Here’s what you shouldn’t do with your Bitcoin

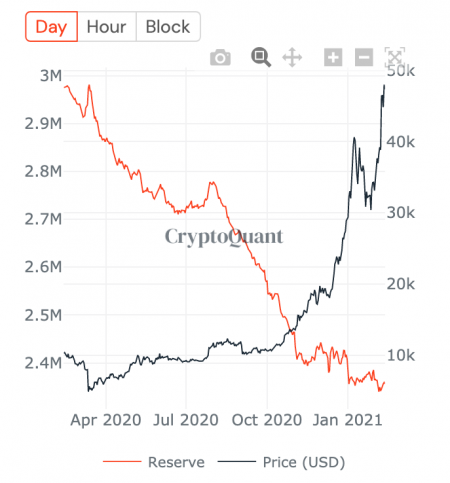

The seven-day moving average of the number of Bitcoins entering exchanges is a clear indicator of Bitcoin reserves on exchanges. What this indicated, however, is that Bitcoins have left exchanges at a pretty quick pace since October 2020. This “scarcity” was the driver of Bitcoin’s bullish narrative, with the same pushing BTC up the charts as well.

Now, although there are other metrics like trade volume on spot exchanges that can also give market watchers an idea, Bitcoin reserves have historically highlighted the direction of the price rally over the last few bull runs.

Bitcoin reserve on exchanges || Source: CryptoQuant

According to CryptoQuant, Bitcoin reserves on exchanges have climbed up to touch their January 2021 levels. Here, it should be noted that Bitcoin reserves had continued to drop until 5 February 2o21, following which, it climbed again.

As of now, Bitcoin reserves are lower than the figures for the last quarter of 2020, a time when Bitcoin broke past its resistance level to hit a new ATH. The press time level of reserves signaled a bullish trend, however, and it may change if the inflow of stablecoins to exchanges hikes too.

Typically, when inflows to exchanges go up, it is considered a bearish indicator since most of the Bitcoin or stablecoins flowing into exchanges are sold.

It may be historically the worst time to sell since we have entered what is termed as the “shakeout zone,” with the chart attached herein highlighting the said zone. This is often considered to be a great reversal indicator, with weak hands getting shaken out whenever the inflows of Bitcoin climb to touch an extreme or local high.

Bitcoin Shakeout zone || Source: Twitter

This zone also represents the worst time to sell at a specific price point in a market cycle. If it is the worst time to sell, is it the best time to buy? In fact, it is an ideal time to buy considering the premium on GBTC is around 5 percent and the volatility on exchanges is high since the price was up by 18.75% in a week, at press time.

End of January 2021, when exchange reserves climbed up, we hit a shakeout, and following that, Bitcoin’s price hit a new ATH above $48,000. The shakeout represented the ideal time to buy in since the ATH followed soon after. In conclusion, selling at the current price point around the $47000-level could leave you out of an extended price rally and cost you an opportunity of turning higher profits in the following weeks.