Here’s Bitcoin miners’ plan to survive the crypto-crisis (to make ends meet)

Bitcoin [BTC]‘s ongoing bearish streak has significantly affected not just holders, but even miners. Bitcoin miners turned into net sellers of Bitcoin, with miner inventories dropping to new lows. Miners might not necessarily turn bearish “en masse,” although some did look to offload excess inventory. Or, is it really the case?

An outcome with nothing concrete…

Bitcoin miners have been distributing their holdings of BTC during the recent sell-off, albeit at a slower pace compared to how it was earlier this year.

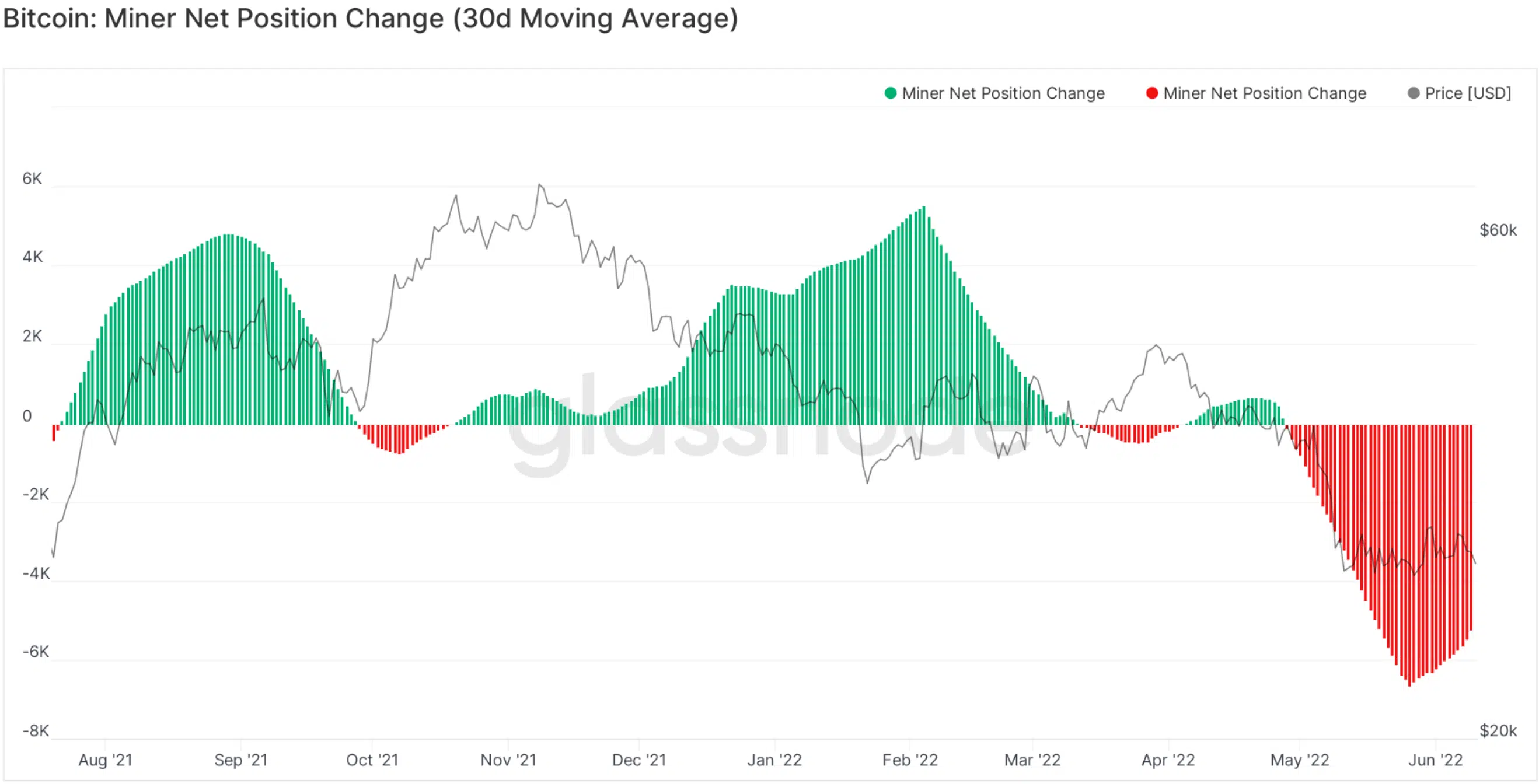

The chart attached herein shows the 30-day change of BTC supply held in miner addresses, according to data compiled by Glassnode.

Here, the red dip hinted at Bitcoin miners becoming net sellers, after being net HODLers for months. Indeed, May and June both saw this changing narrative.

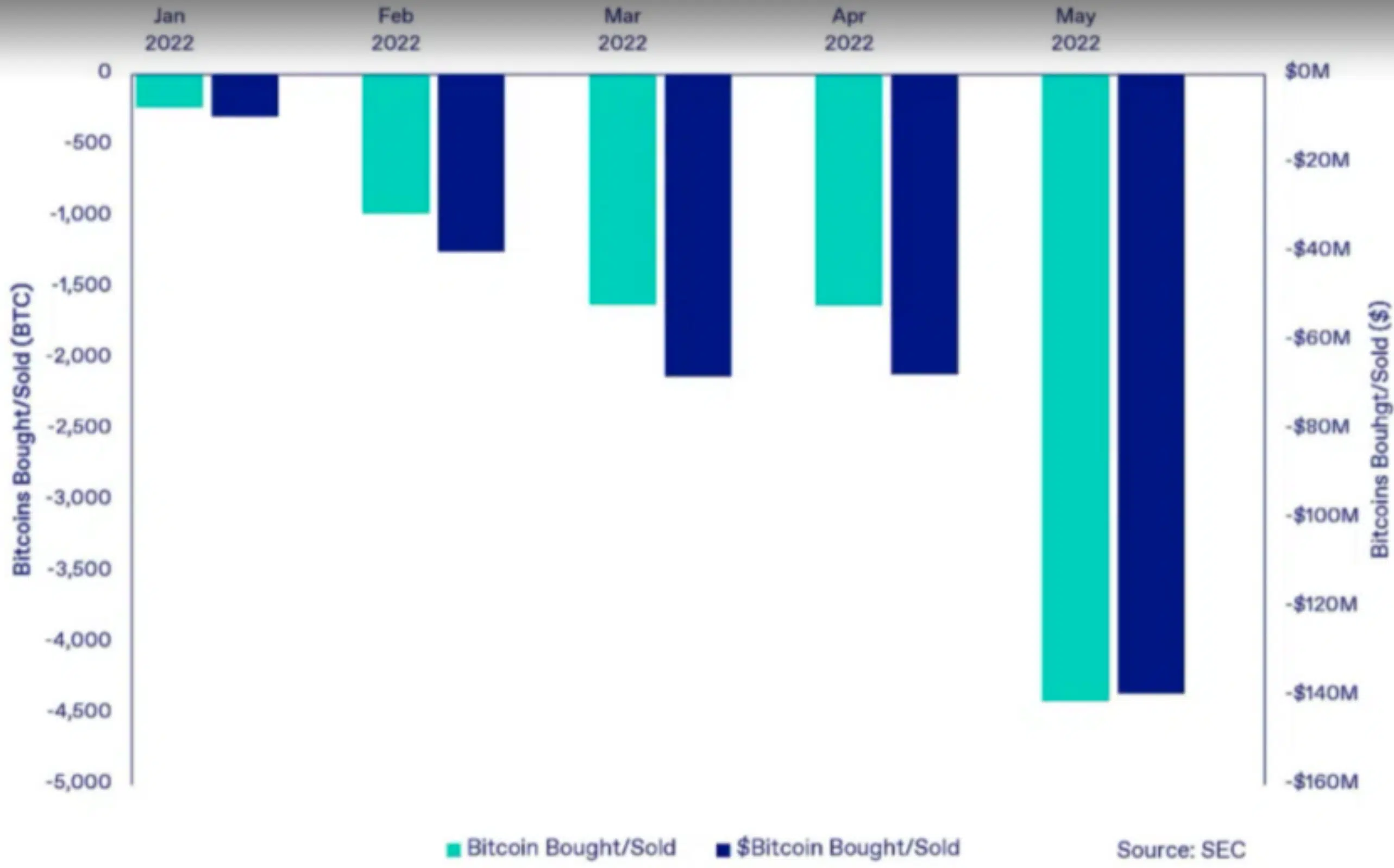

In May 2022, public mining companies sold 4,411 Bitcoins. This figure is four times more than the average for January to April 2022. Financial statements of public mining companies showed that they had to quadruple BTC sales to make ends meet.

Source: NYDIG

The decline in BTC miners’ revenue could be a key reason behind this scenario. Miners’ balances have recently declined at a peak rate of 5k to 8k BTC per month (or roughly $150 million to $240 million worth of BTC at $30k).

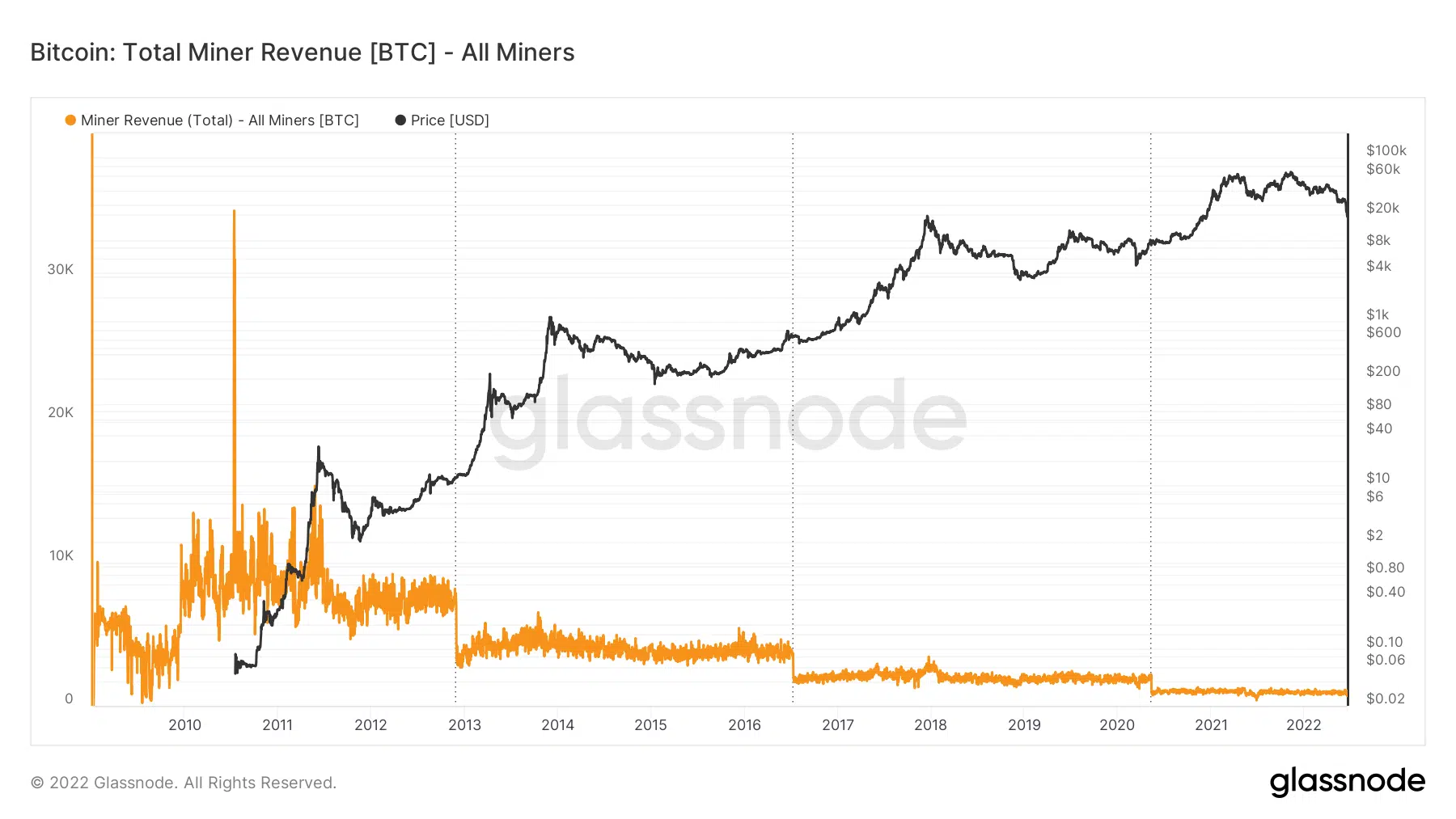

Currently, the total miner revenues barely amount to even close to what it was before. This is evident in the graph below –

In addition, electricity prices are rising, given the inflation scars. Furthermore, the profits of miners fell along with cryptocurrency rates. Ergo, this effort at distribution is to offset further losses.

Also, Bitcoin mining hashrate observed a fall during the month of June as miner revenues continue to stay low. The “mining hashrate” is an indicator that measures the total amount of computing power connected to the Bitcoin blockchain. Miners have started to disconnect their machines, perhaps because of low or no profitability levels.

Fighting their own demons

Currently, miners’ position changes might or might not lead to BTC price swings. Even so, the crypto has struggled to keep up amidst the sea of chaos, FUDs, and regulatory scars.

At press time, however, the king coin did note an 8% hike on CoinMarketcap after trading around the $20k-mark.

Deepening bearish narratives, such as extreme sell-offs, could inject further corrections though.