Bitcoin holders are avoiding leverage in the latest rally, here’s why

- Low demand for leverage gives insights into the current Bitcoin investor psychology.

- BTC enjoys demand in the derivatives market courtesy of a strong recovery in open interest.

Glassnode alerts just revealed that the amount of HODLed or lost Bitcoin is now at a 5-year high. This reflects the positive price action that the cryptocurrency has delivered in the last few weeks. This means BTC investors have been accumulating but despite this, leverage has been on a decline.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin trading with leverage gained popularity in the last few years. A great tool for traders when the market is going their way but not so much when things go sideways.

Many crypto traders have unfortunately suffered huge losses in the 2022 bear market and even during the current recovery. This is why it is interesting to see lower demand for leverage despite heavy HODLing.

? #Bitcoin $BTC Amount of HODLed or Lost Coins just reached a 5-year high of 7,562,069.403 BTC

Previous 5-year high of 7,561,969.550 BTC was observed on 04 November 2022

View metric:https://t.co/dJK8rxBVD3 pic.twitter.com/9PLAK2TH8i

— glassnode alerts (@glassnodealerts) January 22, 2023

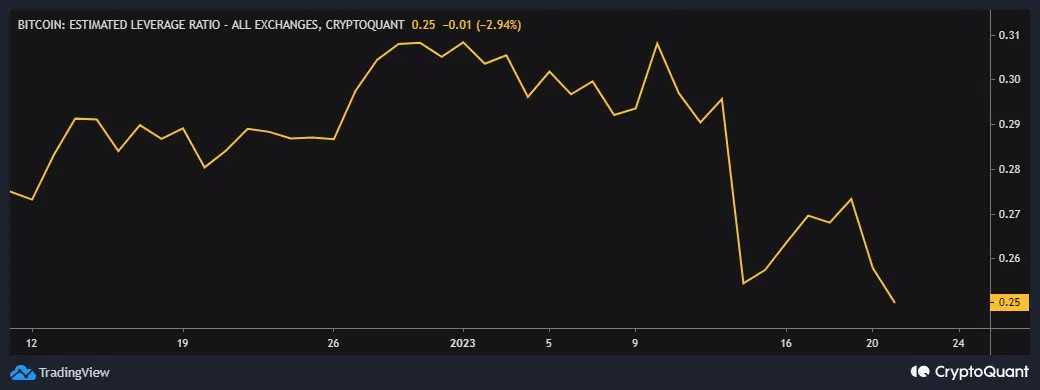

Bitcoin’s estimated leverage ratio has been declining since the end of December 2022. The last time it was as low as it currently is was in May 22. But what does this really mean for the market?

It suggests that more BTC investors are opening their eyes to the risks associated with leverage. Especially considering the highly volatile and uncertain nature of the crypto market.

This might actually be a good thing for BTC holders because it means there is not a heavy risk of leverage-induced liquidation. The liquidation of heavily leveraged trades is among the reasons why many have lost their BTC holdings in the past.

Bitcoin bulls are still dominant but for how long?

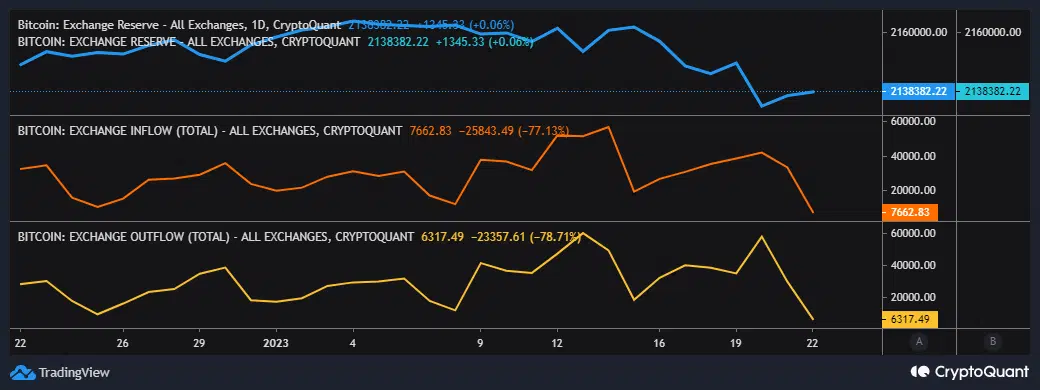

Bitcoin is still experiencing healthy demand, especially from the derivatives segment despite the lower demand for leverage. Open interest bottomed out just after mid-December after which a bullish pivot was observed. This might be a sign that investors in the segment, especially institutional buyers have also been accumulating.

The BTC bulls are starting to experience an increase in friction despite this demand from the derivatives market. A good example of this is the pivot we observed on the Bitcoin exchange reserve metric which suggests that there might be some incoming sell pressure. Unsurprisingly, exchange inflows outweighed exchange outflows at press time.

How many are 1,10,100 BTCs worth today?

Exchange flows have notably decreased in the last few days, which suggests that buying pressure might be losing its momentum. This means profit-taking may pave the way for an influx of sell pressure, especially after the rally in the last three weeks.

What to expect?

Now that the bulls are slowing down, the expectations of some retracement are notably higher. However, the low leverage may indicate that many BTC holders have a long-term bias, thus the low focus on leveraged trades. A potential implication is that we may see a weak retracement.