How can the CME’s rise affect Bitcoin’s spot prices?

Bitcoin’s present market is undergoing significant price discovery and its effects are being felt all across the industry. Traders and Investors are paying close attention to the market and the level of activity is very high too.

The derivatives landscape hasn’t been left alone either with institutional caterers CME currently registering impressive highs on the charts.

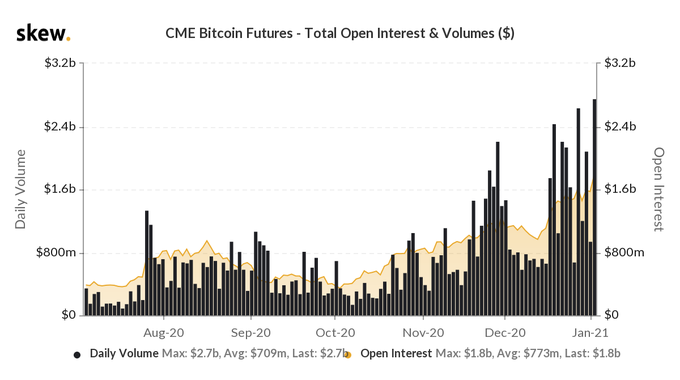

CME Bitcoin Futures – High OI and Higher Volume

Source: Skew

As illustrated by the attached chart, CME Futures volume recorded its all-time high in the last 24 hours, with the figures for the same close to $2.7 billion. The daily average volume, at the time of writing, was well above $700 million.

Additionally, the Open Interest registered a new high as well. $1.8 billion in OI was registered on 4 January 2020, with the figures for the same continuing to rise since the December contract expiry.

While the derivatives market does not directly impact Bitcoin’s spot prices, the conditions seemed to be particularly different, at press time.

Is an arbitrage opportunity in the mix?

While spot prices are not directly affected by Futures products, in the short-term, it does have a degree of impact. A significant purchase in the Futures market can quickly be taken advantage of through arbitrage trading in the spot market and vice versa.

In simple terms, whenever there is a high rise in CME Futures volume or OI like at press time, traders can be looking for an arbitrage where they are eager to buy or sell spot Bitcoin at a higher or cheaper price after the purchase. It is a time-intensive process where the price discrepancy between multiple exchanges comes into play.

While this works in the short-term, over the long-term, CME Bitcoin Futures may also allow a heightened level of stability for spot prices. The increasing capital flow in CME Futures is indicative of a higher accredited trader’s interest. It leads to the de-risking of BTC spot prices as CME brings in capital inflows from mainstream traders and that could be the result of higher volumes and OI.

Cohesive Bullish Market with CME

It is important to note that 2017’s bull run was starved off any institutional products which did not manifest price appreciation for the spot prices. Hence, the rally was washed away like a sandcastle without strong fundamentals.

CME derivatives are much more pronounced and popular at the moment, and the impact on BTC’s spot prices will possibly manifest in the long run as well.