Here’s how zkEVM, Chainlink reacted to the new integration

- Polygon posted a blog highlighting details on this latest integration.

- LINK was down by 14%, and selling pressure on it was high.

Polygon [MATIC] zkEVM recently made an important integration with Chainlink [LINK] that can boost the blockchain’s offerings and capabilities.

In fact, Sanadeep Nailwal, co-founder of Polygon, took to X and posted a tweet highlighting those benefits. However, despite this integration, zkEVM’s key network stats failed to go up.

Details on Polygon and Chainlink integration

As per Sandeep Nailwal, the combination of LINK’s solution and the Polygon zkEVM’s ZK rollup will be a game changer for DeFi.

.@chainlink has been with @0xPolygon ecosystem side-by-side ever since Matic Network became Polygon in Feb. 2021. And what a journey it has been for both communities! On Polygon PoS, Chainlink is now used by the largest protocols like Aave and Gains and secures 85-90% of the… https://t.co/61lg61UdsK

— Sandeep Nailwal | sandeep. polygon ? (@sandeepnailwal) December 15, 2023

Polygon also posted a blog pointing out the benefits for developers. The integration allows DeFi developers to easily tap external price data to build and launch highly effective liquidity protocols, advanced decentralized exchanges, and more.

Marc Borion, CEO of Polygon Labs, said,

“This functionality is set to unlock the deployment of several significant DeFi protocols on Polygon zkEVM early next year.”

It was interesting to see that while developers worked on this integration, zkEVM’s DeFi ecosystem also started to grow.

As per AMBCrypto’s analysis of Artemis’ data, Polygon zkEVM’s TVL has been on the rise for multiple weeks now.

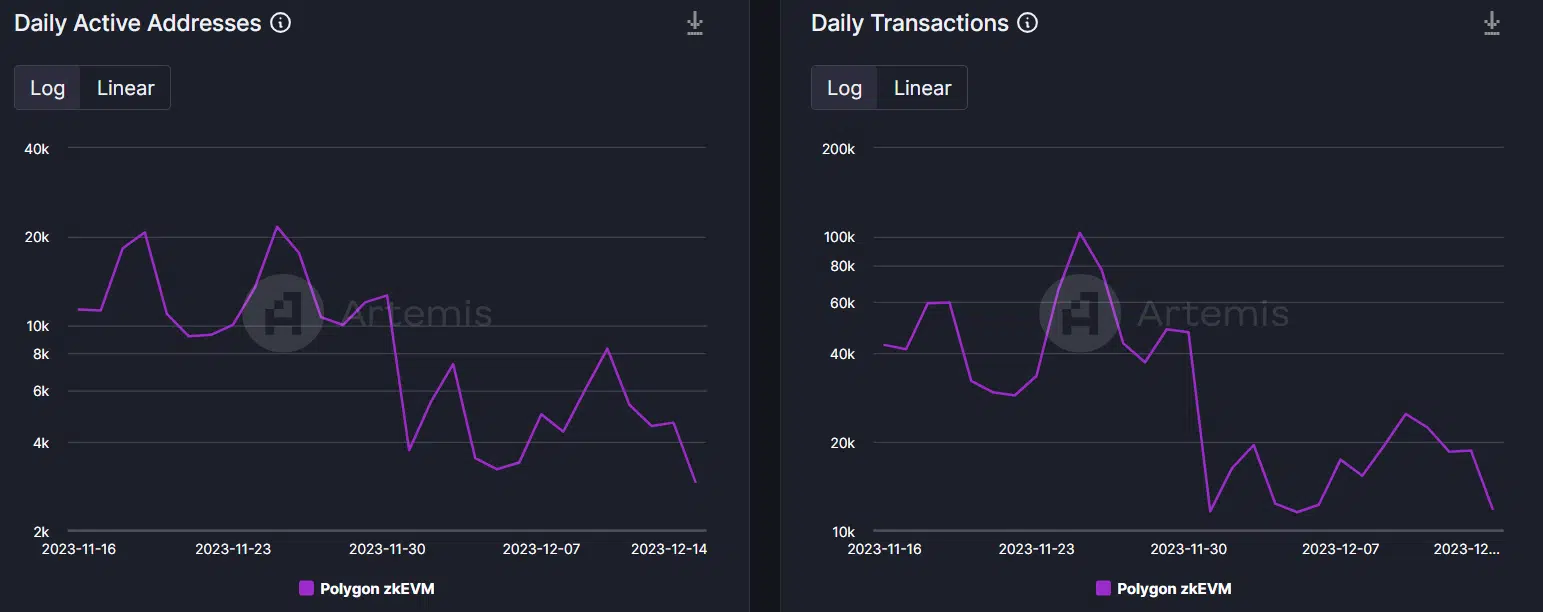

However, while the DeFi space grew, its network activity dropped. This was evident from the fact that its daily active addresses and transactions started to decline.

Chainlink is not benefiting

While zkEVM grew in DeFi, Chainlink did not follow the same trend on its price front. According to CoinMarketCap, LINK was down by nearly 15% in the last seven days.

At the time of writing, LINK was trading at $14.50 with a market capitalization of over $8.2 billion.

The token’s trading volume also dropped in the last 24 hours, meaning that investors weren’t actively trading LINK.

To better understand the scenario, AMBCrypto took a look at Santiment’s data. We found that LINK’s supply on exchanges registered a massive surge in the recent past.

This was accompanied by a drop in its supply outside of exchanges, suggesting that it witnessed a massive sell-off. Additionally, its MVRV ratio also remained low, which is a typical bearish signal.

Is your portfolio green? Checkout the LINK Profit Calculator

Nonetheless, the good news was that Chainlink’s open interest dropped slightly along with its price.

A decline in the metric generally hints at a trend reversal, suggesting there were chances of LINK registering greens on its price chart.