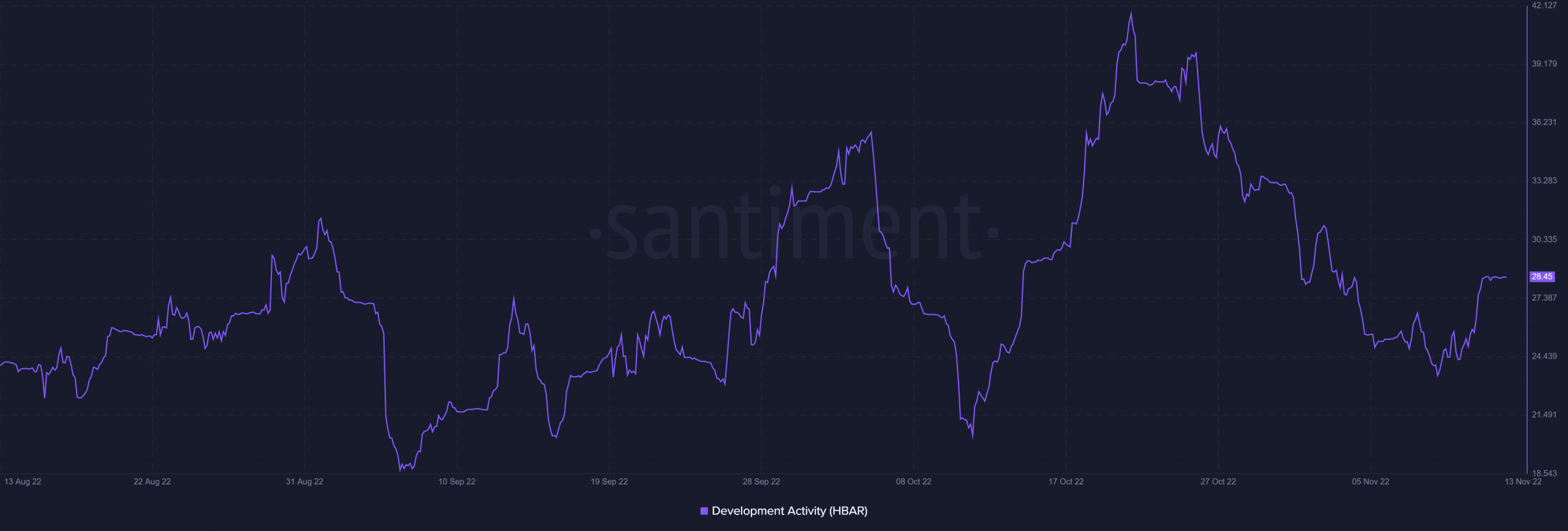

Such a large number of projects building on the Hedera network pointed towards robust potential value. This could be considered as the value that could contribute to long-term organic demand for the HBAR cryptocurrency. The large number of projects should also contribute to healthy development activity within the network.

The Hedera network also focused majorly on fostering development within the decentralized ecosystem. Nevertheless, it recognized the need for industry changes. Pesok acknowledged that regulatory uncertainty was one of the biggest challenges that the crypto industry was currently facing. Pesok had this to say regarding regulation.

“I think it is all interesting. That’s why I love the space. It keeps me on my toes and makes me stay on top of the recent developments.”

Pesok also expressed excitement about the use-cases that blockchain unlocked. He particularly acknowledged the problems that blockchain is solving in the remittance industry and the digital assets space.

When asked to make a prediction about the crypto market, the chief legal officer stated that he expected short-term headwinds to continue. He also noted that he hoped for a stronger recovery during the next bull run and stronger institutional demand.

A quick price check

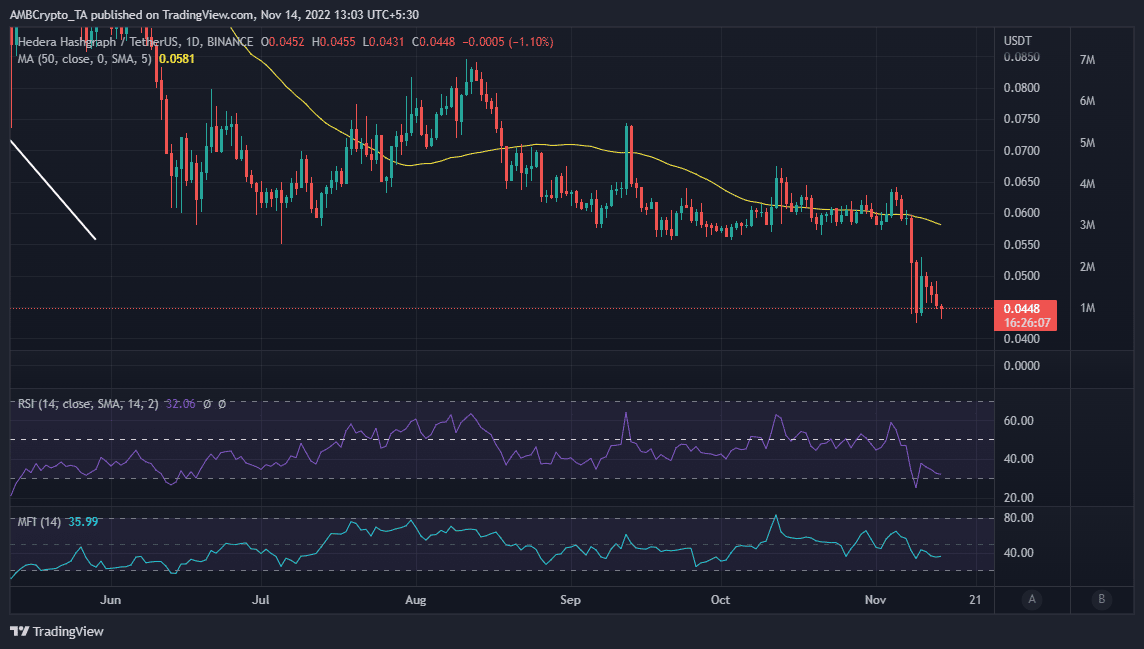

HBAR’s latest price action suggested that demand was yet to recover especially after last week’s bearish outcome. It traded at $0.44 at press time, which means it reverted closer to its current 2022 low.

Source: TradingView

We might see HBAR attempt some recovery in the next couple of weeks. However, this would require a favorable market sentiment shift. The sentiment of investors was still one of caution especially after the events that took place a week ago.

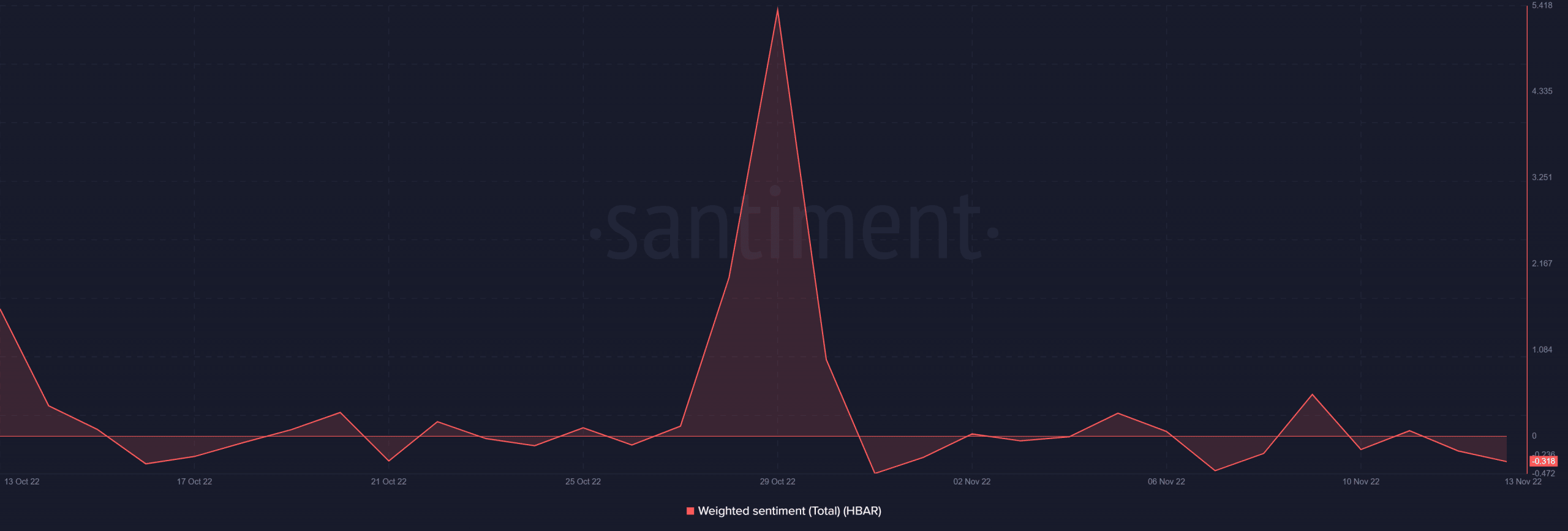

Furthermore, HBAR’s weighted sentiment was still leaning towards the bearish side.

Source: Santiment