Hedera’s funding rate, weighted sentiment were positive, is recovery likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- HBAR could aim at a critical overhead resistance level in the short term.

- Sentiment and Funding Rate was positive, which could bolster its uptrend momentum.

Hedera [HBAR] posted over 20% gains on Saturday, 21 January, after Bitcoin [BTC] moved to the $23K zone. The uptrend momentum saw HBAR reach a high of $0.0810. However, correction occurred after BTC fell back to the $22K zone.

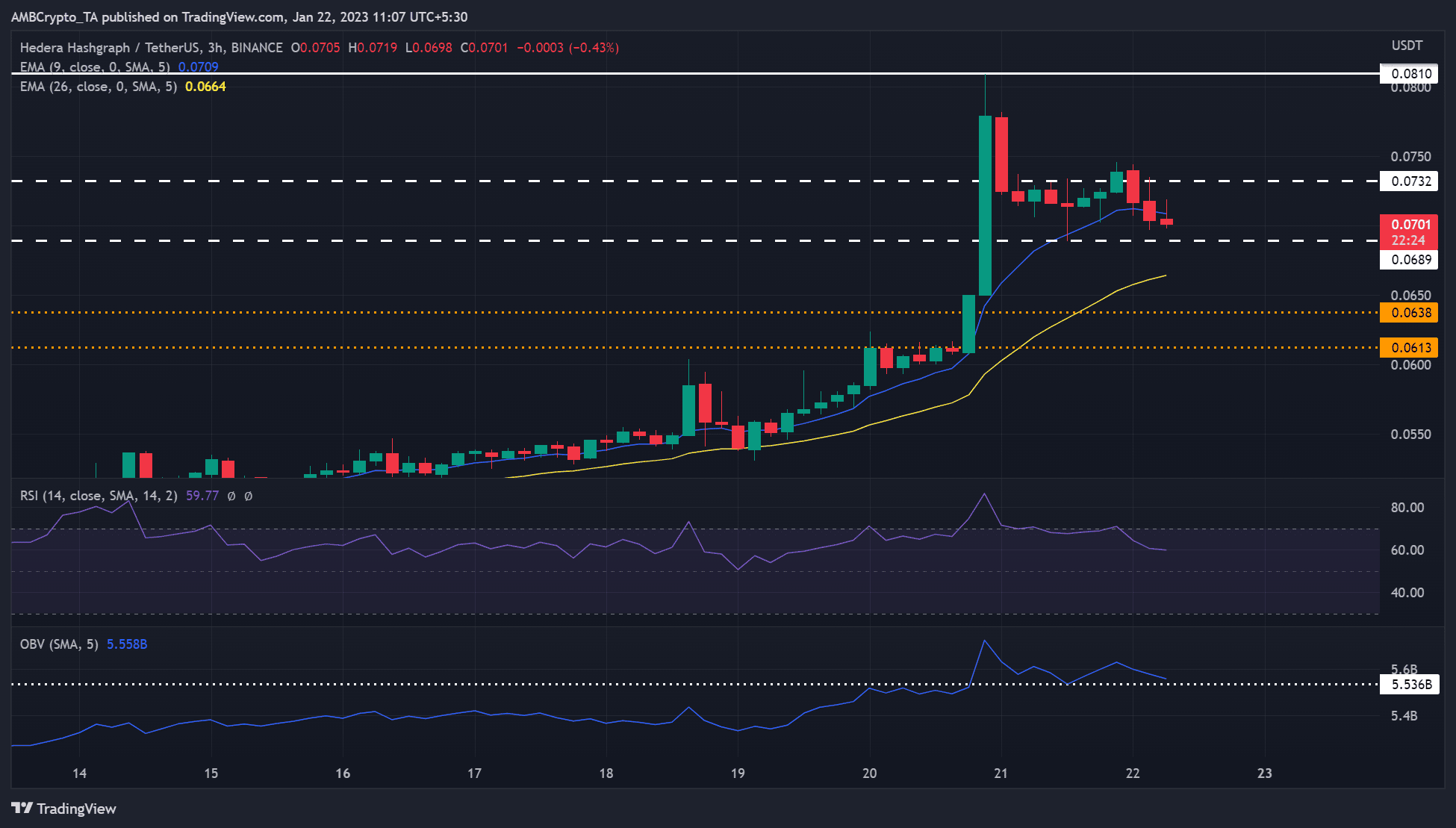

At the time of publication, HBAR’s value was $0.0701, as BTC maintained its $22K level. If BTC reclaims the $23K zone, HBAR could witness an upswing aimed at this overhead resistance level.

Read Hedera [HBAR] Price Prediction 2023-24

The overhead resistance level at $0.0810

The three-hour chart showed a bullish HBAR with an RSI (Relative Strength Index) of 59. The RSI had retreated from the overbought zone and rested on the 60 mark. It shows buying pressure declined slightly.

Historical RSI patterns showed rejection at the 60 or 50 levels. Therefore, the RSI could bounce back from 60 or an equilibrium level of 50, initiating a recovery. It could set HBAR to retest or break above the $0.0732 level and target the overhead resistance at $0.0810.

However, a break below $0.0689 would invalidate the above bullish bias. The downtrend could be checked by the 26-period EMA or the $0.0638 support level.

How much are 1,10,100 HBARs worth today?

Therefore, investors should watch for RSI and On Balance Volume (OBV). An RSI rejection at the 60 or 50 levels will denote a potential recovery. However, an OBV drop below the $5.54B level (white line) will undermine any uptrend momentum due to limited trading volumes.

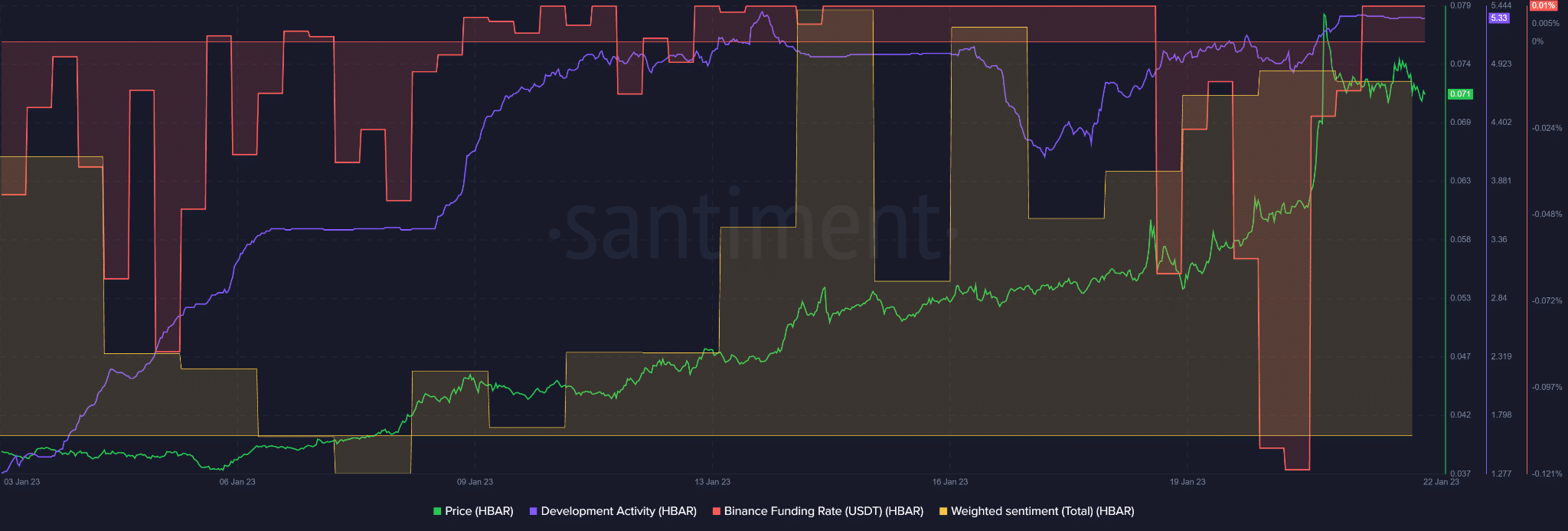

HBAR’s Funding Rate and sentiment were positive

According to Santiment, HBAR’s Funding Rate and weighted sentiment were positive, indicating the asset enjoyed demand in the derivatives market while investors’ were confident with it. This could boost the asset’s uptrend momentum.

The investors’ confidence could also be partly attributed to HBAR’s impressive development activity growth. However, the development activity was stagnant at press time.

Although the stagnation could affect the HBAR’s sentiment and price, BTC price action significantly impacts the asset’s performance. Therefore, investors should track BTC to gauge HBAR’s possible trend direction.