Here’s how Ethereum has one-upped Bitcoin over the past year

It’s been over a year since Black Thursday, the unceremonious black swan event that led to the crypto-market crashing back in March 2020. The drawdown happened in the middle of a complete market meltdown, where a liquidity crisis in the traditional marketplace due to COVID-19 disrupted economies around the globe.

At the time, Bitcoin, Ethereum, and other crypto-assets collapsed like a house of cards. Since then, however, the growth has been unprecedented. With the rise of DeFi, institutional interest, and NFTs right now, it is fair to say that a lot has changed. Interestingly, even between Bitcoin and Ethereum, the latter has flipped some of the traditional power dynamics.

Bitcoin v. Ethereum – Year-on-Year difference

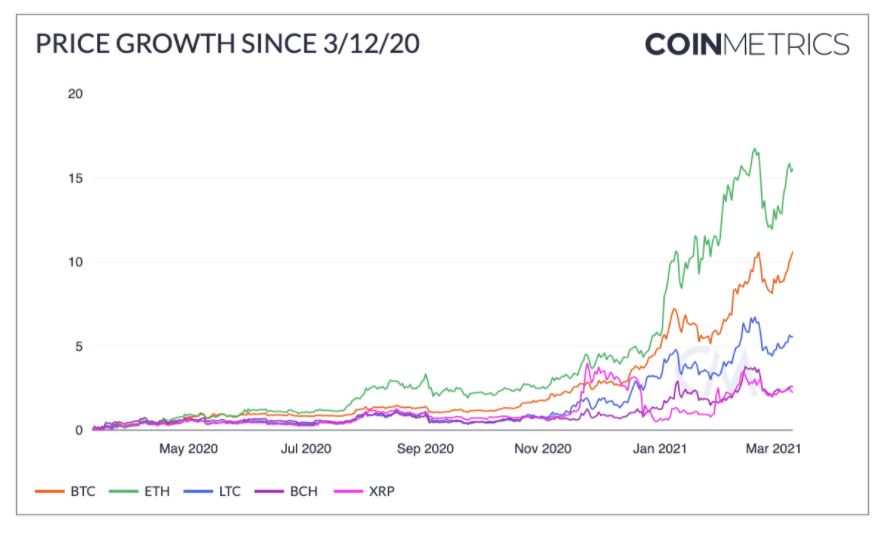

CoinMetrics’ latest report presented a YoY comparison between Bitcoin and Ethereum, with the same finding that Ether’s value was up 16 times with respect to BTC’s 10x returns over the same time period.

Now, while price appreciation may not tell the entire story, there are quite a few on-chain factors that are giving an upper hand to Ethereum too. User adoption, for instance, has been progressing well for both coins but Ether addresses registered a 55% hike while Bitcoin’s grew by just 11%.

That being said, large BTC addresses grew faster than ETH addresses for the majority of 2020. Interestingly, since the start of 2021, Ether has managed to flip the narrative in that regard as well. As of 12 March 2021, there were 1,066 ETH addresses with at least 0.01% of the supply, an 8% growth from 983 in March 2020.

ETH hodled more than BTC?

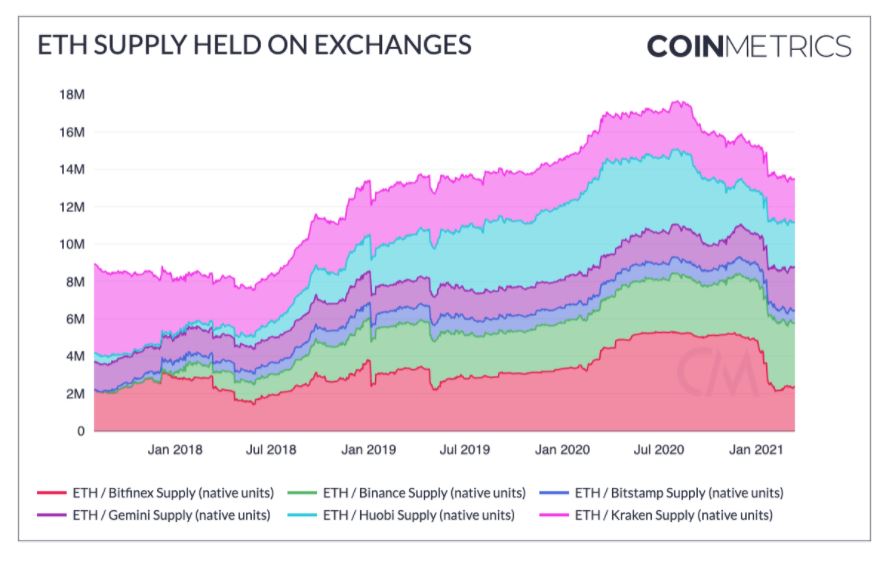

Before the March 2020 crash, both Bitcoin and Ethereum held by exchanges were at their peaks, but they dramatically started to decline after the market dump. This happened to be the case for Bitcoin throughout 2020, with the same considered to be a bullish factor during BTC’s price surge.

2021 has been a little different in that regard, especially since Bitcoin supply held on exchanges has risen as retail traders are currently holding their supply in exchanges, rather than their own wallets.

On the contrary, the number of Ethereum held by exchanges has continued to decline in 2021 as well, indicating that ETH traders might be more comfortable holding their asset off-exchange, estimating a better ROI over the long-term.

Ethereum is breaking out of Bitcoin’s shadow?

Bitcoin’s market cap is one metric that might not be breached by any asset in a long time. On the question of building its market, however, Ethereum may be on the right path to push itself away from Bitcoin. In fact, multiple factors suggest that ETH has gained tremendous interest over Bitcoin in 2020.

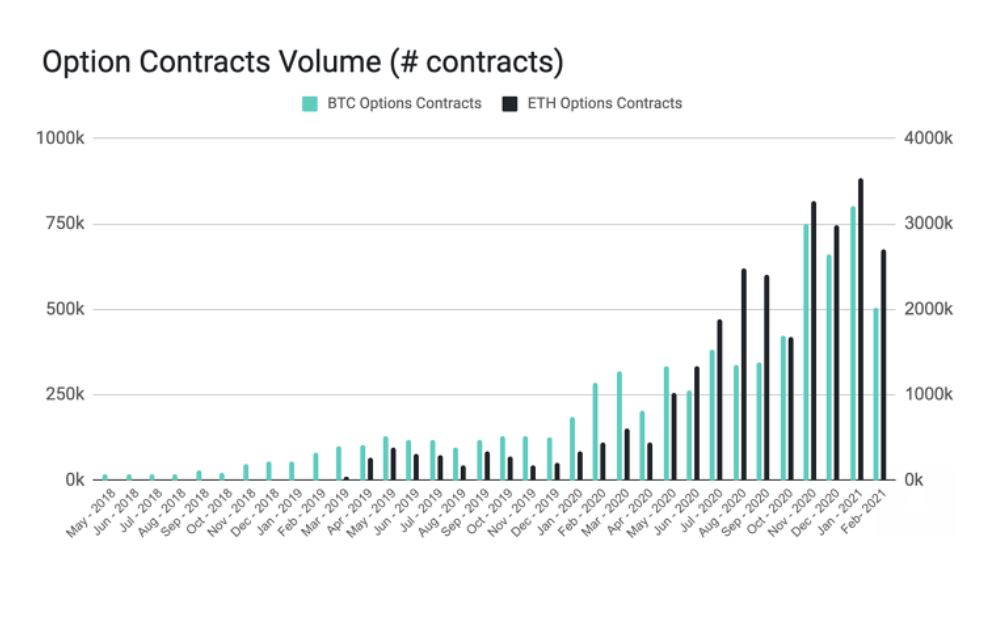

Deribit’s Option Contracts Volume, for instance, suggests that ETH Options have surpassed BTC Options since July 2020, and it has continued to do so in 2021. The CME also launched ETH Futures last month, underlining the rising interest for Ethereum from the institutional end.

While 2020 was a blessing for the collective crypto-market after the unfortunate Black Thursday event, a year later, Ethereum might just have gained more momentum than Bitcoin.