Will Chainlink’s recovery halt at this roadblock?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Chainlink’s [LINK] recovery in late May stalled at $6.635, just above its mid-range. After that, sellers took control of the market and extended gains close to the range low of $6.2.

The downswing followed Bitcoin’s [BTC] price rejection at $28k. Although the king coin reclaimed $27k at press time, it was yet to flip its higher timeframe market structure into bullish.

Will sellers regain control?

LINK has been trading in a range since 8 May, with range extremes at $6.2 and $6.8. The range low of $6.2 also aligns with a bullish order block (OB) of $6.25 – $6.4 (white) formed on the 4-hour chart. The bearish OB of $6.51 – $6.64 (red) also aligns with the mid-range level of $6.53.

Unless BTC surges to $28k, LINK bulls could face difficulty bypassing the bearish order block (OB). The roadblock could set LINK to head southwards to the bullish OB ($6.25 – $6.4) or the range low of $6.2.

A session close above $6.635 will invalidate the above bearish thesis. Such an impulse move, especially if BTC retests $27.8k or $28k, could tip LINK to rally towards the range high of $6.8.

In the meantime, the RSI had retreated from lower ranges and crossed the 50 mark – buying pressure improved. Despite OBV’s slight uptick, it has been making lower lows since late April – declining overall demand in the same period.

Bulls had little leverage

Is your portfolio green? Check out the LINK Profit Calculator

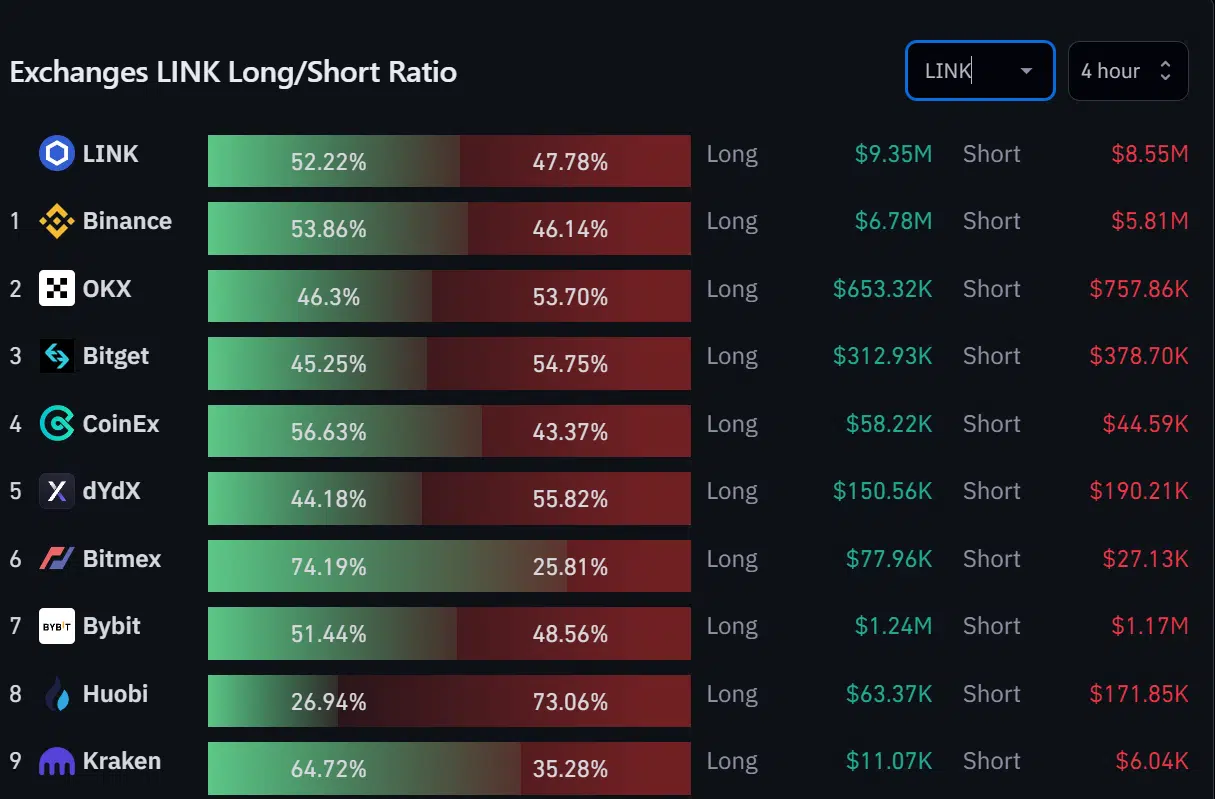

At press time, long positions dominated exchanges at 52%, denoting a bullish outlook on the 4-hour timeframe in the futures market. But sellers couldn’t be overruled yet, given the roadblock above the mid-range level.

However, a bullish BTC could tip Chainlink bulls to smash the bearish OB and target the range high. Thus, traders should track this front before making moves.