How Curve Finance bounced back, departed tumbling state

- The CRV price increased following its founder’s decision to deposit into Aave.

- The hike did not convince market participants that CRV’s decline was over.

Curve Finance’s [CRV] price rose to $0.61 in a move that saw the token exit a long two-week decline. Between 4 and 14 June, the native token of the decentralized exchange protocol fell by 33%, Santiment revealed.

? #Curve was seeing major #FUD as prices dropped 33% between June 4th and 14th. Its founder deposited $24M into #Aave this past weekend. But as funding rates often predict, prices have bounced +8% as soon as extreme shorts began appearing on #Binance. https://t.co/pVit4FosTr pic.twitter.com/nqFo6AP3v8

— Santiment (@santimentfeed) June 15, 2023

Realistic or not, here’s CRV’s market cap in AAVE terms

However, the decision of its founder Michael Egorov to deposit $24.5 million into Aave [AAVE] may have paid off despite the FUD around the action.

Founder puts the collateral to use to curb…

On 10 June, an address linked to Egorov deposited 38 million CRV tokens into the Aave protocol. This action was taken to reduce the liquidation effect of the stablecoin loans Egorov had been borrowing.

As someone who used 32% of CRV’s circulating supply as collateral for an Aave loan, not taking the action would have impacted the token more severely than recorded. However, on-chain analysts Lookonchain reported that Curve’s health improved shortly after the decision.

Deposited 288.4M $CRV($166M) and borrowed 63.44M $USDT on #Aave;

Deposited 79.4M $CRV($45.65M) and borrowed 20.5M $MIM on #Abracadabra;

Deposited 46.65M $CRV($26.82M) and borrowed 12.86M $FRAX on #Fraxlend;

Deposited 16M $CRV($9.27M) and borrowed 4.68M $DOLA on #Inverse. pic.twitter.com/AwF6RXZXXM

— Lookonchain (@lookonchain) June 15, 2023

Although CRV’s value has shrunk further, activities in the market were crucial to its recent resilient rise. As was mentioned above, the sharp drop in the funding rate played its part in the process.

As of 15 June, CRV’s funding rate was -0.077%. Normally, a negative funding rate implies that the perpetual price is lower than the spot price. So, most traders held bearish positions than longs.

Not all glitters are gold

Despite the price increase, CRV’s weighted sentiment remained negative. As a measure of the balance of crowd commentary on social platforms, the metric considers positive and negative perceptions around a token.

Therefore, the weighted sentiment at -0.93 suggests a developing pattern where the average acumen toward CRV was cynical.

However, when the negative funding rate is extreme, it could serve as a catalyst to shift an asset price away from the downtrend. And this was what happened with CRV.

Meanwhile, Curve’s social volume increased up until 15 June. This metric shows the number of times search terms linked to an asset. So, the hike implies that CRV was on the radar of the crypto community between the decline period and the revival.

How much are 1,10,100 CRVs worth today?

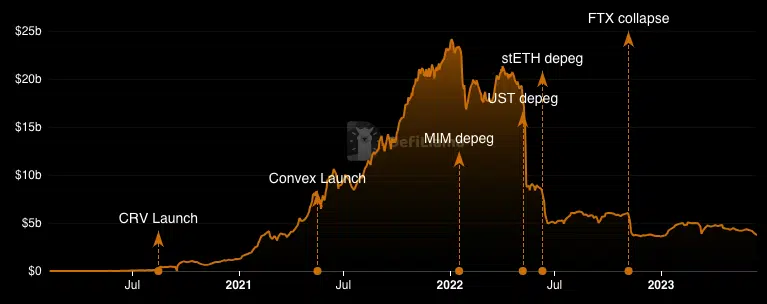

Though CRV’s health improved, the Total Value Locked (TVL) did not follow suit. According to DefiLlama, Curve Finance’s TVL decreased by 9.10% in the last seven days.

Typically, this metric is used to measure the value of assets staked and locked in a protocol. But like its counterparts who were affected by widespread contagion, there was a respite in the last 24 hours.