Bitcoin

Here’s why Bitcoin is becoming an option for Wall Street veterans

The disappointing state of Treasury bonds could trigger a rescue plan from the Fed. Either way, Bitcoin is likely to attract more liquidity. Here’s how…

- U.S Treasury bonds’ 20-year performance was an eyesore, leading traditional assets players to look in Bitcoin’s direction

- BTC’s volatility decreased and long-term holders are not ready to back down

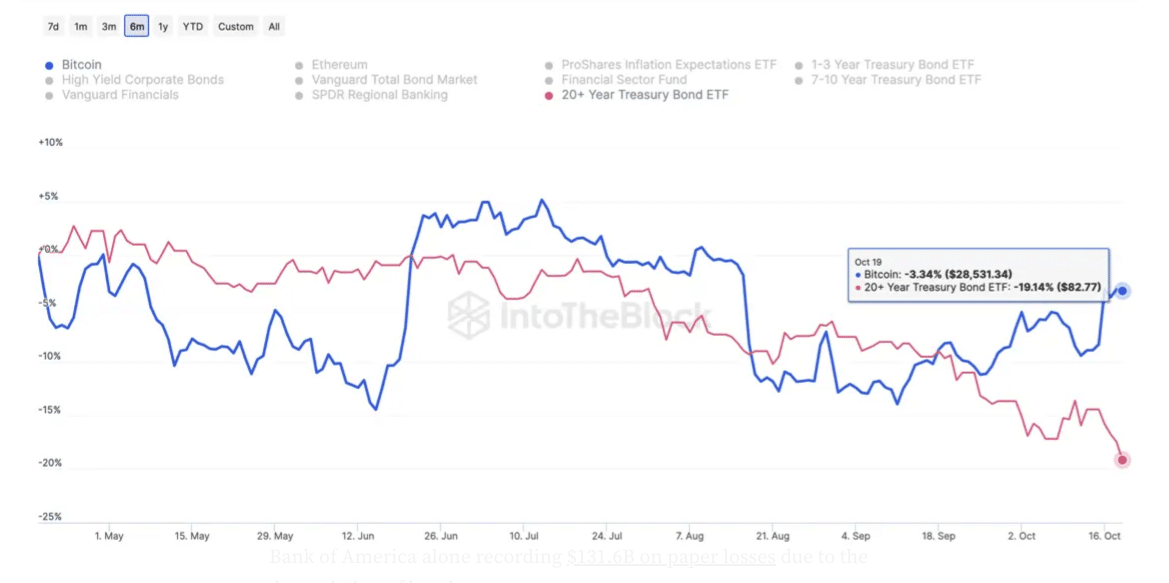

Bitcoin’s [BTC] growth over the last few days may have gladdened the hearts of market players. However, according to IntoTheBlock, the king coin’s performance has also influenced the macroeconomic landscape, especially in the U.S.

How much are 1,10,100 BTCs worth today?

No bond can break the king coin

IntoTheBlock, in a Medium post published on 20 October, specifically focused on the crash of U.S bonds. In the post, it also considered the effect on Bitcoin’s liquidity.

U.S. bonds, popularly known as Treasury Bonds, are fixed rates of government debt securities offered to citizens with a maturity of 20 to 30 years.

According to the crypto-market insight provider, bonds are witnessing their biggest sell-offs in their history right now. Also, the 20-year performance is at a 19.14% drawdown at the moment.As a result of the underwhelming performance of these securities, hundreds of billions of dollars are now in unrealized losses. Also, the U.S. debt profile climbed to $604 billion over the last month due to the depreciation of bonds. Concluding its take on the effect on the U.S economy, IntoTheBlock explained,

“This creates structural problems for the economy since the rates the government pays on their debt continue rising along with the size of their debt.”

Meanwhile, the loss of the bonds seems to be a gain for Bitcoin as Wall Street veterans who are mostly

inclined to traditional assets are looking in the direction of the cryptocurrency. This was also evident in the digital asset investment report of 16 October.Earlier in the week, CoinShares reported that investment products around Bitcoin rose for the third consecutive week. This hike brought $260 million in inflows on a Year-To-Date (YTD) basis.

The said appreciation means that more investors are confident in the performance of BTC in the coming months, especially as investments related to altcoins were largely ignored. However, the attention given to Bitcoin did not result in a hike in fees recorded.

Fewer fees, less volatility, and a growing belief

At the time of writing, fees registered by the Bitcoin blockchain over the last seven days were down by 293%. This means that the volume of transactions compared to the week prior was lower.

In terms of volatility, BTC has been less volatile than bonds in the last 30 days, despite the former recognition as a very volatile asset. However, there are specific reasons for the stability Bitcoin has enjoyed lately. One of which is the increasing optimism around the market that a Bitcoin spot ETF would soon be approved.

Another factor is the resolute nature displayed by long-term holders of the coin. At press time, about 80% of Bitcoin holders have held for at least six months. If this trend continues as Bitcoin’s halving nears, then it is likely that we’ll see BTC at another high in a couple of months.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

IntoTheBlock concluded that the fall of bonds depicts a possible crack in the traditional investment industry. Although it admitted that the Fed could come to the sector’s rescue, it also mentioned that the action could be in Bitcoin’s favor.

“This is likely one of the main drivers for Bitcoin’s recent outperformance. As the probability of the proverbial money printer being resuming increases, Bitcoin’s scarcity is being sought by more investors in a flight to quality.”