Why Bitcoin’s transactions are soaring today

- Active addresses hit the one million mark on 6 and 7 June.

- Traders’ positions suggested optimism for BTC’s price.

The number of active addresses transacting with Bitcoin [BTC] reached one million for two consecutive days, on 6 June and 7 June, according to Santiment.

? With volatility increasing market-wide, #Bitcoin's level of utility has picked up quite drastically. The amount of unique addresses interacting on the $BTC network has exceeded 1 million in each of the past two days, the first time since April 21st. https://t.co/QVfRuwUwXQ pic.twitter.com/k1jvEXDi7G

— Santiment (@santimentfeed) June 8, 2023

How much are 1,10,100 BTCs worth today?

Skepticism drives the act

Although active addresses showed the number of unique senders and receivers, the hike did not entirely imply that these participants were buying BTC.

While this suggested significant activity for Bitcoin, it tilted more toward investors’ action to move assets away from exchanges and into self-custody.

Lately, Binance and Coinbase, two of the world’s largest exchanges with high trading volumes, were served court papers by the U.S. SEC. This resulted in a high rate of outflows from both platforms.

Despite the challenges and an initial downturn, BTC did not fall below the $25,000 mark. Also, the regulatory issues and hike in transactions propelled an increase in Bitcoin’s social dominance.

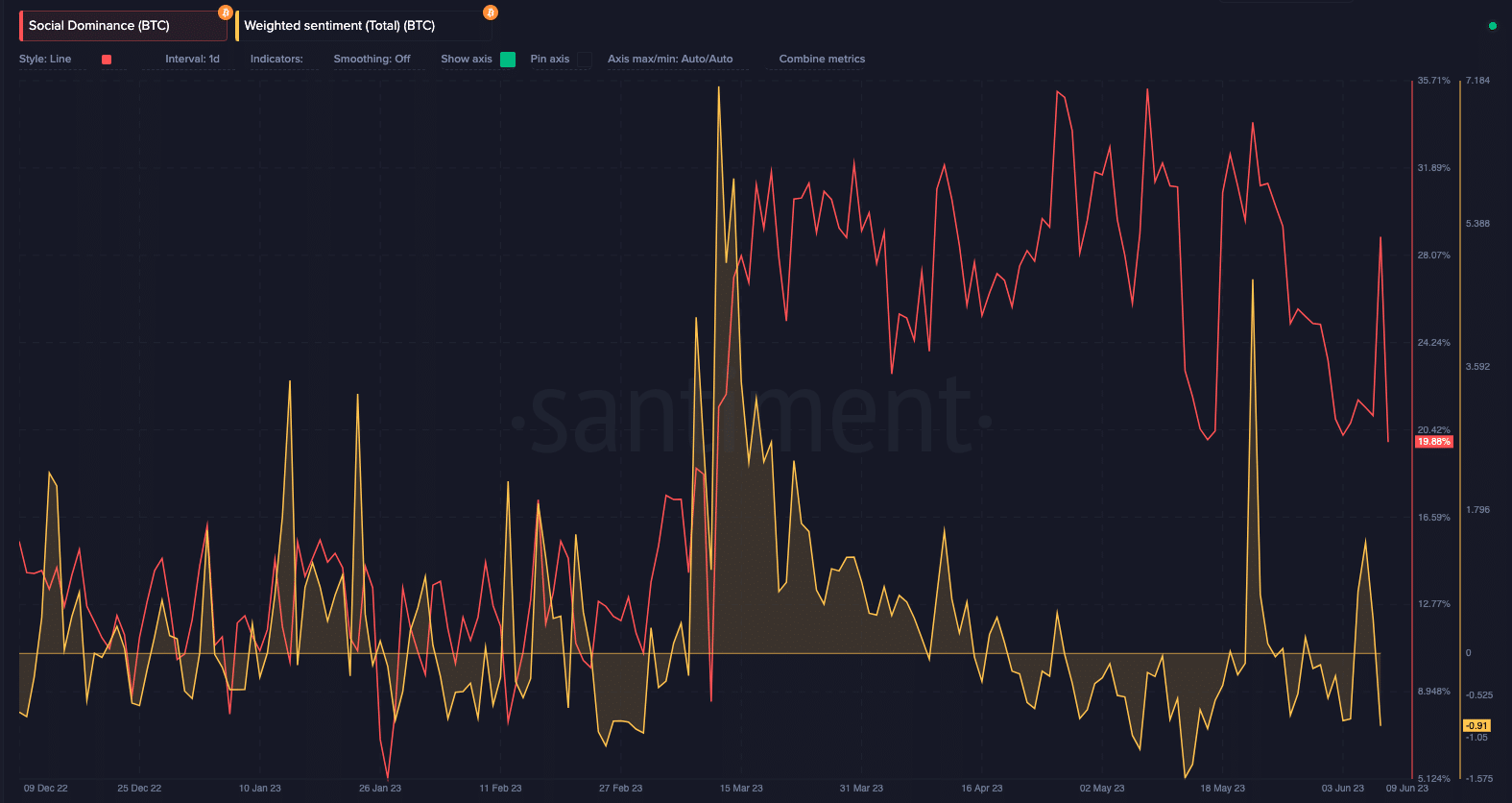

Social dominance shows the share of discussions in the crypto community that is connected to an asset. So, the increase means that attention toward the BTC spiked. While the metric had fallen at press time, the weighted sentiment also followed the same route.

Used as a measure of the investors’ perception toward an asset, the Bitcoin-weighted sentiment increased to 1.45 on 6 June. However, it had decreased to -0.91 at the time of this writing, insinuating a backpedal in optimism around the coin.

Open Interest falls

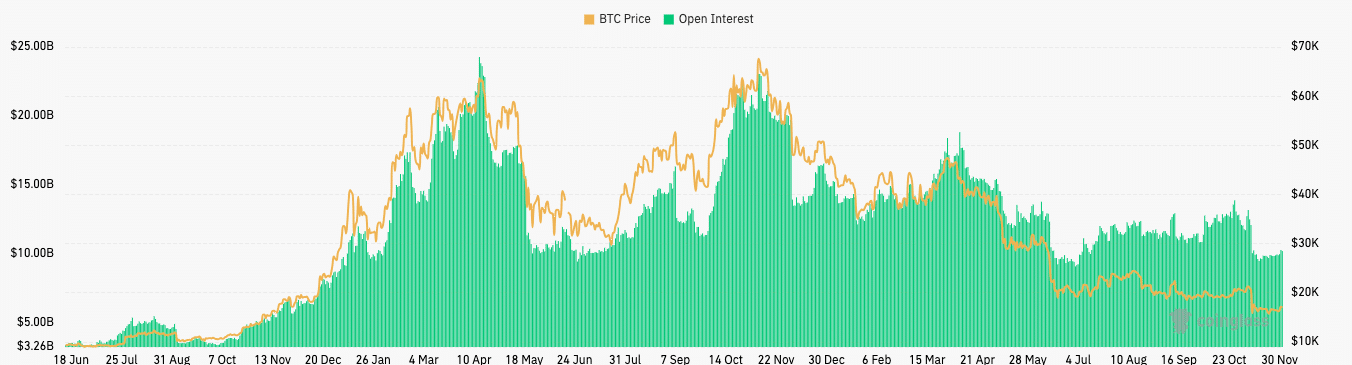

In the derivatives arm of the market, Bitcoin’s Open Interest (OI) decreased. The OI serves as an indicator of the interest in opening futures or options contracts for an underlying asset.

If the OI increases over time, then it means that traders are opening more positions. But since its decrease, it indicated how traders were exiting postins and taking liquidity out of the market.

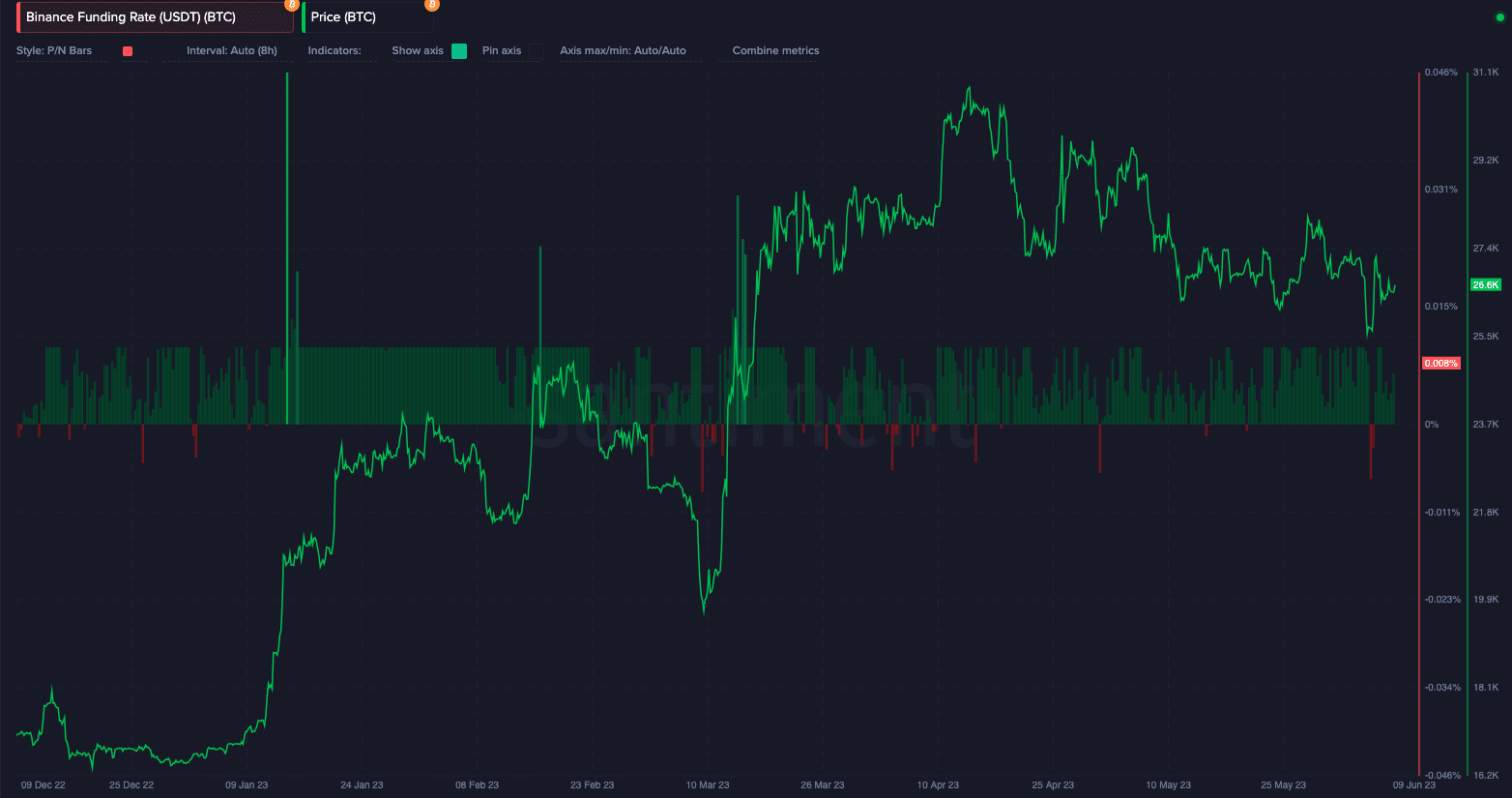

Regardless of the exits, most traders still in search of potential gains have opted to go long. This inference was indicated by the funding rate. Usually, a positive funding rate indicates that long-positioned traders are willing to keep open their contracts by paying short.

But when the funding rate is negative, it means that more short positions were open, and outpacing their long counterparts.

Realistic or not, here’s BTC’s market cap in ETH terms

In another development, ArkInvest CEO Cathie Wood maintained her optimistic BTC position in a recent Bloomberg interview. This was after her company accumulated more of the Coinbase stock after the SEC served the company.

While she said the crackdown on the firms is healthy for competition, she also answered another question about her $1 million prediction. In backing her stance, Wood said:

“The more uncertainty and volatility there is in the global economies, the more confidence increases in Bitcoin.”