Solana [SOL] outshines Ethereum [ETH] on this crucial parameter

![Solana [SOL] outshines Ethereum [ETH] on this crucial parameter](https://ambcrypto.com/wp-content/uploads/2023/03/Solana-2.jpg.webp)

- Solana’s Nakamoto Coefficient stood at 31 as compared to Ethereum’s 1.

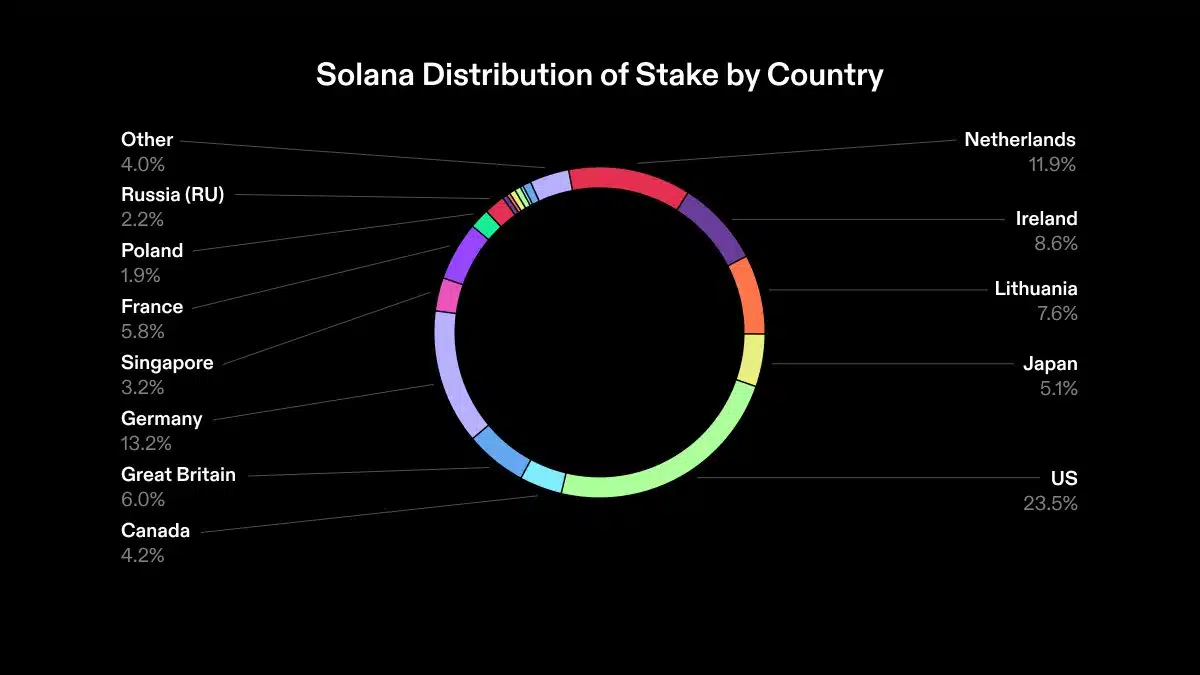

- Solana was well-distributed across geographies with no country controlling 33% of the active stake.

The Solana [SOL] Foundation published its latest Validator Health Report wherein it disclosed vital stats like the number of validator nodes and their distribution across the network.

According to the report, the network boasted more than 3,400 nodes out of which over 2,400 were nodes that participated in validating transactions on the chain, also called consensus nodes.

1/ The March 2023 Validator Health Report is out.

Today, @Solana is one of the largest proof of stake networks in the world by node count, and one of the most distributed by Nakamoto Coefficient. https://t.co/NlxHZqHnV5 pic.twitter.com/1AcDtQK7p2

— Solana Foundation (@SolanaFndn) March 23, 2023

Is your portfolio green? Check out the Solana Profit Calculator

Solana scores over Ethereum?

The Nakamoto Coefficient, created by former Coinbase CTO Balaji Srinivasan, is a widely-used measure of the decentralization of a blockchain.

The Nakamoto coefficient measures decentralization and represents the minimum number of nodes required to disrupt the blockchain’s network.

A higher Nakamoto Coefficient indicates that the network has a large number of nodes and is thus more decentralized and safe.

One of the major takeaways of the report was the reading of the Nakamoto Coefficient. For the Solana chain, it stood at 31 as compared to just 1 for the biggest proof-of-stake network, Ethereum [ETH].

A look at Ethereum’s validator distribution will most likely sum this up. More than 44% of the staked ETH was held by just four participants.

Furthermore, the report highlighted that Solana was well-distributed across geographies with no country controlling 33% of the active stake. However, in the case of Ethereum, more than 45% of the nodes were concentrated in only one country, the U.S.

Solana’s safety precautions

A bug in a validator client has the potential to shut an entire network down if there’s no backup. Solana stated that it had two validator clients at its disposal to help during exigencies. A third client was under development.

It should be noted that the network was hit by a major outage on 25 February, which lasted for nearly 20 hours. Tech disruptions for Solana aren’t a new phenomenon. It was hit by several network glitches in 2022 as well.

Realistic or not, here’s SOL market cap in BTC’s terms

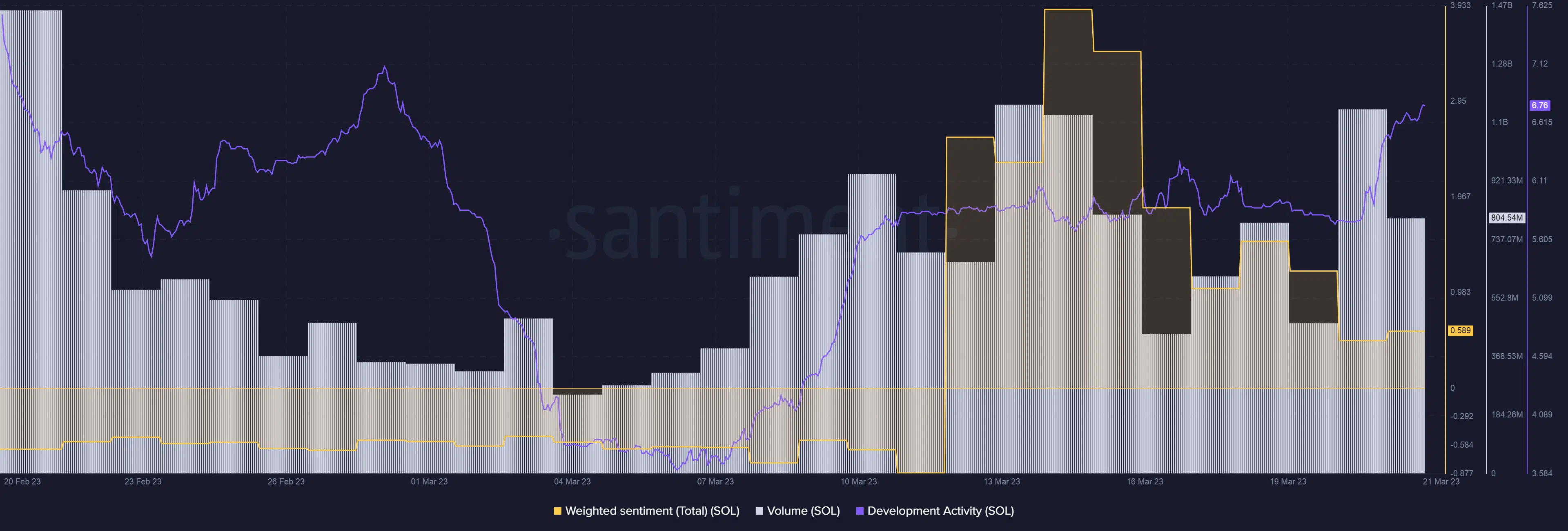

It was clear that Solana was focusing on network enhancements as indicated by the increasing development activity. The investors’ sentiment stayed in the positive terrain as well, which in part was fueled by improving market conditions.

The transaction volume for SOL declined by over 50% since hitting $1.14 billion on 20 March. Consequently, the price fell by more than 8% until press time, per CoinMarketCap data.