How Bitcoin’s small addresses helped defy the bear market

- Bitcoin defied the bear market with record-high addresses and ongoing accumulation trends.

- Undervaluation persisted as price showed signs of a rebound and positive flows across exchanges.

Recent statistics indicated that Bitcoin [BTC] had defied the extended bear market by witnessing a surge in addresses. Notably, these addresses have continued to accumulate BTC and have recently reached an all-time high, marking an impressive milestone.

Small Bitcoin holders pile up more

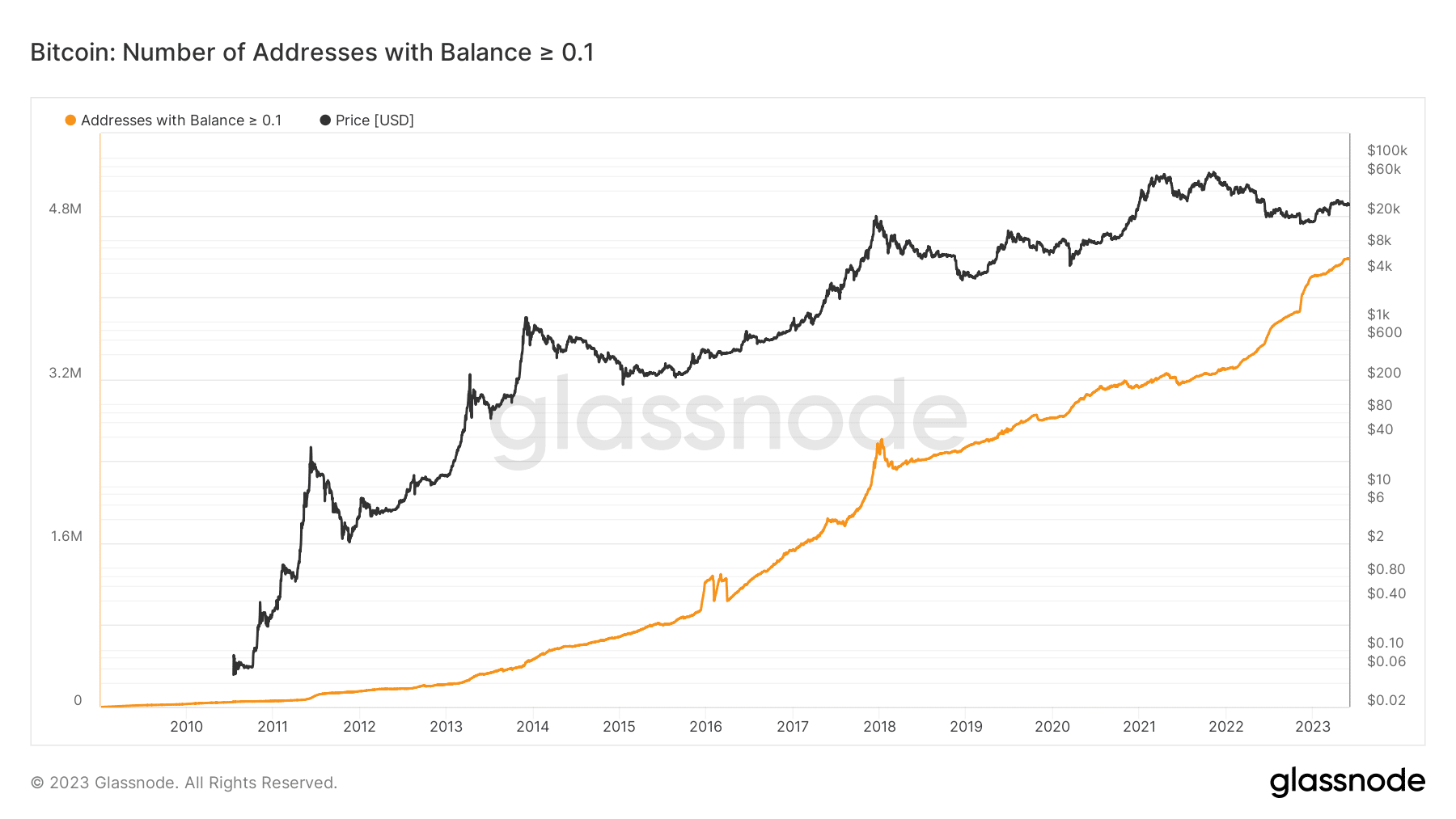

Glassnode Alerts recently shared an intriguing Bitcoin observation. Despite the unpredictable fluctuations in Bitcoin’s price, certain Bitcoin addresses have been engaging in an impressive accumulation spree.

The Glassnode chart vividly portrayed the upward trajectory of addresses holding less than one BTC, showcasing a remarkable growth trend. As of this writing, this number had surpassed 4.3 million, setting a record high.

This address surge could be observed across various Bitcoin price points. It suggested that their expansion may persist regardless of market conditions.

Notably, the chart highlighted a significant increase of approximately one million addresses since January, where the count stood at around 4.2 million. This substantial rise further accentuates the prevailing accumulation trend.

Current Bitcoin valuation

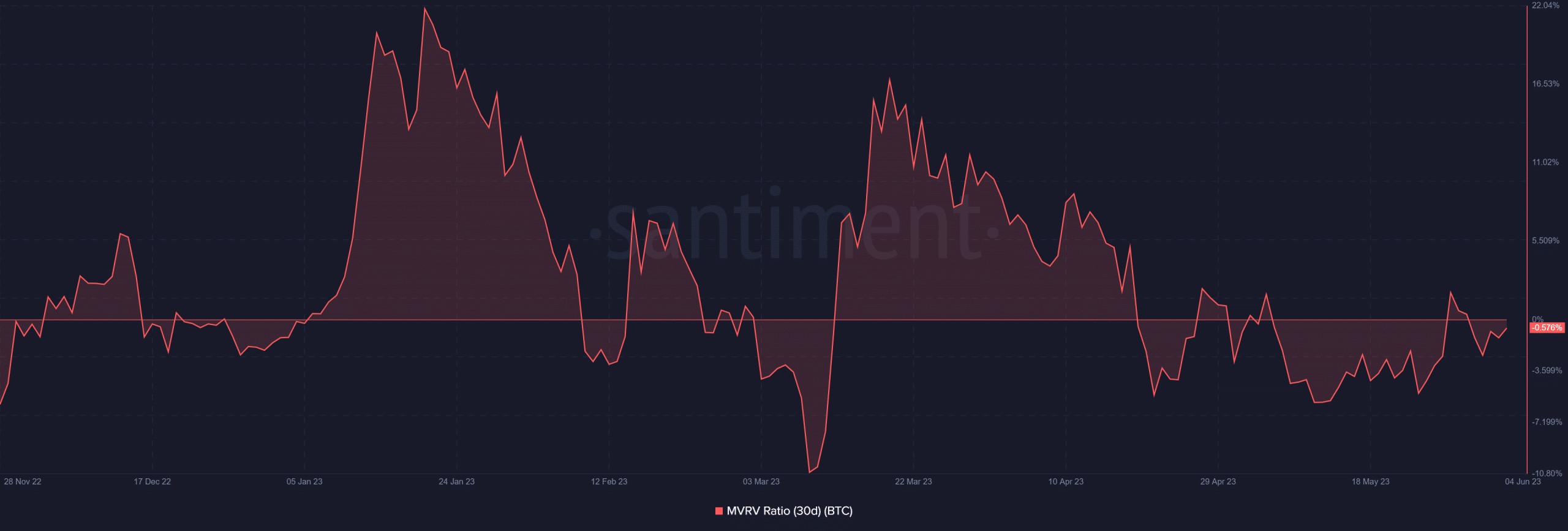

Analyzing the 30-day Market Value to Realized Value (MVRV) ratio unveiled an interesting insight into the ongoing accumulations. This metric, observed through Santiment, revealed that certain accumulations of Bitcoin might currently be undervalued.

Starting from 19 April, Bitcoin had consistently registered a negative MVRV value.

Also, as of this writing, the 30-day MVRV stood at -0.6, indicating that BTC was undervalued at press time. It also meant holders were experiencing a loss in their holdings.

Thus, despite the accumulation trend, the market sentiment towards BTC’s value has been predominantly bearish. It also presented an intriguing dynamic for investors and enthusiasts to consider.

Flow and price trend

As of this writing, Bitcoin exhibited a modest daily increase in value according to the daily timeframe chart. The price of BTC had risen by less than 1% and was hovering around $27,270.

Notably, this marked only the second instance of a value increase within the past seven days, as the cryptocurrency had experienced a decline on other days.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The upward movement also brought BTC closer to surpassing the neutral line on the Relative Strength Index (RSI), indicating the potential for a bullish trend to emerge.

Besides the price movement, Bitcoin has recently witnessed positive flows across various exchanges per Glassnode. As of this writing, the Netflow for BTC stood at over 2,400 across all exchanges.