Here’s what’s different for Uniswap, this time around

Despite a drop in Uniswap’s trade volume in the past week, the price has resisted selling pressure. UNI was trading at $24.55, up from the price drop to $15.49 level. The price is still 45% away from its ATH and while trading at less than half of the ATH. The fully diluted market capitalization is up 41% in the past week.

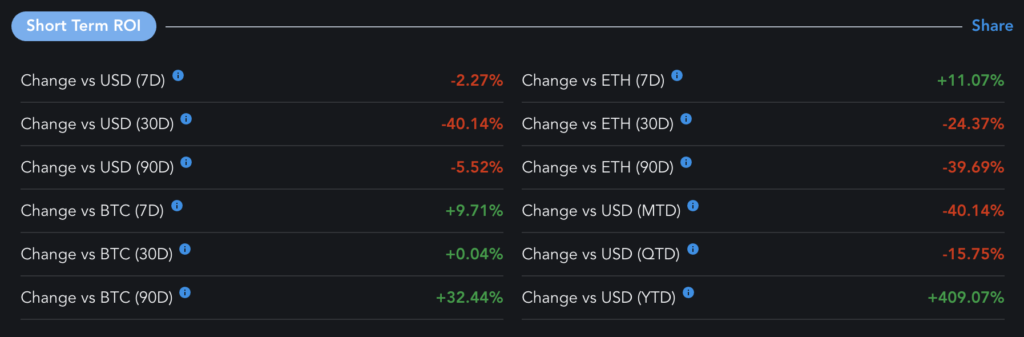

In the past 30 days, UNI gained 30% against BTC based on data from Messari. Further, short-term ROI is largely negative for UNI, this may be one of the reasons why UNI is largely concentrated in the wallets of HODLers.

Source: Messari

YTD ROI vs USD was above 400% and this fuels the demand and the bullish narrative for Uniswap. The market capitalization is $13.9 Billion based on data from coinmarketcap.com. UNI’s price rallies in the past were not as sustainable. Nearly half the HODLers are profitable at the current price level. The network had over $2.2 Billion worth of transactions in the past week and the on-chain sentiment is bearish.

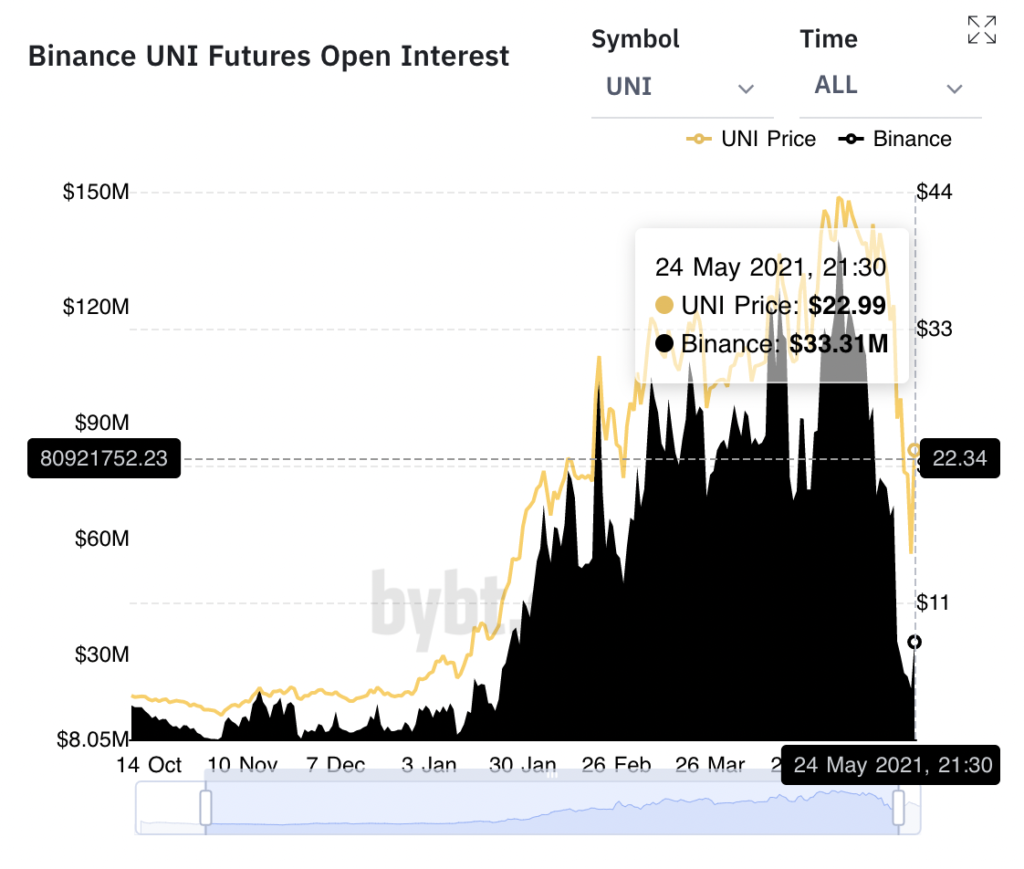

However, despite the bearish sentiment, Uniswap’s futures open interest is back at the same level as it was a week ago, based on data from Bybt’s chart.

Source: Bybt

This rally of UNI is different from other tokens and DeFi projects and that is likely since most DeFi projects are profitable in the short term. Since DEX volume has become more dominant, Uniswap’s trade volume is up to $784 Million (V2+V3). The transaction volume is up to $423 Million and the TVL is up to $5.1 Billion level based on data from coinmarketcap.com.

The price rally is different for UNI since, among other projects, Uniswap has a higher impact on the profitability of traders’ portfolio.

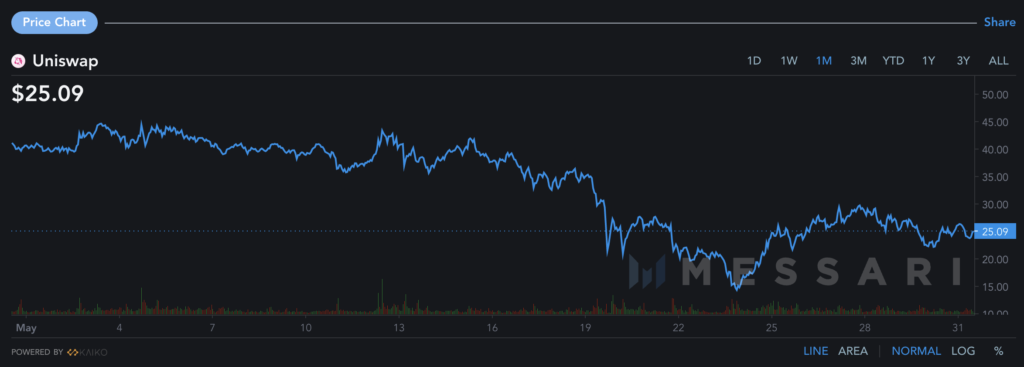

Source: Messari

Based on the above chart, Uniswap’s price has recovered consistently, following a drop on May 23, 2021, and it is rallying towards the $35 level. The rally is expected to be a long one, since there are more HODLers than ever, at the current price level. SUSHI, LINK, AAVE, CRV are rallying in DeFi summer 2.0 and UNI could lead the way with high profitability for traders HODLing UNI in their portfolio from 30 days to 3 months and more.