Helio Protocol: The revolutionary USD Destablecoin backed by BNB

Stablecoins have emerged as one of the most significant innovations in the crypto sector. These stablecoins were seen as the entry point to broad cryptocurrency adoption since they provide a stable store of value compared to more volatile assets such as BTC. Nonetheless, because of its centralized management structure and sensitivity to inflation, it works mostly like a fiat currency.

Although fiat-backed, centralized stablecoins such as USDC, USDT, and BUSD have been widespread, alternative forms of stablecoins promising to address these shortcomings have gained traction.

Crypto-backed stablecoins are the primary alternative to fiat-backed stablecoins. These stablecoins typically utilize a unique combination of behavioral economics, smart contracts, and carefully designed algorithms to maintain the peg to fiat currencies without the control of a centralized custodian.

Helio Protocol strives to upgrade existing stablecoin initiatives by focusing on safety and capital efficiency with a revolutionary model.

Helio Protocol

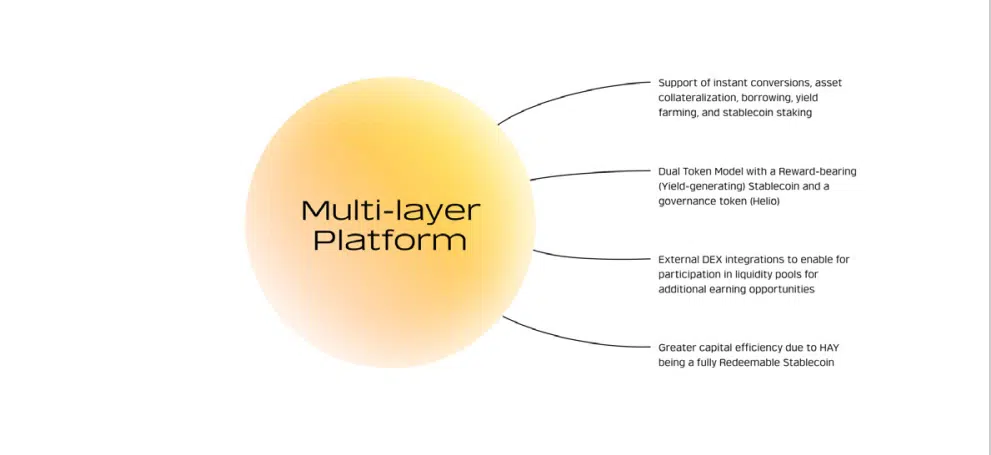

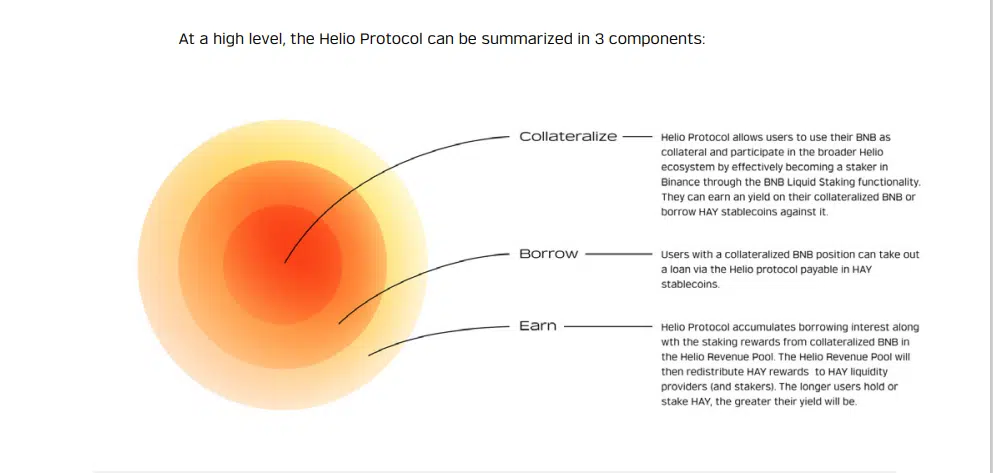

Helio Protocol is an open-source liquidity protocol built on the BNB Chain that features a dual token model and tools for quick conversions, asset over-collateralization, borrowing, yield farming, and staking.

The protocol allows users to borrow and earn interest on HAY destablecoin. This new asset class is over-collateralized with liquid-staked asset BNB. The protocol seeks to establish HAY as the dominant destablecoin in the BNB Chain ecosystem.

Leveraging proof-of-stake (PoS) rewards, liquid staking, and yield-bearing assets. Helio Protocol will operate as a DAO, where the community will govern the protocol’s treasury, revenue pool, and future direction.

Sustainable model for the Stablecoin market

The rise of various decentralized stablecoin projects over the last several years to gain market dominance has produced a very intense and competitive environment. As a result of this competitive dynamic, projects are promising more ambitious promises and payouts than the next player if customers opt to invest.

To make matters worse, the lack of a clear leader and historical best practices have prevented users from doing their research and discerning effectively between the influx of new stablecoin projects. Several initiatives have ignored their long-term sustainability to get consumers in the short term, which has considerably slowed down the goal of broad market adoption.

Stablecoins built on the Ethereum blockchain continue to use costly and ineffective proof-of-work mechanisms. On the other hand, the BNB Chain has the potential to offer the same maturity and scale as Ethereum, but with lower cost and far greater efficiency. Yet, there currently needs to be a dominant stablecoin that is decentralized and safe for users within the BNB ecosystem. As a result, there is a market need for a sustainable yet profitable stablecoin project, which Helio Protocol intends to fill.

Helio protocol aims to overcome concerns such as frozen funds (fiat-backed) or held value loss (algorithmic) due to price volatility by combining liquid staking, the functionality of the MakerDAO model and added liquidity from LPs on DEXs.

Destablecoins: A new asset class

Helio Protocol introduces the concept of “Destablecoins,” a new asset class inside the crypto space that seeks to represent a new model in the existing stablecoin environment. The word “destablecoins” aids in the achievement of the following goals:

1) The prefix “de” in “destablecoins” refers to decentralized, which distinguishes products like HAY from classic stablecoins like BUSD and USDC, which are governed by a centralized custodian. This also contributes to the evolution of stablecoins from centralized to decentralized, and the DeFi sector as a whole.

2) Destablecoins strives to establish widespread stability without absolute reliance on fiat currencies. Because all currencies are distinct and have various reference rates, price fluctuations should be seen as a standard determined by the free market rather than striving for absolute price stability at all costs. Similarly, destablecoins do not seek absolute price parity with the US dollar as a primary objective nor do they rely on fiat assets as collateral.

3) The terms “stablecoin” or “algorithmic stablecoin” is often misleading, because all stablecoins, even fiat-backed ones, have the ability to de-peg, although at a considerably lower level. The stablecoin sector is under ongoing criticism since many retail investors over-invest in the promise of constant stability, leaving themselves exposed to considerable financial loss during such an occurrence.

The word “destablecoins” emphasizes the inherent risk of stablecoins and encourages users to invest more responsibly, resulting in a healthier and more sustainable user environment.

The HAY Destablecoin

HAY is an overcollateralized destablecoin backed by liquid-staked BNB and is redeemable for a $1 USD value of cryptocurrency. The Helio Protocol can ensure HAY is redeemable following the scenarios below.

When HAY > $1, the supply of HAY will have to be increased.

- Since HAY is at a premium, borrowers are incentivized to borrow more HAY to sell for other assets for arbitrage opportunities.

- To reduce demand for HAY farming, Helio will reduce HAY farming rewards by decreasing HAY borrowing interest.

When HAY < $1, the supply of HAY will have to be reduced.

- Since HAY is at a discount, borrowers are incentivized to buy HAY from the market to pay back the debt.

- To decrease HAY borrowing demand, Helio will increase HAY borrowing interest, which increases HAY farming rewards

Upon launch, HAY will be issued as a BEP-20 compatible token. Its use cases include the following:

- Borrowing HAY.

- Users who have deposited BNB on the Helio Protocol (CeVault) are eligible to borrow HAY.

- The operations of borrowing HAY, repaying the loan, and withdrawing the original collateral are all governed by a set of smart contracts.

- Liquidity Mining via third-party LPs on DEXes.

Final word

The Helio Protocol is designed to offer users an alternate way to produce long-term income and unlock liquidity for their crypto assets. The protocol loans HAY to borrowers that employ liquid-staked BNB as collateral. In exchange, it earns a competitive interest rate on its collateralized assets via HAY staking and DEX liquidity.

Helio Protocol aspires to be the BNB Chain ecosystem’s top destablecoin and reliable reference rate enabler. Users will be investing in the greater Helio ecosystem by holding and borrowing HAY to make it the go-to settlement layer throughout the broader crypto world.

To know more about the platform, please visit their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.