Here’s what Bitcoin must do BEFORE it breaches $50,000 again

The king coin’s struggle below $50,000 has been longer than expected. With Bitcoin still consolidating between $46k and $49.5k at press time, expectations of a quick leap above $50k faded. Needless to say, the market seemed to be seeing the effects of the same in different ways.

A cooldown in place?

Bitcoin’s price, at the time of writing, was highly volatile on shorter time frames. This, even though it was still bullish on weekly and almost neutral on the daily chart. Now, some consolidation was expected after the massive price gains over the last month. However, is the worst truly over or will this spell of ups and downs continue?

One worrisome trend, at press time, was BTC testing the 200-day moving average yet again on the daily chart. Over its previous rallies, the 200-day moving average has acted as a support for Bitcoin’s price. If it fails to hold the same, a fall to lower levels can be expected.

Source: Trading View

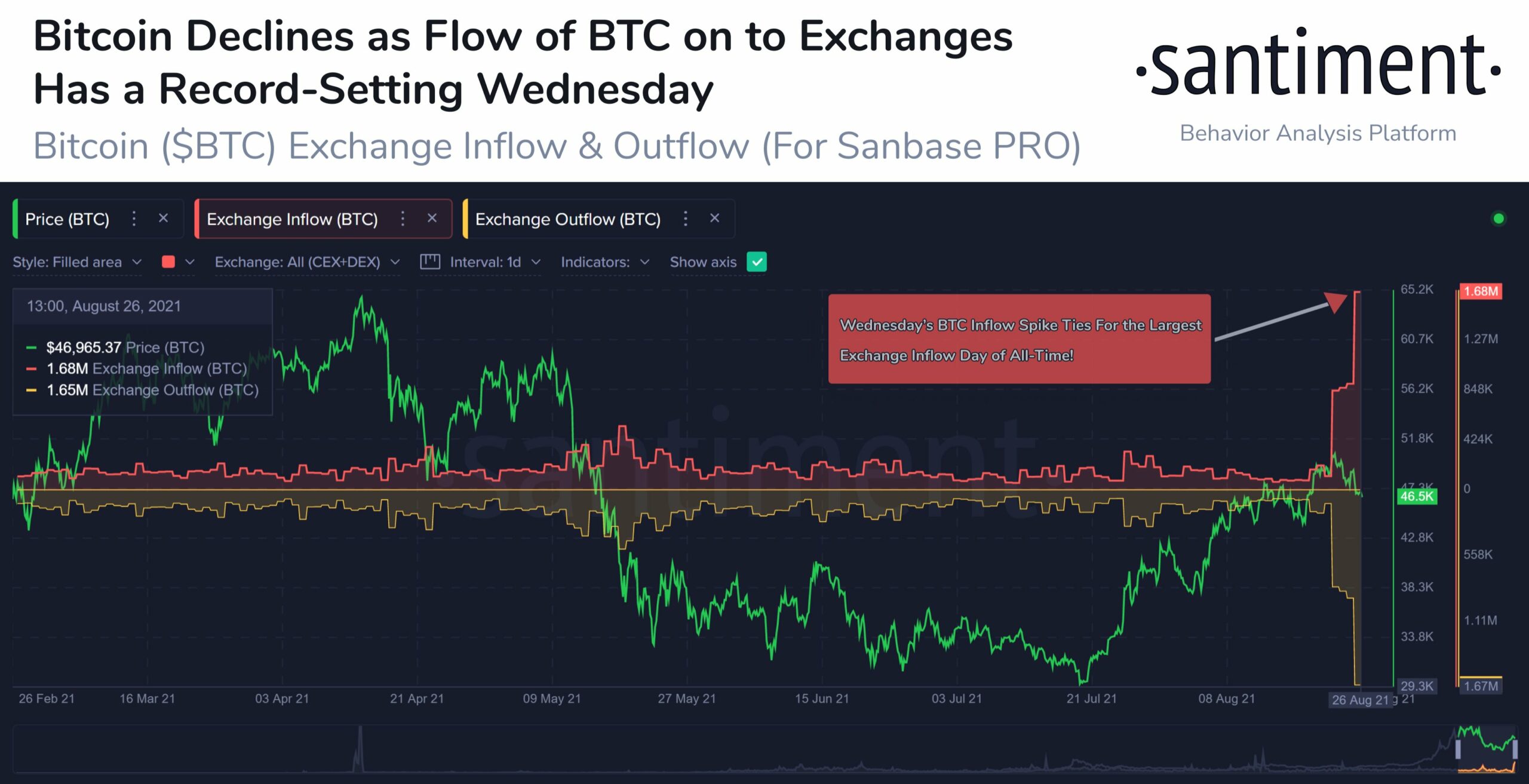

Other than that, a dip in Bitcoin’s RSI on the daily chart also highlighted selling pressure creeping into the market. The effects of this selling pressure were seen in the market as on 26 August, the largest exchange inflows since 19 June took place. This was a bearish sign because coins could have been moved from cold rooms and digital wallets with the primary goal of liquidation.

The slumping price too was an aftereffect of liquidations or inflows seen on exchanges.

What’s more, a Santiment tweet noted that the last two days were the largest inflow days of all time – Both with 1.68 million BTC flowing to exchanges. This could give rise to more volatility over the rest of the week.

Difficulties ahead of $50k?

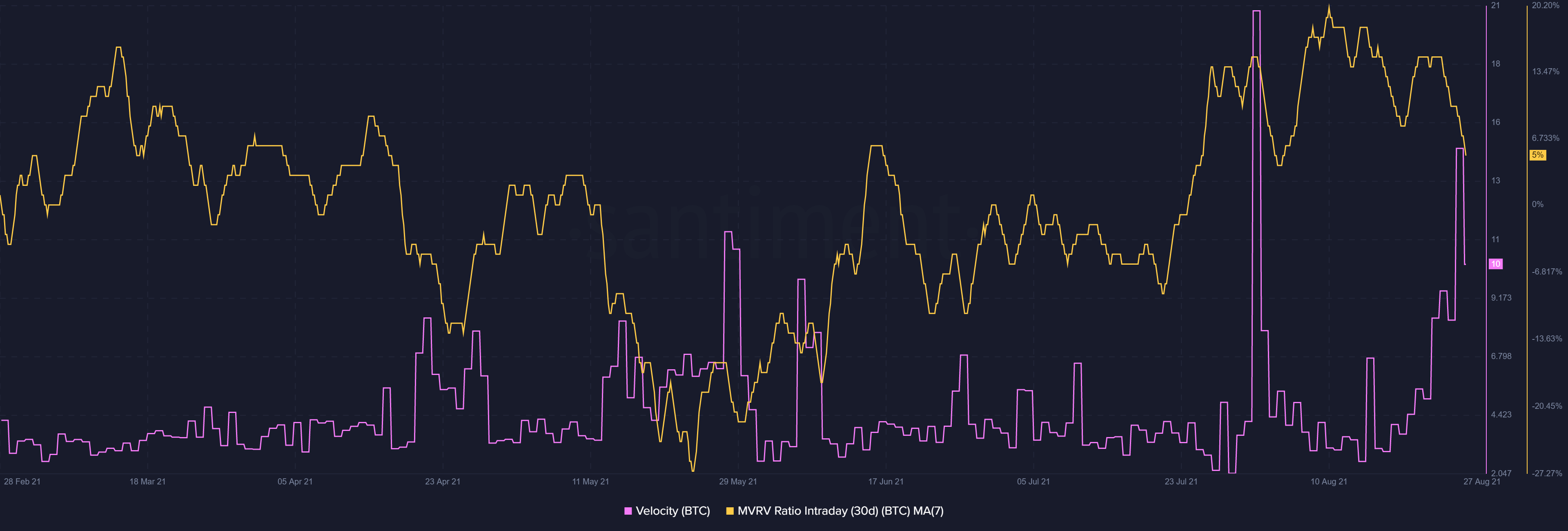

Bitcoin’s MVRV Intraday (30day) registered a sharp downturn which was in line with the turbulent market. The indicator noted its lowest value in a month, a finding that underlined that the price was below the “fair value” it saw over the last month.

Source: Sanbase

Additionally, a sharp fall in velocity highlighted that fewer coins were circulating within the network. This meant that the coin was used in transactions less often during that time frame. Fewer transactions on the network, as well as a fall in active addresses over the last couple of days, were some difficulties that lay ahead before BTC can breach $50k.

Bitcoin would need more participants and more action for a push forward.

Further, if BTC holds the 200-day MA, it would be a good sign. However, if it doesn’t, the support levels at $42,500 and $40k need to be watched carefully. At the time of writing, however, metrics pointed to a stretched period of consolidation with high volatility.