SUI forms symmetrical channel: Is $4.96 the next target?

- SUI was trading within a symmetrical triangle pattern, with a key support level to provide a potential base for upward momentum.

- A slight dip remains possible as the coin sought stronger support before resuming its bullish trajectory.

Over the past 24 hours, Sui [SUI] has declined by 4.89%, suggesting further downside risk in the short term. Despite this, the asset’s monthly gain of 24.75% highlights its broader bullish trend.

Based on technical indicators and on-chain data, SUI may soon break out of its current range and rally toward a higher price zone, potentially reaching $4.96 in the near term.

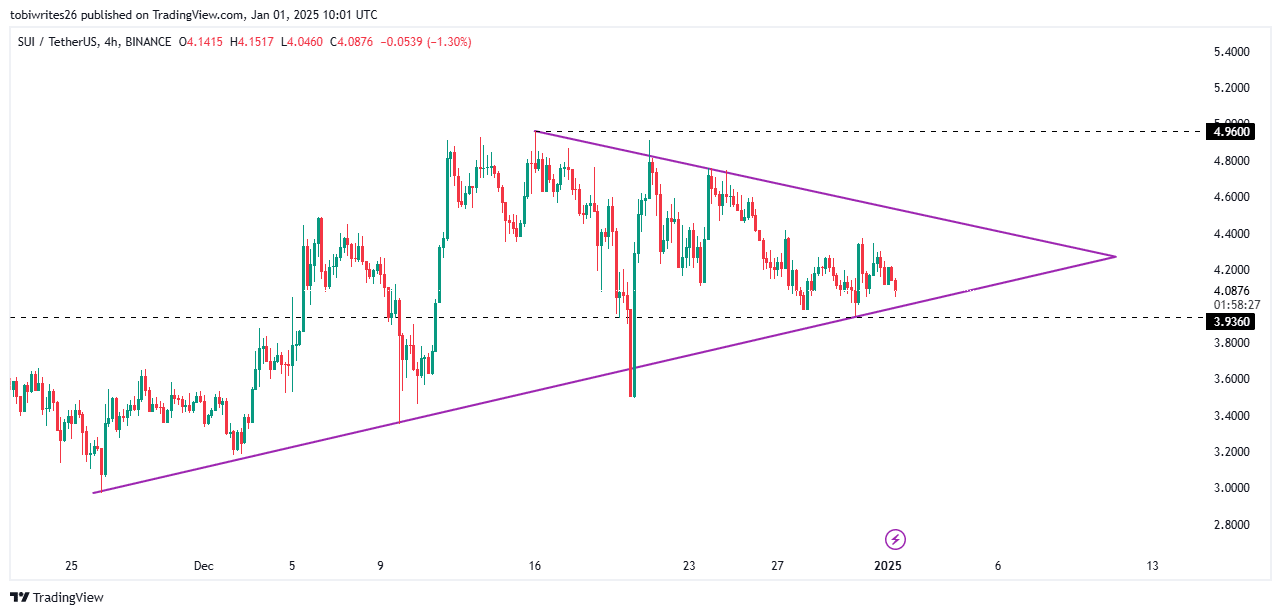

SUI trades within a symmetrical channel

On the 4-hour chart, SUI appears to have entered an accumulation phase and is forming a symmetrical triangle. This pattern suggests market participants are buying at lower levels, which could lead the market to swing higher.

This phase is characterized by two converging trendlines: the upper line as resistance and the lower as support. For a rally, SUI might need to drop to establish sufficient support at two key levels.

First, the coin could test the support on the lower trendline. Alternatively, it might decline further to a historical level of 3.926, which could trigger a move to the $4.96 level. Beyond that, the price will likely trend higher.

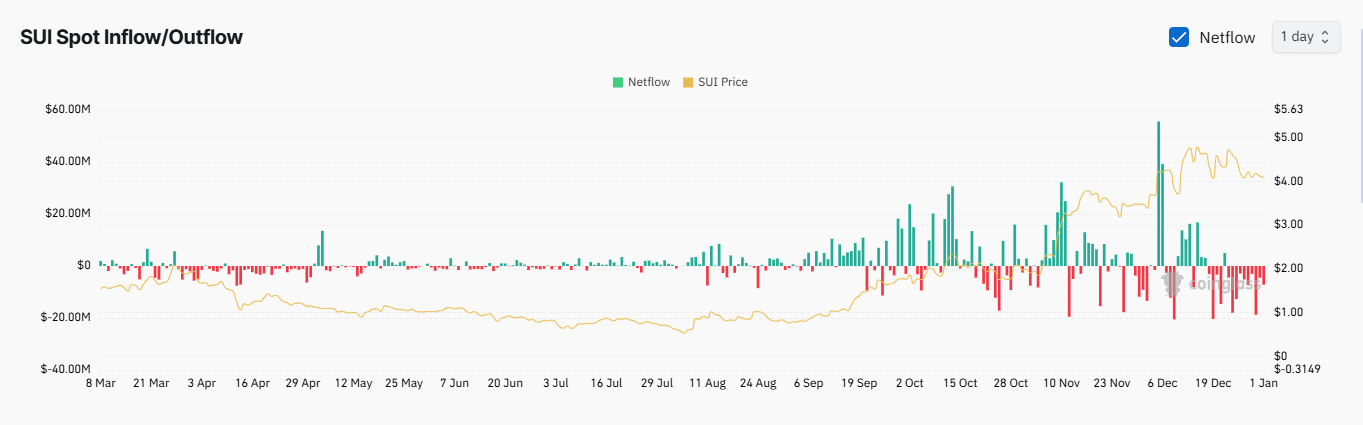

Currently, the bullish momentum is supported by a continued negative net outflow, as recorded by the Exchange Netflow metric on Coinglass. Negative net flow, where more assets leave exchanges than enter, often positively impacts the price.

Approximately $26 million worth of SUI has been withdrawn from exchanges, with $7.11 million withdrawn in the past 24 hours.

Although the altcoin was trading in a generally bullish environment, AMBCrypto has identified other confluences that suggest the price could see short-term downward pressure.

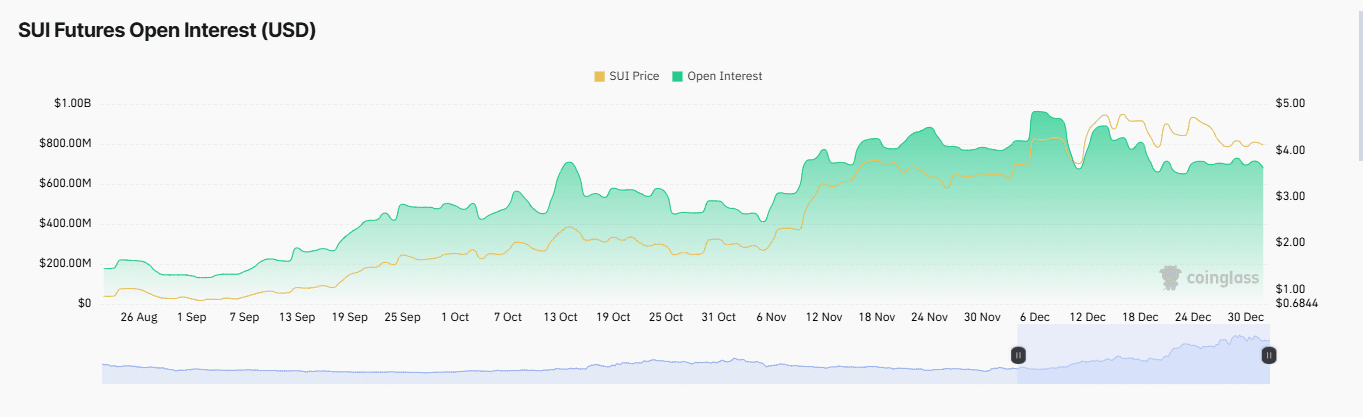

Open Interest declines

The coin’s Open Interest(OI) in the market has dropped by 5.68% in the past 24 hours, falling to $677.82 million.

A decline in OI often indicates waning participation from market players, as the number of unsettled derivative contracts decreases.

This trend is further supported by a significant drop in trading volume, which has fallen by 48.84% in the same period, landing at $1.15 billion.

The reduced trading activity and selling pressure suggest the price of SUI could fall further, potentially testing support at the $3.96 level based on current chart patterns.

SUI surpasses SHIB in market capitalization

SUI has become more valuable than SHIB by market capitalization. At press time, SUI’s market cap stood at $12.54 billion, compared to SHIB’s $12.45 billion.

Is your portfolio green? Check out the SUI Profit Calculator

With an anticipated rally for SUI, the margin between the two assets is expected to widen further, potentially pushing SUI’s market cap even higher.