How Bitcoin’s election-fueled surge failed to lift DEX tokens like UNI, CAKE

- U.S. Presidential elections, among other bullish drivers, have bolstered the crypto market this month.

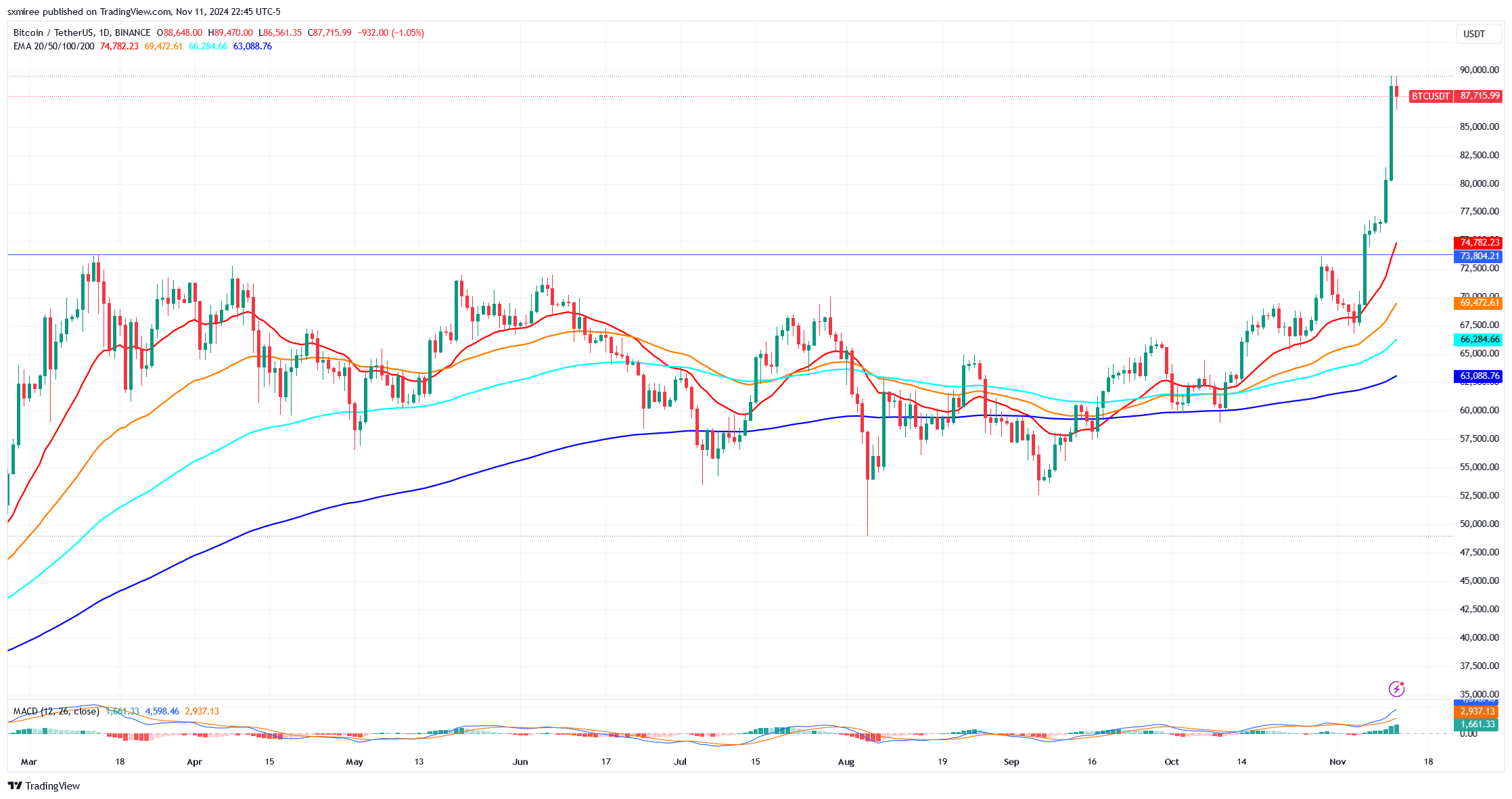

- Bitcoin surpassed its March price high last week, on course to track its best weekly returns since February.

Cryptocurrencies led by Bitcoin [BTC] extended their streak of gains after a strong performance last week fueled by President-elect Donald Trump’s victory.

Bitcoin skyrocketed in the wake of the US election outcome with the price surpassing its previous March year high. The flagship cryptocurrency posted another unusual leap this week.

In the latest price action, Bitcoin shot up above $82,00 early Monday before accelerating further to set a daily high just shy of $90,000 at press time.

Bitcoin’s bullish price action has buoyed the wider crypto market with price of most altcoins rallying after a period of consolation between August and September.

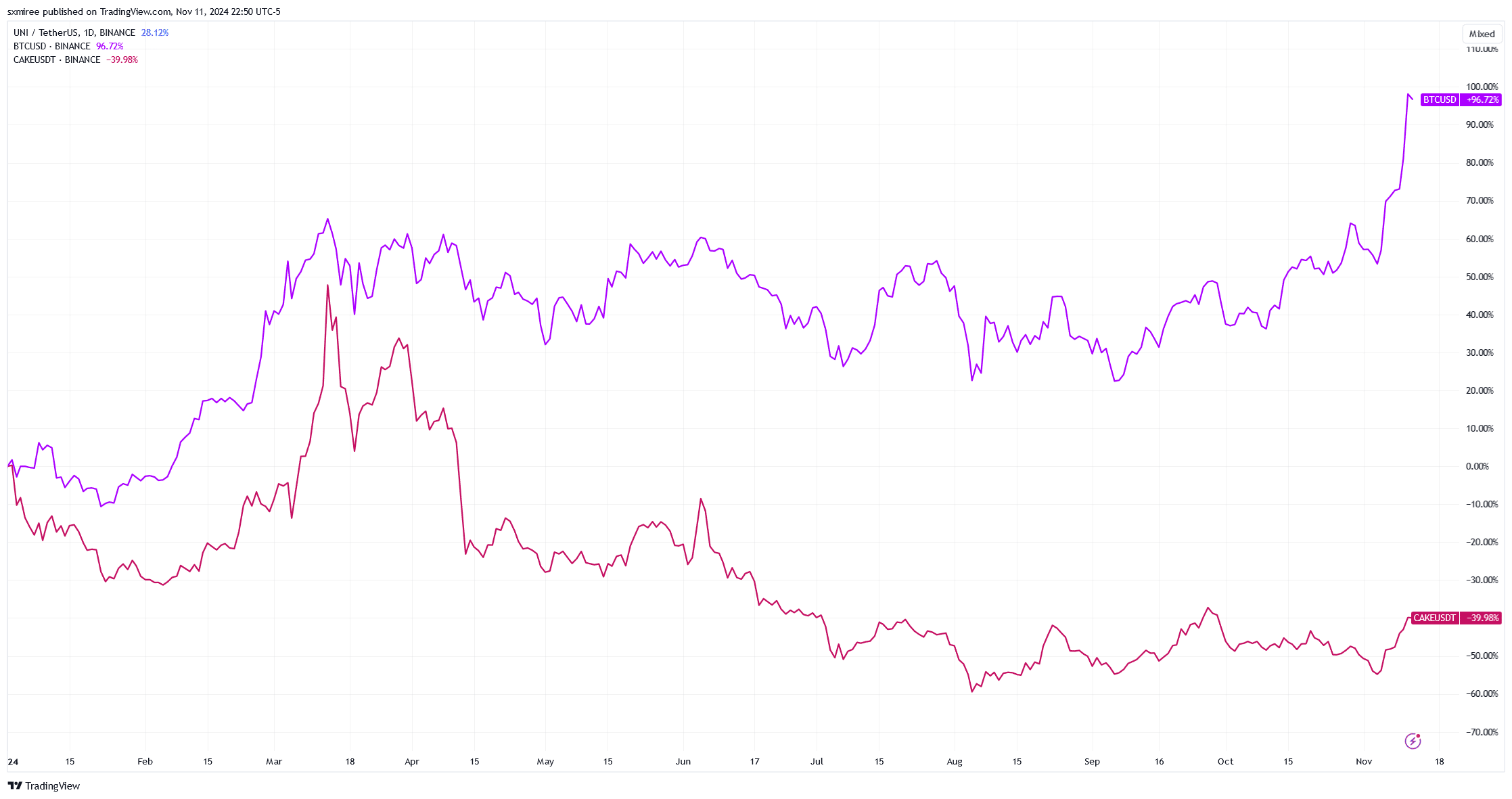

However, the native tokens tied to DEX platforms like Uniswap and PancakeSwap have for the most part remained underwhelmed despite tracking modest gains.

DEX tokens’ underperformance

CoinMarketCap data shows Uniswap [UNI] and Raydium [RAY] were trading more 70% below their all-time highs.

Meanwhile, PancakeSwap [CAKE] and Synthetix [SNX] were on the extreme end – both down more than 40% year-to-date and hovering 95% below their respective historical highs.

The performance of DEX tokens sharply contrasts that of Bitcoin whose price has doubled since the start of the year, and Ethereum, which was last spotted trading 45% higher on the YTD chart.

Market commentators have attributed this relative underperformance to the increasing competition DEX platforms face from centralized exchanges (CEXs), which have been integrating DeFi-like features.

The majority of centralized exchanges including Binance, KuCoin and OKX have debuted and incentivized their own token offerings with benefits like lower fees.

User trends have also contributed to the lackluster performance. The decentralized finance (DeFi) narrative was popular during the 2020–2021 bull run.

In recent market cycles, retail traders have been swayed by other emerging narratives like RWA and AI which has in turn dampened the hype around DEXs tokens.

Read Uniswap’s [UNI] Price Prediction 2024–2025

Market analysts, nonetheless, opine that DEX tokens may be undervalued, especially as DeFi continues to evolve. This phase of underperformance presents opportunities for speculators given decentralized exchanges remain an essential part of the DeFi space.

The most resilient DEX platforms, in particular, stand to benefit from a long-term DeFi vision focused on improved user experience and a streamlined regulatory approach.

![Can Stellar [XLM] hit $0.60? Assessing key levels](https://ambcrypto.com/wp-content/uploads/2025/01/a-cartoon-character-pointing-at-a-large-xlm-coin-i_11zon-400x240.jpg)