Here’s the ‘but’ of Monero [XMR] chalking up a bearish pattern

![Here's the 'but' of Monero [XMR] chalking up a bearish pattern](https://ambcrypto.com/wp-content/uploads/2022/11/1667827922315-bbdd0f22-190a-4161-8edd-7d188a8a0ba1-e1669114841220.png)

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Monero (XMR) was bearish on the daily chart

- The elevated positive sentiment over the weekend has flattened out

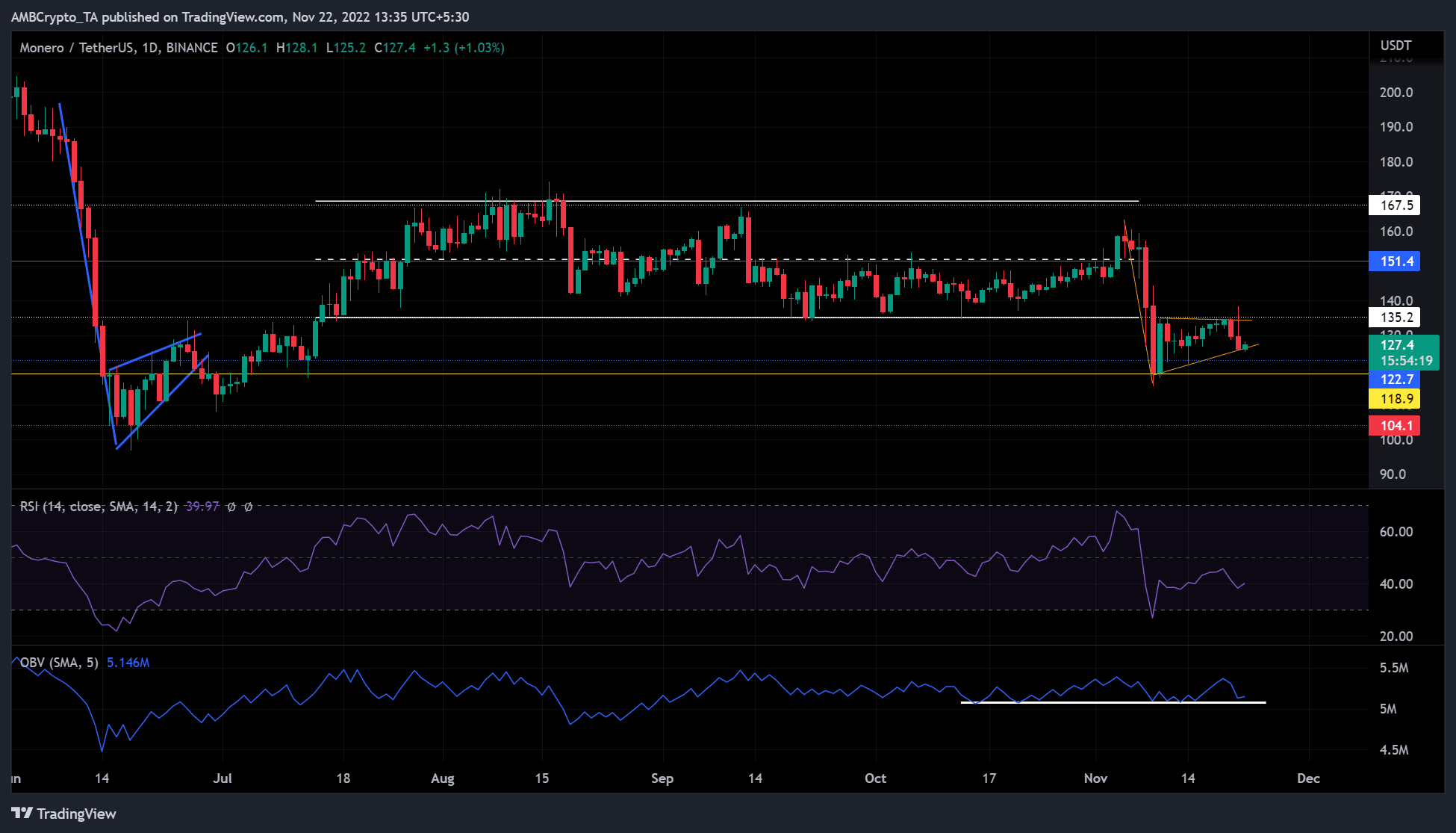

Monero (XMR) bulls were cut to size over the weekend as bears threw a massive party. This was evidenced by the bearish engulfing pattern (A tiny green candle followed by a larger red candle) on the charts. It indicates that the bears will lower the prices soon.

Read Monero’s [XMR] Price Prediction 2023-24

The bulls tried to regain control on Monday, pushing XMR’s price above $135.2. However, the bears furiously neutralized their efforts and pushed the price lower, as shown by the Shooting Star (red candlestick with a long tail).

The recent price action has formed a bearish pennant pattern. Should a bearish breakout occur, XMR could see a deep plunge towards $104.1.

XMR falls below its 3-month trading range

After a false bearish breakout from a bearish pennant pattern in June, XMR posted a rally leading to the ATH of $174.2 in August. Since mid-July, XMR has been confined to a range of $135.2 to $167.5, with $154.1 as the midpoint.

On 9 November, XMR fell below this range and shifted to a bearish market structure. The Relative Strength Index (RSI) was at 39, below the neutral level of 50 and the On Balance Volume (OBV) has been steady for about a month. These indicators, thus, support the bearish market structure.

Therefore, a breakout to the downside could transpire, dropping the altcoin to $104.1 in the long term.

However, the bearish pennant is similar to the line formed in June (blue lines). So, if history repeats itself, XMR could see a false bearish breakout before rallying to the mid-range at $151.4 in the long term. This would invalidate the bearish bias.

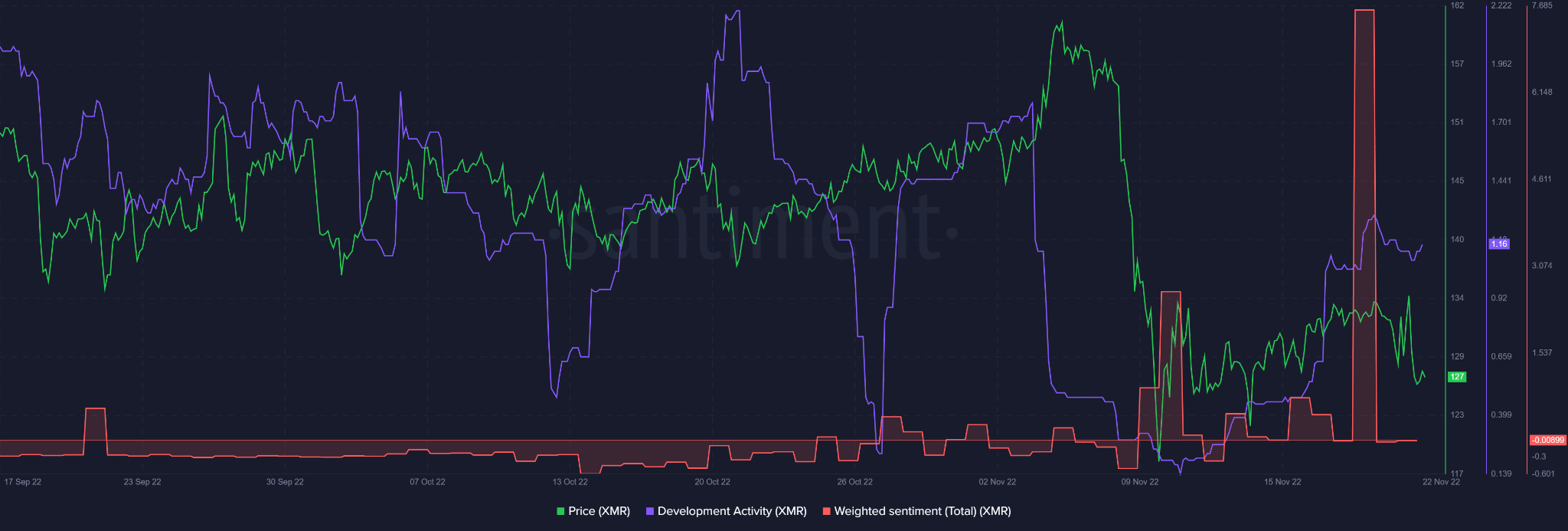

Neutral sentiment could undermine upside price action as development activity rebounds

According to Santiment, the elevated weighted positive sentiment seen over the weekend has levelled off. The elevated sentiment corresponded with an increase in development activity on the Monero network.

A decline in development activity was later reflected in a reduction in positive sentiment. There was a slight increase in development activity at press time, despite the neutral sentiment. Interestingly, there was also a slight increase in price movement.

Long-term investors should therefore track the network’s development activity to assess its viability and ability to attract other long-term players.