How ASI Alliance’s ‘Earn & Burn’ plan could push FET token to $2

- Head and Shoulders pattern flashed bullish momentum ahead for the AI coin

- Fetch.Ai has saw a gradual hike in midterm cruisers in 2024

Fetch.AI [FET] was trading at $1.26, at press time, with a 24-hour trading volume of approximately $383.56 million. Over the past week, FET recorded a 10% decline, likely due to general market volatility. Even though its year-long performance has been largely impressive.

In light of the 198.8% hike over the past year, the token’s strong growth reflected a sustained interest in Fetch.AI’s innovative role in AI and blockchain ecosystems.

Charts show ‘Head and Shoulders ‘pattern

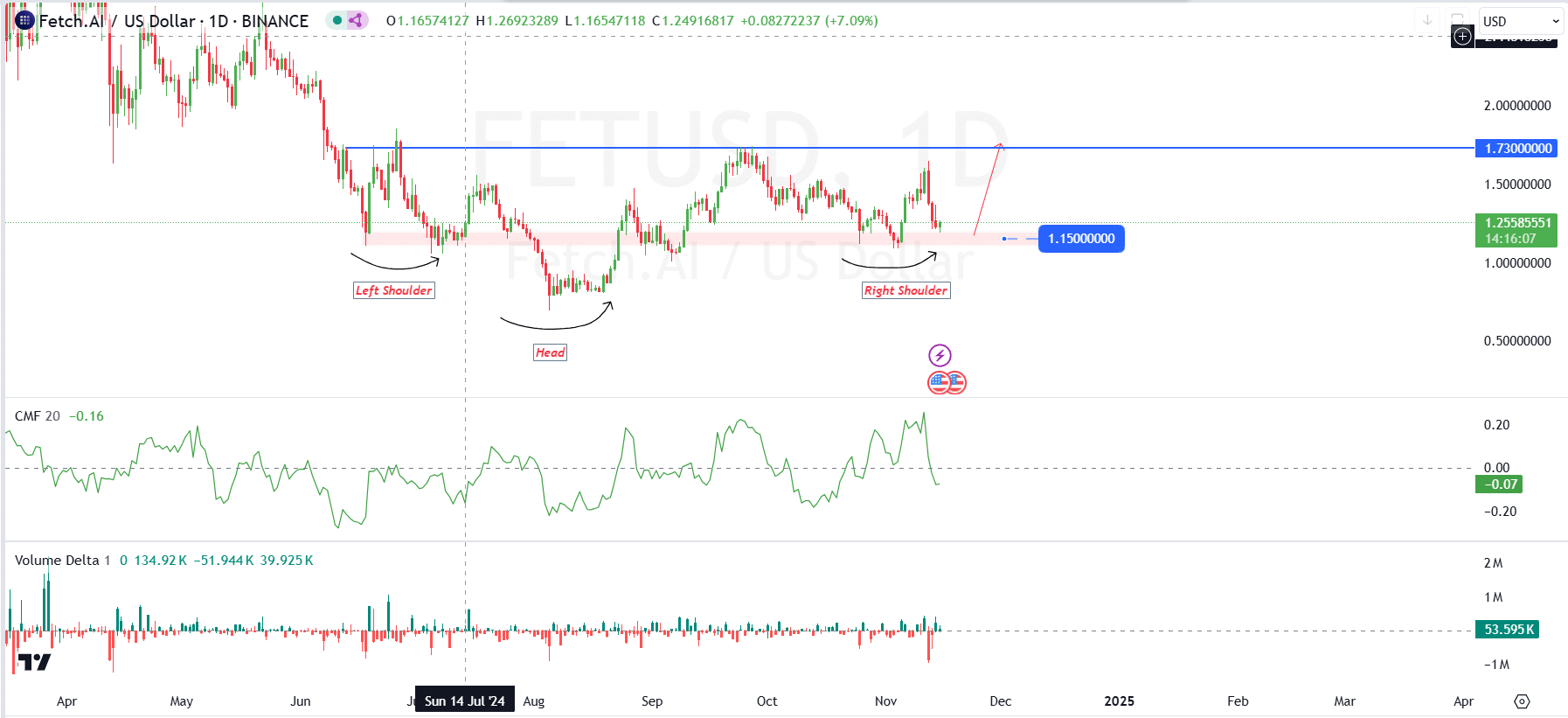

AMBCrypto’s technical analysis of Fetch.AI revealed a bullish reversal pattern on the daily chart, known as an inverse Head and Shoulders.

This pattern often signals the end of a downtrend and a possible shift towards upward momentum. The neckline at the $1.73 resistance level seemed to serve as a key barrier. And, a breakout above this level could catalyze further gains. Such a move would likely confirm buyers’ control.

Moreover, volume analysis highlighted notable spikes at critical points within the pattern, particularly around the head and right shoulder formations.

These volume increases pointed to active buying interest, which is crucial for a sustainable bullish movement. On the contrary, a breakout with lower volume would indicate weaker buying pressure.

At the time of writing, the Chaikin Money Flow Indicator (CMF) was at -0.07, indicating mild selling pressure in the market, while also showing signs of gradual accumulation. If the CMF moves into positive territory alongside a price breakout, it would further confirm the strength of buying interest.

Market sentiment & on-chain data analysis

On the fundamentals side, the ASI Alliance recently confirmed plans to implement an “Earn & Burn” mechanism for FET tokens, aimed at reducing token supply.

This move is expected to create a deflationary environment, which often increases token value if demand remains steady or grows. By balancing token rewards for users with controlled inflation, the initiative aims to create a sustainable ecosystem that encourages holding and usage of FET.

The news has sparked excitement within the Fetch.AI community, suggesting that this may be just the start of more strategic developments designed to enhance FET’s value.

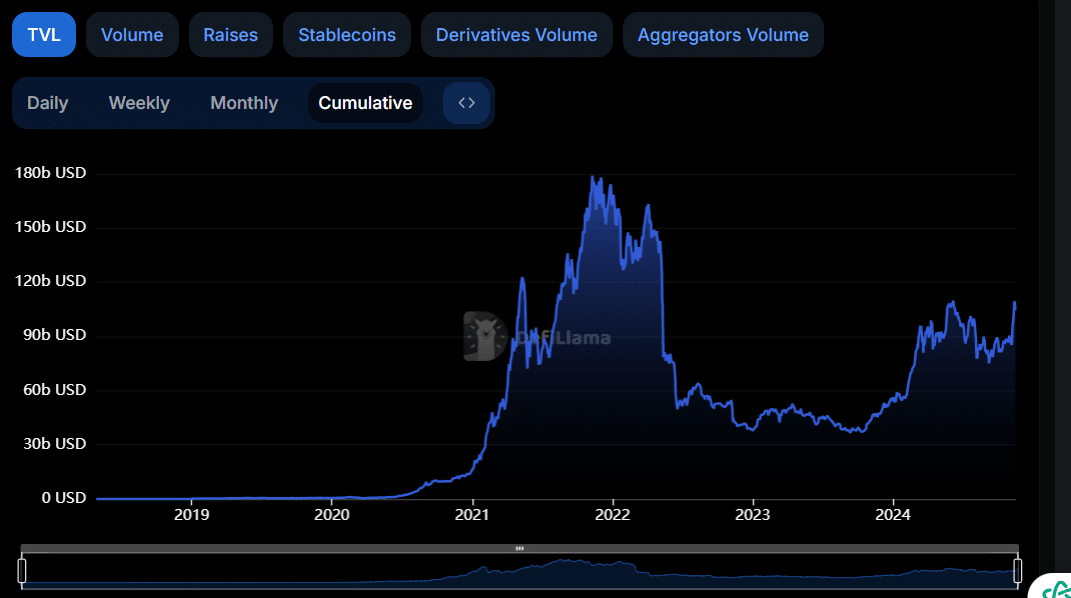

Meanwhile, the broader crypto market has seen signs of recovery in Total Value Locked, with a noticeable uptrend in 2024. Following a sharp drop in 2022 due to tightening macroeconomic conditions, the TVL stabilized throughout 2023.

As of 2024, a gradual hike in TVL suggested renewed interest and cautious reinvestment in DeFi and blockchain projects.

This trend is likely a sign of improving market sentiment, especially as new partnerships and innovations attract capital back into the ecosystem.

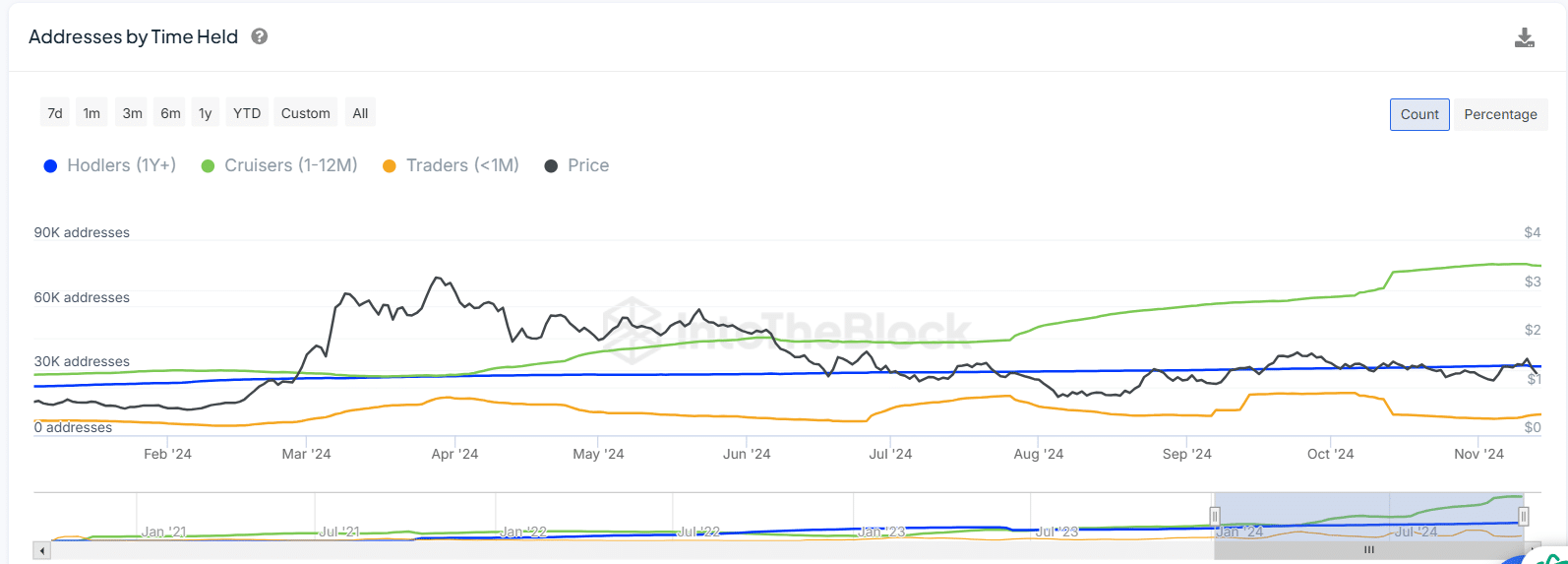

The behavior of Fetch.AI holders also painted a stable outlook, with long-term holders remaining steady throughout 2024. For instance – Addresses holding FET for one year or more have shown minimal fluctuation, indicating confidence among early adopters.

Meanwhile, mid-term cruisers have gradually increased, suggesting that newer investors are more inclined to hold onto FET for extended periods.

Read FET Price Prediction 2024- 2025

Conversely, the number of short-term traders fell through the year – A sign of reduced speculative activity.

This shift towards longer holding durations could reduce FET’s volatility over time, potentially supporting price stability and reflecting greater maturity within the holder base.