Helium bottoms out in oversold territory- here’s what investors can expect next

- Assessing the prospects of an HNT recovery as sell pressure runs out.

- A strong bounce-back may not be on the cards following Binance’s delisting.

Helium’s native token HNT had a rough start in the second half of March. Binance delisted it from its exchange, triggering massive outflows which led to a hard crash. But is the worst over for HNT? Should investors consider buying the dip?

Is your portfolio green? Check out the Helium Profit Calculator

Understanding the reasons behind HNT’s crash may allow investors to make more informed decisions. HNT’s crash came after the Helium network confirmed that the date for its transition to Solana would be delayed and pushed back to 18 April.

While that decision was hardly enough to shift investor sentiment, it may have fueled Binance’s decision to delist HNT.

Binance did not disclose a clear reason for its decision. However, there can be two main reasons, reportedly. First, when a change in industry circumstances warrants such a shift, and second when the native project breaks Binance’s listing standards. Well, the latter is likely the reason in Helium’s case.

Deep HNT discount lures back buyers

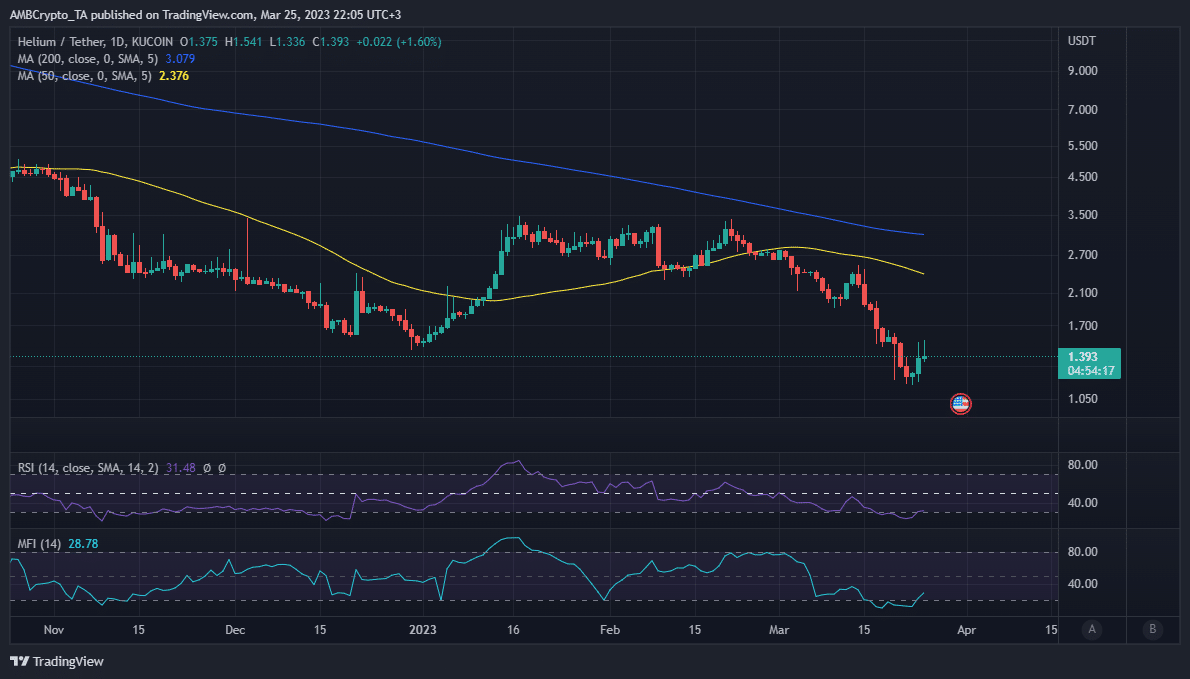

The delisting led to FUD and a large wave of liquidity outflows. HNT tanked by roughly 53% from mid-March to a new low at $1.15. This was lower than its previous support in December 2022.

Meanwhile, HNT exchanged hands at $1.39 at press time, which represented a 19% bounce back from its recent low. The re-accumulation occurred after the price fell deep into oversold territory.

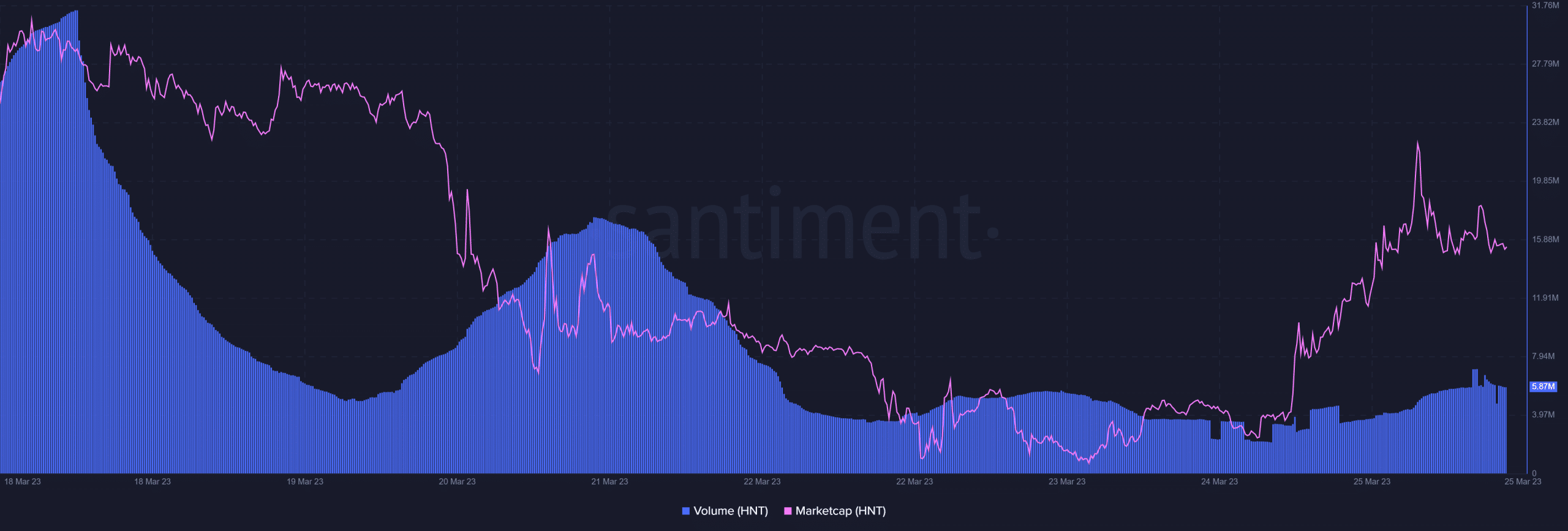

HNT has reclaimed roughly $33.6 million back into its market cap from its bottom range. But this is just a fraction compared to the $184 million that was shaved off HNT’s market cap from mid-March to its recent lows.

Realistic or not, here’s Helium’s market cap in BTC terms

Moreover, HNT’s volume bounced back slightly due to the return of buying pressure. However, it was clear that the prevailing buying volume was still relatively low.

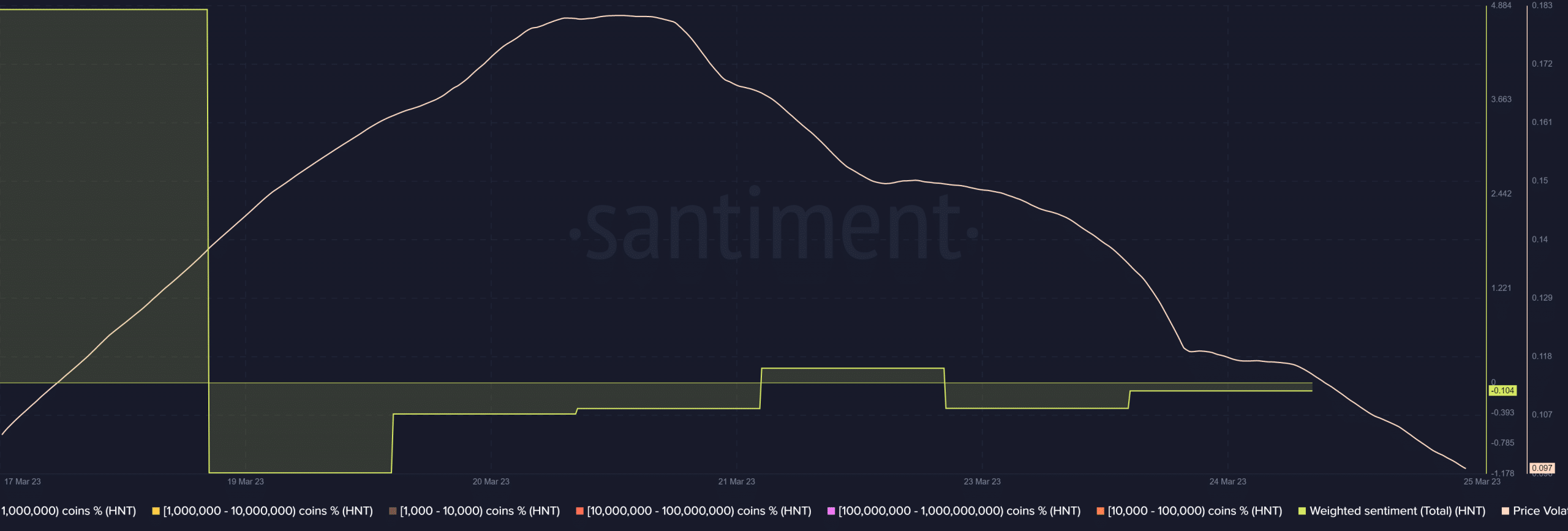

This reflected a slight increase in the weighted sentiment metric.

HNT’s volatility is currently at its weekly low, meaning the recent pivot has not yet registered as a large move. But will HNT eventually recover?

Well, the delisting from Binance prevents HNT from accessing a large amount of liquidity that would have otherwise been accessible. This might be one of the reasons for the slow recovery.

This is just the beginning of a more accessible and usable @helium experience.

Read more about Open LNS and follow along with developments: https://t.co/RvSxyu1q8e

— Helium Foundation (@HeliumFndn) March 24, 2023

However, Helium recently confirmed that it is still moving forward with its plans, and development activity is still ongoing.

The network just announced the launch of Open SNL as its latest development. While this reaffirms the network’s operations, it does not necessarily guarantee a speedy recovery.

Binance may also list HNT in the future, but that is still within the realm of uncertainty. In the meantime, buyers may take advantage of the hype ahead of the 18 April migration to Solana.