How Bitcoin remains unfazed amid market instability

- The new year rally boosted BTC’s network adoption further, as more than 4.36 million non-zero addresses were added.

- Bitcoin stays immune to regulatory agencies’ hawkish stance

The crypto market was wrecked by two major implosions last year – collapse of Terra [LUNA] in May and bankruptcy of crypto exchange FTX in November, which ultimately drove it into a crisis. However, throughout the periods of turmoil, the one thing which has stayed resilient is Bitcoin [BTC], the first and the oldest crypto asset in the market.

How many BTCs can you get for $1?

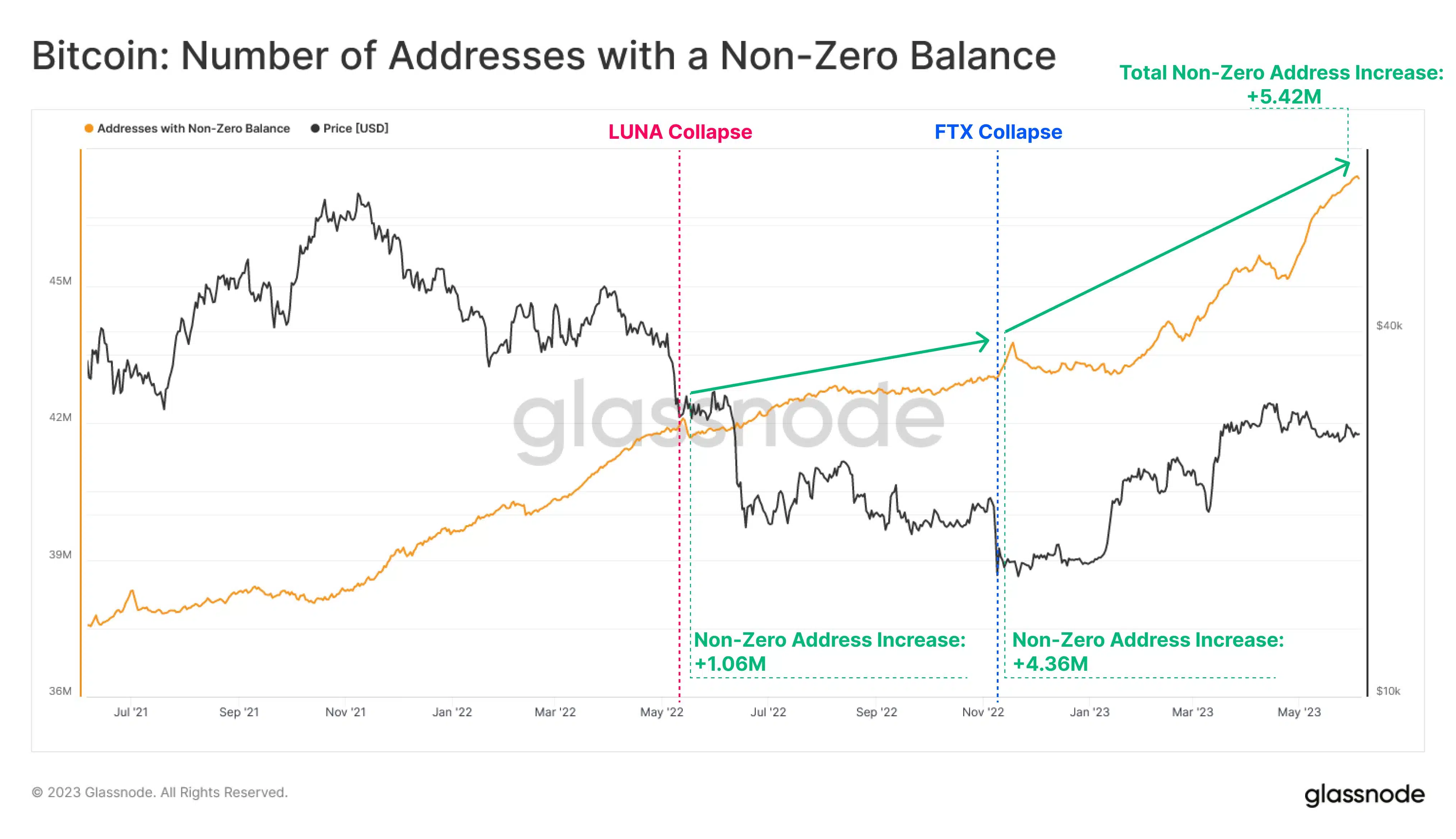

According to on-chain analytics firm Glassnode, addresses holding a non-zero number of BTC coins have increased by more than 5.4 million over the last one year.

Around 1.06 million wallets were added in the period from LUNA’s collapse to FTX. The new year rally boosted BTC’s network adoption even further, as more than 4.36 million non-zero addresses were added since the fall of FTX.

King coin stands tall

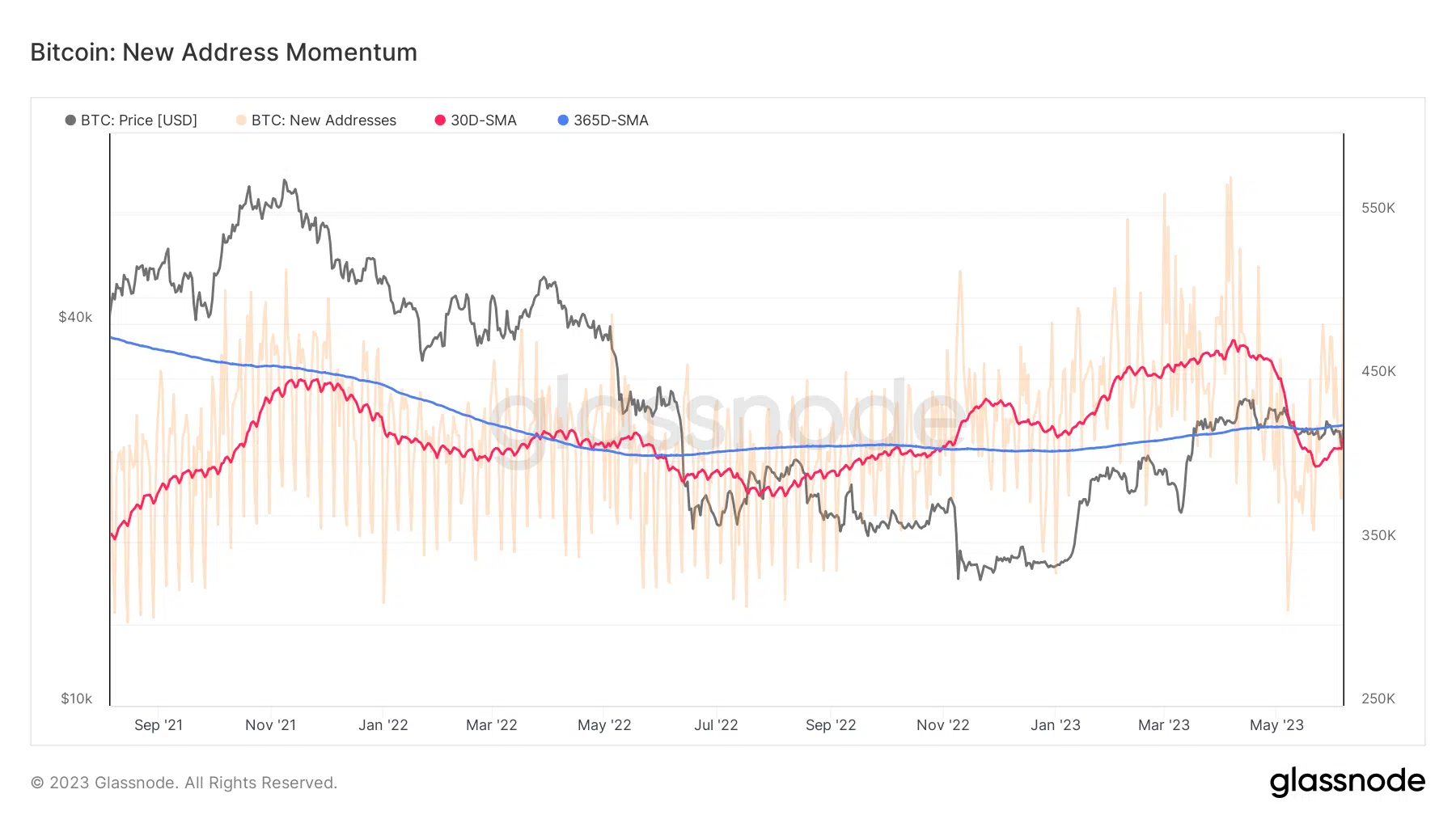

Healthy network adoption is characterized by growth in daily active users and more transaction throughput. The graph below compares the monthly average of new addresses to the yearly average, capturing Bitcoin’s journey through 2022.

The monthly average dipped below the yearly average, indicative of contraction in on-chain activity and reduced network utilization.

However, network activity recovered steadily and was unfazed during FTX’s collapse as the monthly average of new addresses remained above the yearly average in the latter part of 2022 and bull rally of 2023.

The recent dip had more to do with the low volatility phase in the market rather than Bitcoin’s weaknesses.

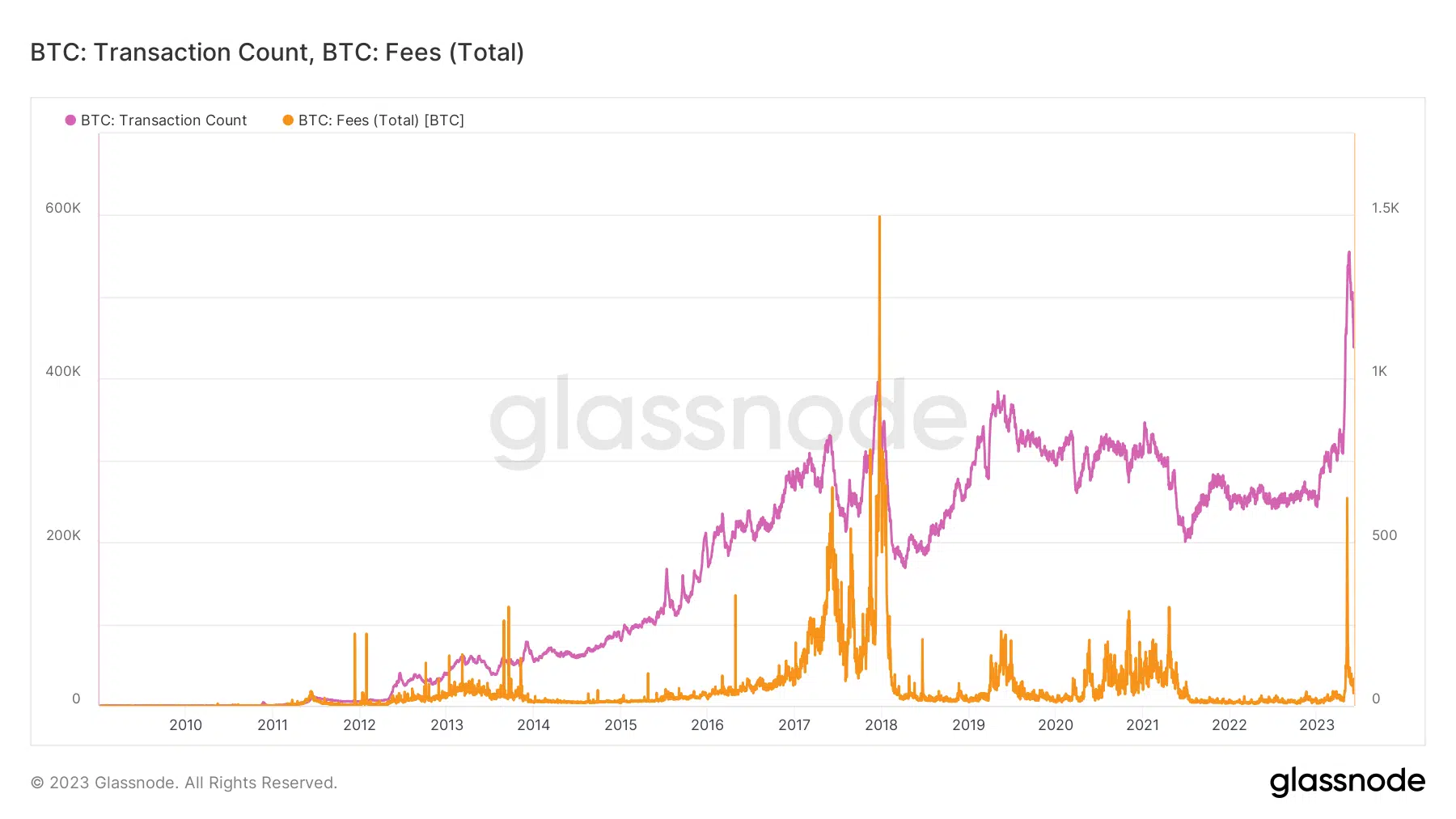

Moreover, daily transactions on the Bitcoin chain have grown steadily over the last four months, with May logging record-breaking traffic. With the network getting jammed by transactions, miners fortune soared. This was because users shelled out extra fees to get their transactions validated, as highlighted below.

The trend started with the minting of NFTs. However, the recent frenzy was driven by the bulk minting and trading of BRC-20 tokens. It significantly expanded the utility of Bitcoin, which was previously limited to use as a payment network until 2022. Thus, spurring mainstream adoption.

Are your BTC holdings flashing green? Check the Profit Calculator

BTC insulated from regulators

The regulatory authorities have been tightening their chokehold on crypto entities over the last few months. The recent back-to-back actions on behemoths like Binance and Coinbase, with major altcoins also in the firing line, have cemented Bitcoin’s image as a reliable decentralized asset that has remained immune to external agencies’ hawkish posture.