Here’s why ‘value flows’ are essential for Bitcoin, Ethereum’s market caps

Over the past decade, the blockchain industry’s growth has been precipitated by the use and popularity of cryptos like Bitcoin and Ethereum. In light of the same, it is critical we understand the value flow from fiat to these assets, and how they have led to other innovations within the industry such as DeFi protocols.

Now, over time, the quantity of value flow has changed. However, the ideology has largely remained the same. In this article, we will be analyzing Bitcoin and Ethereum’s value flow and evaluate how the DeFi space has benefited in the process.

Bitcoin – Dictating the pace of the market?

It goes without saying that Bitcoin’s value flow is the most prominent in the market since it acts as the entry point for most assets.

Now, over the past few months, 57,700 BTCs have been taken out of CEXs or centralized exchanges. While this just leads to the drop in circulation supply on-chain, the fiat value is indefinitely locked and isn’t reverting to cash. What this suggests is that the value remains on the blockchain.

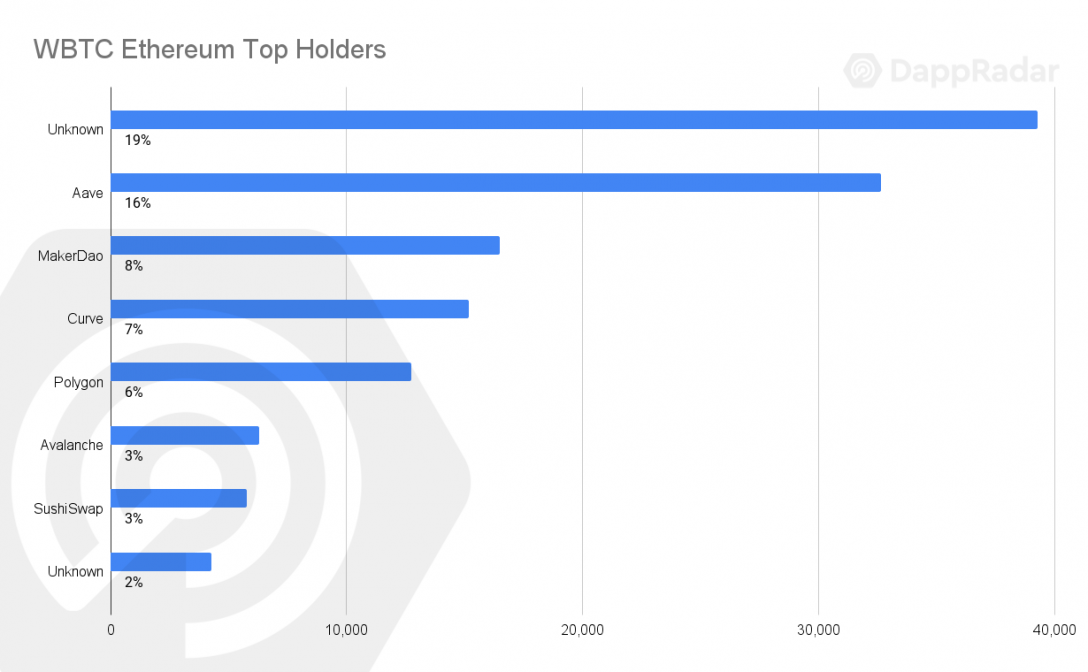

The example of Wrapped Bitcoins on Ethereum is a case in point.

Coupled with Bitcoin’s strong liquidity, the amount of WBTC in DeFi contracts has increased by more than 100% in 2021.

At the moment, close to 1.2% of BTC’s circulating supply is wrapped and on Ethereum because of its essential value flow. Therefore, these DeFi projects can flourish because of the value brought in by Bitcoin for the ecosystem.

How credible is Ethereum’s value flow?

For Ethereum, it is more from a point of utility. It is the leading blockchain in terms of total value locked with over $122 billion in place. Through the movement of ETH’s value, it is building more of an innovative side, as the emergence of NFTs can be taken as an example.

Additionally, the influence of stablecoins cannot be denied since they are key players in DeFi’s operational framework. Stablecoins have also generated value in a specific direction in terms of transactional activity, so interoperability is less of an issue.

Expansive value flow is essential for organic growth

As can be identified, the concept of value flow is allowing both the major assets in Bitcoin, Ethereum to be built on a stronger financial front for innovation. What’s more, DeFi protocols have been receiving more traction due to the support of sustained capital flows as well.

There is a wider gap being filled in this aspect. One where all types of asset classes are propagating the right form of value distribution. This is invariably leading to more growth and larger market caps for Bitcoin, Ethereum, and the rest of the market.