How altcoins COMP, MKR, and AAVE helped the DeFi comeback

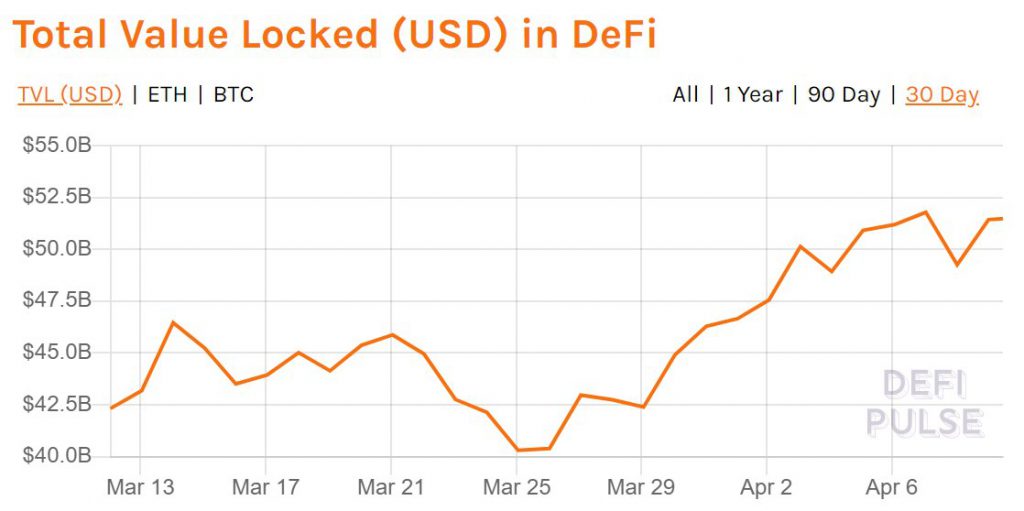

The recovery for the altcoin market was quick, and in the case of DeFi’s top tokens, it was even quicker. The market capitalization is currently above the $2 trillion level and the target is to recover the lost market cap, from over the past few weeks. DeFi’s TVL has recovered from the initial drop based on the following chart.

DeFi’s TVL || Source: DeFiPulse

Based on the above chart, the TVL has steadily climbed up since March 25, 2021, and recovered from the recent drop in April 2021. The top projects that have contributed to DeFi’s comeback are lending projects – COMP, MKR, and AAVE, based on market capitalization on DeFiPulse. These three are also the top projects in terms of TVL and rank among the top 10 based on daily returns.

There are other projects for retail traders to buy in, while top projects rally. Polygon with a gain of over 13% in the past 24 hours is one such project to watch out for. Among other lending projects from DeFiPulse, less popular ones with mid-level market capitalization like CREAM finance, Idle finance, and Alpha Homora are currently on top, when it comes to returns. Besides the top projects, a factor boosting the TVL of DeFi and the price of top tokens is the recent update on the DeFi alliance and the role Coinbase has assumed in the development of DeFi projects and the ecosystem.

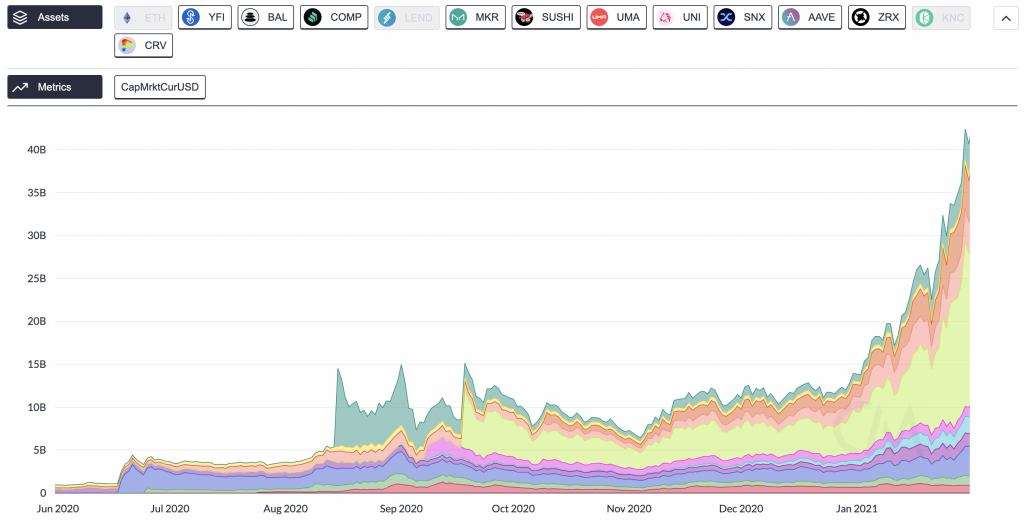

Over the past year, this has had a positive impact on DeFi through an increase in active addresses and TVL across exchanges.

DeFi’s TVL || Source: Coinmetrics

Based on the above chart, top projects have contributed to the TVL, like MKR, AAVE, and SUSHI. There is an anticipation that the increase in TVL in the DeFi market may repeat and the price of top projects may rally further with the support of the alliance. The active addresses have increased more consistently when compared to TVL.

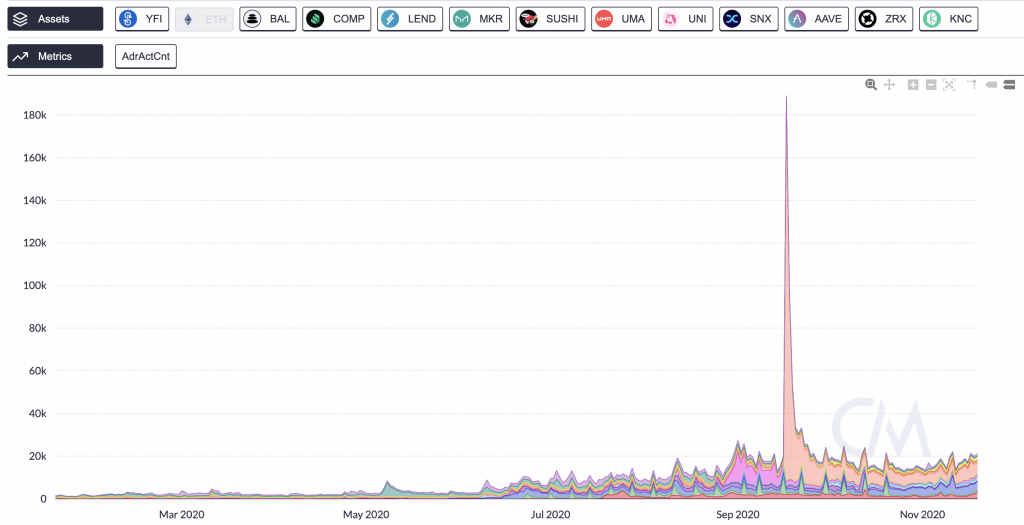

Source: Coinmetrics

The DeFi alliance led to an increase in the active addresses. With Coinbase’s involvement in the alliance, traders with top DeFi projects in their portfolio can expect double-digit returns within the following months. ROI for projects in the top 20 is expected to increase in the current phase of the altcoin cycle.