Hedera’s [HBAR] latest report highlights growth in these areas

![Hedera's [HBAR] latest report highlights growth in these areas](https://ambcrypto.com/wp-content/uploads/2023/01/1674581818442-6733ac7c-a57f-4581-8d38-1df088094c35-3072-e1674828575636.png)

- Hedera reveals a list of achievements it made in 2022 underscoring healthy growth.

- HBAR’s long-term outlook looks interesting but current price action is marked by indecisiveness.

The Hedera blockchain’s 2022 community update is out and the results of the network’s performance are in. And for those interested in its performance and that of its native crypto HBAR, here are some interesting findings to consider.

According to the latest posts, Hedera managed to achieve a speed of 18.98 transactions per second (TPS). As far as the transactions are concerned, it achieved 530 million transactions during the year.

Roughly 769,000 transactions were created during the year. These findings highlight healthy growth despite the unfavorable market conditions in 2022.

1/ 2022 was an incredible year for #Hedera – between our ever-growing community, consistent network upgrades, & a burgeoning dApp ecosystem, Hedera showed considerable growth with no signs of slowing.

Special thanks to @defigirlxoxo for this writeup?

— Hedera (@hedera) January 26, 2023

Hedera kept its community together through various events throughout the year. In addition, the report reveals that the network issued 195 grants targeting the expansion of its ecosystem.

These findings confirm the healthy state of the network, which means it managed to overcome the market challenges.

What does the future hold for HBAR?

The report findings do indicate that Hedera is in good shape in terms of network health. But not so much for the HBAR cryptocurrency. The latter is still down by more than 80% from its ATH despite its recent rally. It traded at $0.068 at press time, which represents a 91% uptick from the current 12-month lows.

HBAR kicked off this week with some selling pressure, which has turned out to be limited. This is because investors are still optimistic about their prospects this year, hence many are opting to HODL. Combining this with the findings in the 2022 report reveals that HBAR may be ripe with long-term potential.

Also, Hedera maintained healthy development activity since the start of January. This is a favorable template for HBAR’s long-term outlook because it may boost investors’ confidence. The favorable outlook is further supported by decent demand from the derivatives market.

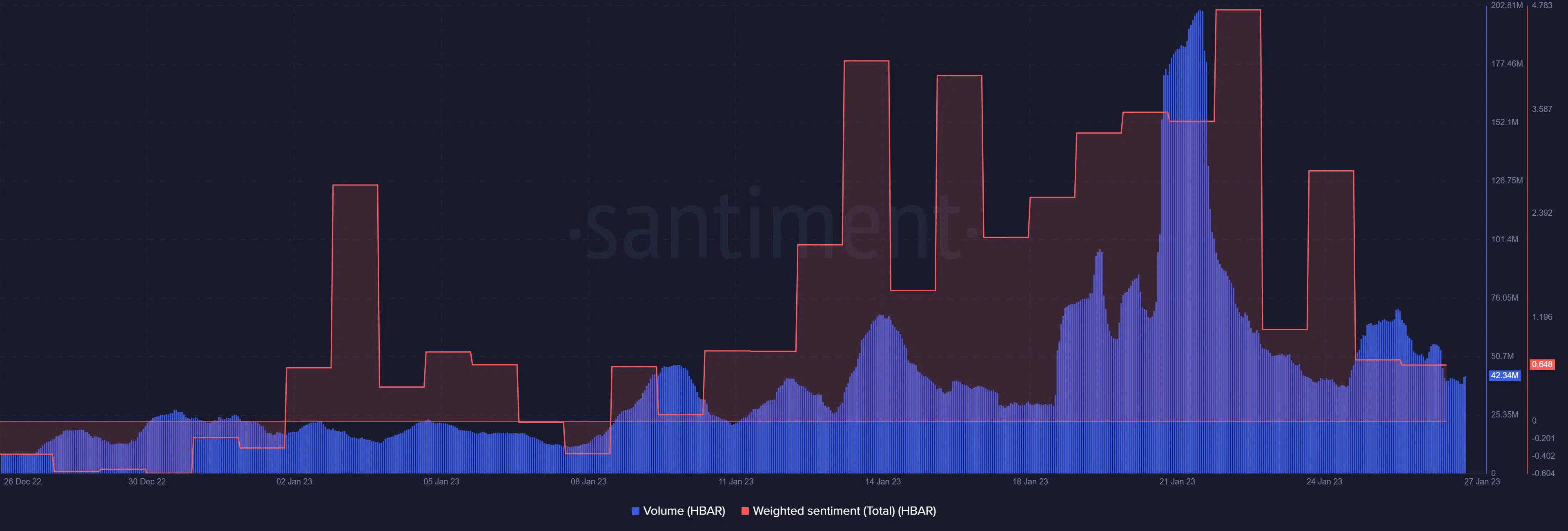

Unfortunately, the short-term outlook does not necessarily reflect these findings. For example, HBAR’s volume, at press time, was down to a weekly low, and this has not favored directional performance. Investor sentiment also dropped substantially in the last seven days according to the weighted sentiment metric.

While these findings may be conflicting, they are a reflection of the current market conditions. Investors are unwilling to let go in hopes of more upside as the bull market continues to unfold. On the other hand, buying pressure has tanked in the last few days after almost everything got overbought.