Here’s how Lido’s TVL reacted as Solana sunsets

- Lido’s TVL dropped by 5% between 9 and 16 October.

- This is primarily attributable to the protocol’s decision to stop operating on Solana.

Leading liquid staking protocol for Ethereum [ETH], Lido Finance [LDO], saw its total value locked (TVL) slip by 5% between 9 and 16 October. The decline was mostly due to Lido’s decision to sunset its activities on Solana [SOL].

Is your portfolio green? Check out the LDO Profit Calculator

Following a community vote on the same, Lido announced its decision to cease operations on Solana on 16 October, as its continued existence on the Layer 1 (L1) blockchain has become a financially unviable venture.

Moreover, in its latest weekly update on X (formerly Twitter), the protocol noted that the TVL decline was also a result of “token prices falling.” Between 9 and 16 October, the values of ETH, Polygon [MATIC], and SOL dropped by 4%, 8%, and 6%, respectively.

Rough seven-day period for Lido

Despite having previously led in net new deposits to the Ethereum Beacon Chain for several weeks, Ether deposits made to the Proof-of-Stake (PoS) network through Lido plummeted significantly within the period under review.

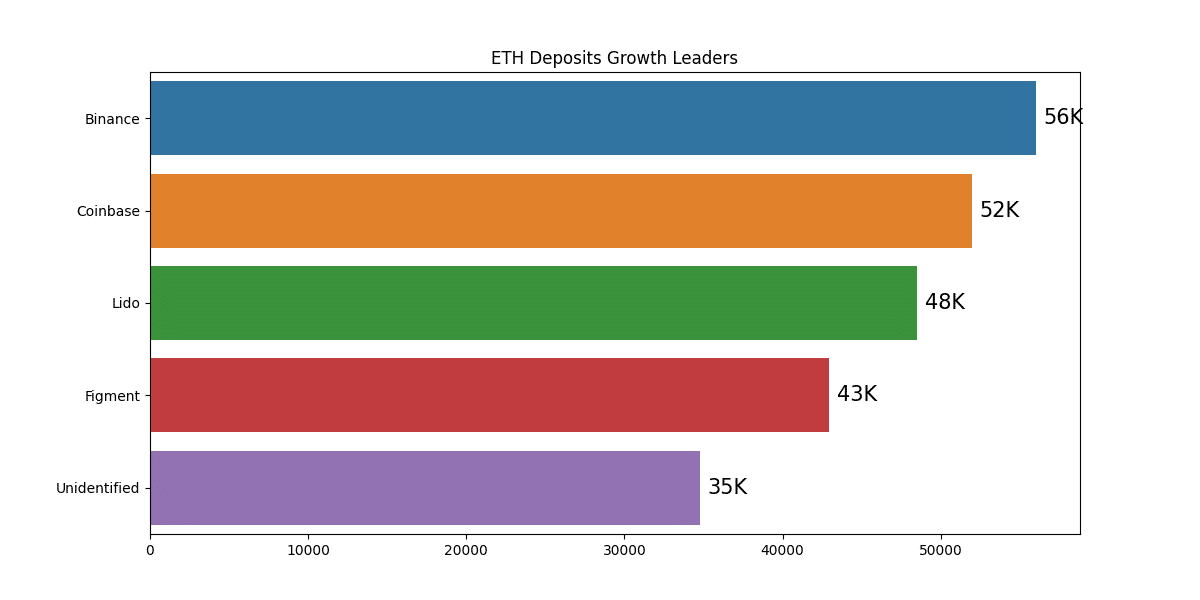

With 48,480 ETH in net new stake made to Ethereum through Lido between 9 and 16 October, the decentralized finance (DeFi) protocol ranked behind Coinbase and Binance, which recorded net new deposits of 56,000 ETH and 52,000 ETH, respectively, according to data from Dune Analytics.

Further, the Annual Percentage Rate (APR) of the protocol’s staked Ether [stETH] assessed on a seven-day moving average witnessed a decline. Lido said the decline was “due to a combination of low gas prices and lowered EL rewards.”

During the period under review, Lido’s staking APR fell by 4%, data from Dune Analytics revealed. At press time, Lido’s stETH APR was 3.44%, logging a 52% decline since its 7.17% peak on 12 May.

Regarding Layer 2 (L2) platforms, data from Dune Analytics showed a 0.46% and 3.24% increase in the amount of stETH bridged to Arbitrum [ARB] and Polygon, respectively.

On the other hand, Optimism [OP] recorded a 1% decrease in the amount of bridged stETH during the period under review.

New demand for LDO trickled in the last week

An on-chain assessment of LDO’s network activity recorded an uptick in new demand for the DeFi token in the last week. According to data from Santiment, the daily count of unique addresses involved in LDO transactions climbed by 9%.

Likewise, the daily count of new addresses created to trade LDO tokens surged by 23% during the same period.

How much are 1,10,100 LDOs worth today?

The influx of new demand caused a 7% rally in LDO’s value between 11 and 16 October. However, the token’s price peaked at $1.64 on 16 October, after the decision regarding Lido on Solana was announced.

The token’s price has since trended downward. LDO traded at $1.54 at press time, according to CoinMarketCap.