Here’s how growing institutional appetite is cranking up Bitcoin’s dominance

With Bitcoin’s price comfortably sitting above $50K for over five days now, its market monopoly seemed to have returned. Noting high weekly gains above 15%, the king coin has been outperforming all the coins in the top ten list by market cap for the last one week.

Following this price breakout, Bitcoin’s dominance climbed to 45%, which was the highest value noted since August. So, what fueled Bitcoin’s growing dominance?

Growing institutional interest

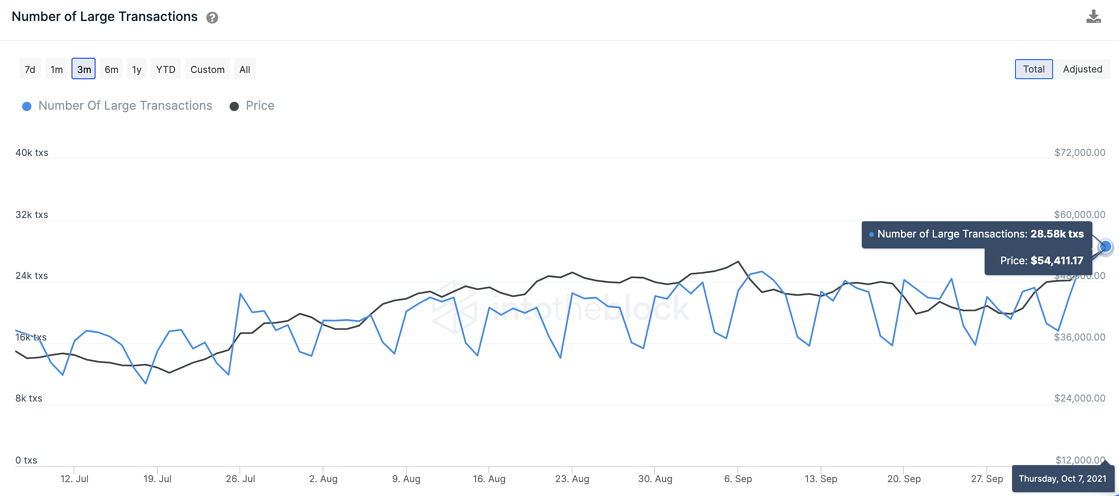

Over the last week, as $100 million worth of BTC left centralized exchanges, the behavior suggested that investors were looking to hold. More importantly, however, the number of large transactions, including those worth over $100,000 taking place on a given day, also saw a rise. Generally, due to their magnitude, large transactions act as a proxy to institutional activity.

Source: IntoTheBlock

Noticeably, the number of Bitcoin large transactions hit a four-month high, with over $240 billion transferred per day for three consecutive days. This was indicative of a growing appetite among institutions investing in the king coin.

In fact, on October 8, JPMorgan shared a note with clients wherein the firm attributed the recent spike in BTC’s price to institutional investors looking for a hedge to inflation. Notably, earlier this year in May, the company held a completely opposite view on the top coin, as JPMorgan analysts noted that big investors at the time were switching out of Bitcoin and into traditional gold.

Healthy derivatives data

There seems to be a growing optimism in the chances of a Bitcoin ETF being approved by the end of October. Eric Balchunas, Senior ETF Analyst at Bloomberg has given the decision a 75% chance of one being approved in October.

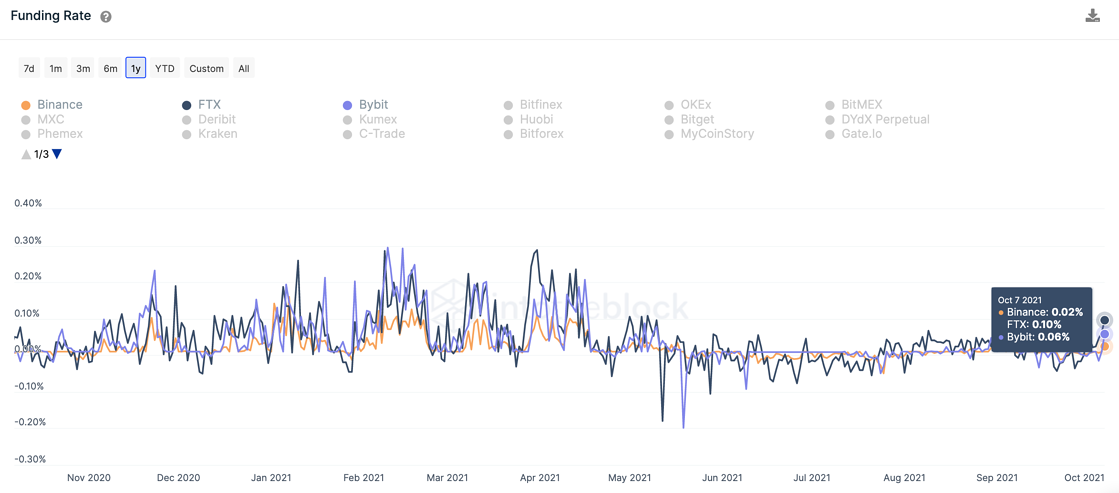

Thus, with this positive news and high expectations from the king coin, the derivatives market too, is seeing some decent action. Notably, the funding rates across the three most traded exchanges reached their highest value since May prior to the crash.

BTC Funding Rate | Source: IntoTheBlock

When funding rates are positive, it means that the asset is priced at a premium and long holders have to pay short holders a fee. At the time of writing, long holders willing to pay the funding fee to buy Bitcoin perpetuals point towards positive expectations for the price.

However, the funding rates still remain significantly lower than they were throughout February and April.

In terms of metrics, BTC’s aSOPR is noting a similar bounce seen in October 2020 that sent the coin 250% up. So if aSOPR’s uptrend continued a similar breakout for BTC could be expected.

For the time being, however, with derivatives data looking good and institutions jumping on the BTC bandwagon, it seemed like this BTC run could play out incredibly well for the top coin.