How Does Blockchain Tokenisation Operate?

Tokenization is capable of turning assets into tokens. When we talk about this procedure, it applies to different types of assets, like intellectual properties, and tangible ones, like artworks, for example.

By improving market accessibility, tokenization permits more involvement in investment areas that were unreachable before. With industry leaders like Microsoft working on tokenization projects for equities and industrial assets, this change generates enormous prospects for several industries.

Understanding Blockchain-Based Tokenisation

Blockchain technology supports the production of various tokens, including NFTs for unique item ownership and stablecoins that are tied to actual currencies. According to research, tokenised assets could potentially reach a value of $16 trillion by 2030, signifying the substantial market potential for a variety of assets, such as private equity, art, and real estate.

Institutional and Government Adoption

Tokenisation is becoming increasingly popular among governments and institutions. The growing industry acceptability was demonstrated, for instance, when the U.K. government proposed a framework for asset tokenization in authorized funds.

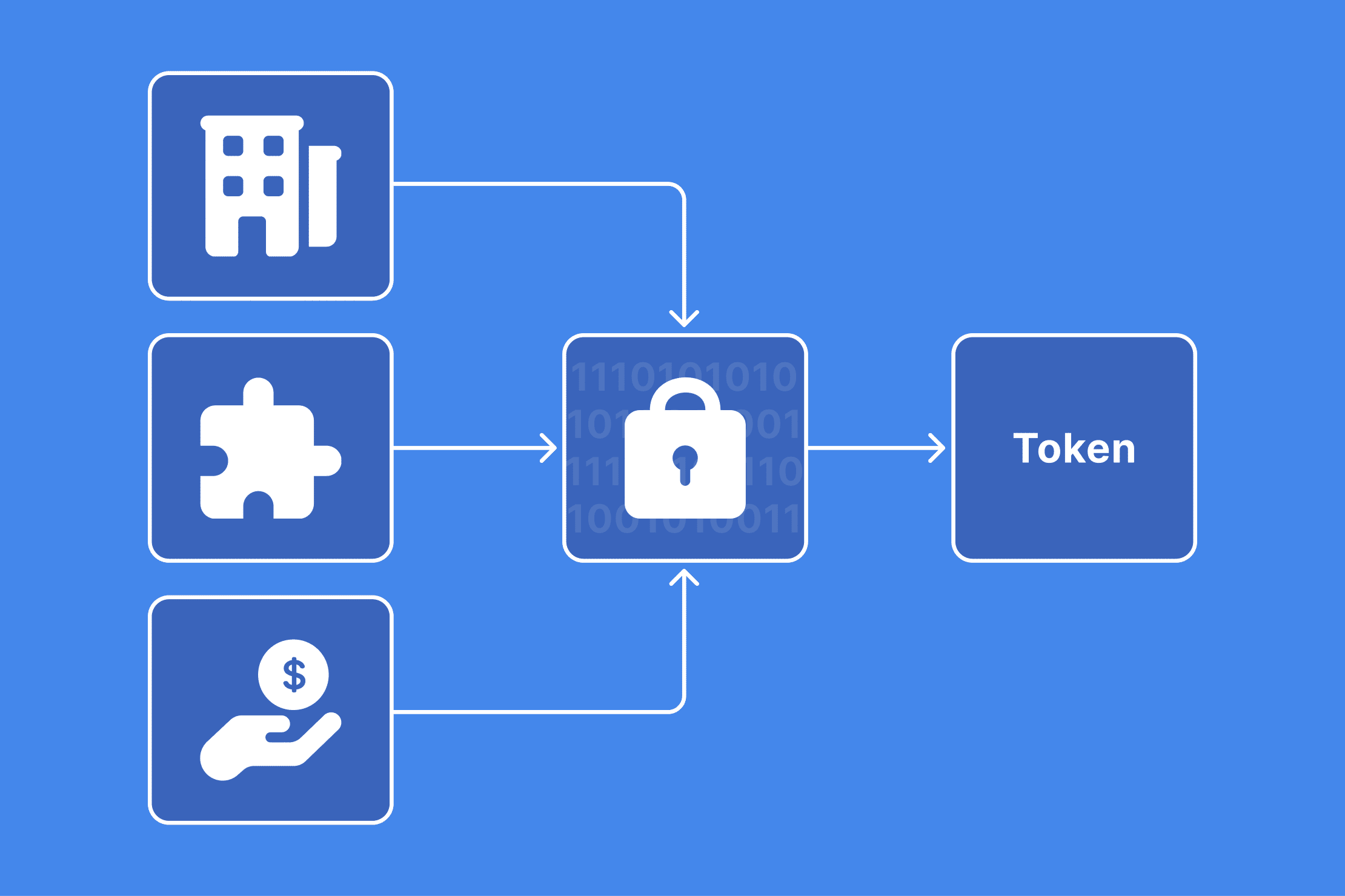

Technical Framework

Blockchain tokenisation minimizes the need for intermediaries and lowers the risk of fraud by applying smart contracts to automatically carry out agreement conditions. Tokenized assets are all assigned distinct digital identifiers that contain ownership and transaction histories, guaranteeing the uniqueness of each item.

Tokenization is reliant on distributed ledger technology, which delivers a reliable, unchangeable record of transactions. This technology is strengthened by security, which stops unauthorized alterations and enhances asset protection inside the blockchain network.

Forms of Tokens

Although there are other categories that cryptocurrency followers may be familiar with, like loyalty, governance, and equity tokens, this classification encompasses the main types of tokens that are present in the blockchain.

- Tokens can be used as transaction currency, ownership symbols, or access tokens for services, among other purposes.

- Utility tokens enable crowdfunding and grant access to platform-specific features and services, as well as voting and unique feature privileges.

- Security tokens comply with regulations and represent ownership of real assets.

- NFTs are distinct digital assets that are valued individually and cannot be exchanged, much like artwork or collectibles.

- Payment tokens are utilized in transactions and serve as network currency without being associated with any specific product or service.

How Tokenisation Operates

It consists of four primary steps:

- Item Selection: Choose an asset and split it up into tokens to start the tokenization process. The choice is based on factors such as market demand and corporate objectives.

- Token Type Determination: The next stage is to determine the token type. Utility tokens, for instance, might be used to represent fungible assets, but security tokens would be more appropriate for unique assets like artwork.

- Regulatory Compliance: It’s critical to make sure the tokenisation complies with all relevant regulatory requirements. This involves being aware of and adhering to the investment and securities rules unique to each nation.

- Blockchain Deployment: By developing smart contracts, a blockchain platform allows for the production of tokens. These contracts oversee the token’s issuance, controlling factors like supply regulation and ownership.

Following the completion of these procedures, tokens can be introduced and sold via Security Token Offerings (STOs) or Initial Token Offerings (ITOs), and they can eventually be exchanged for secondary market transactions on cryptocurrency exchanges.

Tokenisation Essentials

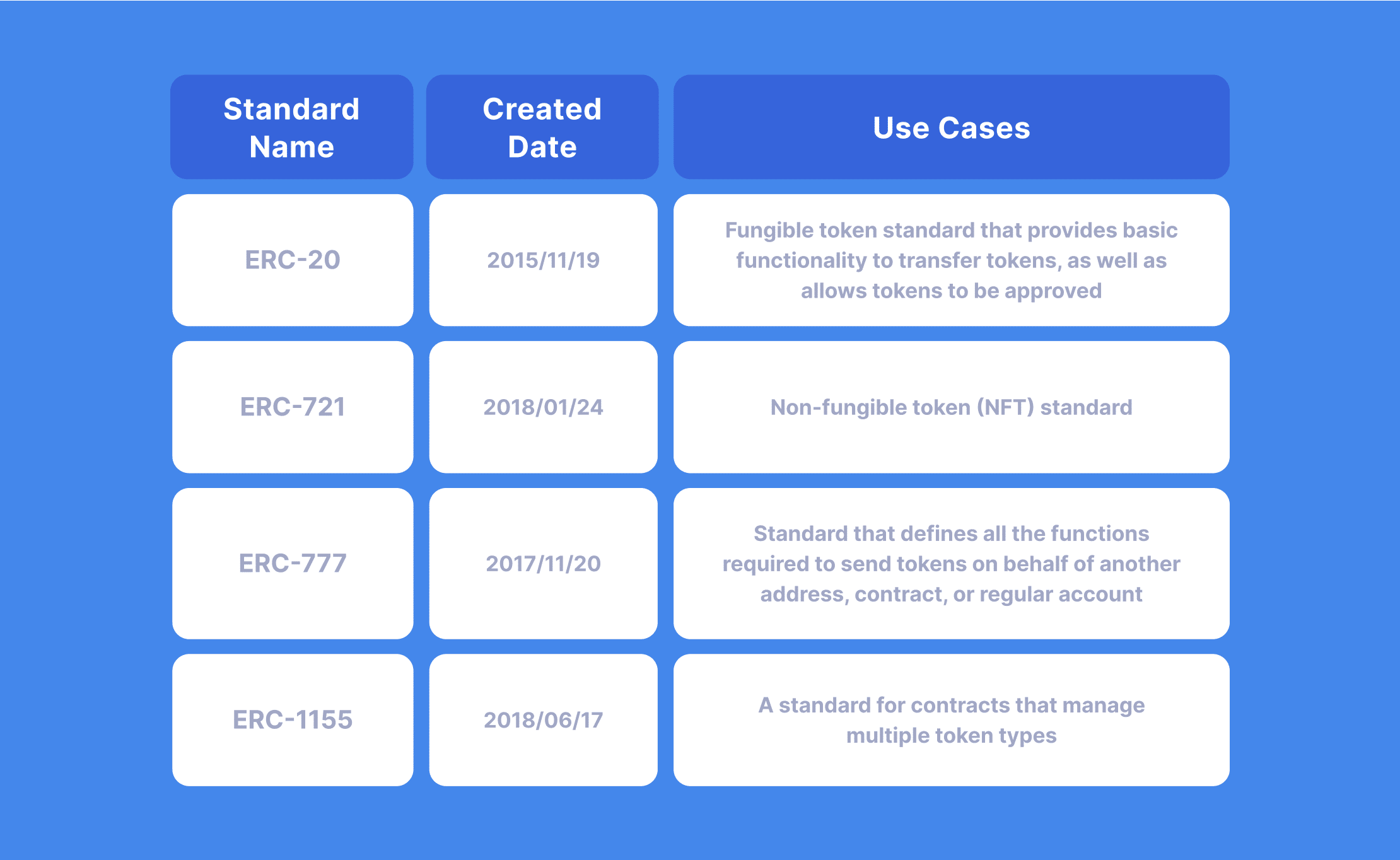

Blockchain token generation, storage, and transfer are governed by token standards such as ERC-20, ERC-721, BEP-20, and ERC-1400.

These frameworks provide the safe, effective management and cross-platform interoperability of digital tokens. By following these guidelines, developers can reduce errors and improve functionality, which will also streamline the token-smart contract interaction.

Beyond customary timeframes like T+2, tokenisation speeds up transaction settlements and may result in cost savings. Automating laborious procedures lowers operating costs and increases inclusivity by making financial services available to a wider range of people.

Smart contracts contribute to a more secure financial environment by enhancing transparency and aiding in the detection of fraudulent activity.

As a result of tokenization’s improved market liquidity, investing in non-traditional assets like real estate and art is also made possible. However, in addition to cybersecurity threats that call for advanced security solutions, it also faces regulatory uncertainties and compliance challenges across several jurisdictions.

Maintaining confidence and legality in tokenized transactions requires finding a way to balance the demands of openness and anonymity.

Launching Your Tokenisation Project

Let’s follow the steps and find out how to start tokenization.

- Get the Basics Right: Learn everything there is to know about tokenization before you start. This fundamental understanding will guide decision-making and assist steer clear of dangers.

- Choose a Platform: Select from a variety of blockchains, each with its own features, such as Ethereum, Tron, EOS, and Binance Smart Chain. The decision should be in line with the specifications of your project.

- Select the Right Token Standards: Choose a token standard that aligns with the expected functionality of your token, such as Ethereum’s ERC-20 or Tron’s TRC-10, based on the blockchain you have chosen.

- Engage Experts: Take into consideration adding experts to the team. Even in cases where coding is not necessary for the original creation of your token, their experience can be very beneficial to its success.

- Keep Up and Adjust: Technology is developing quickly. To keep ahead of the competition, stay up to date on emerging trends and be prepared to modify your approach as needed.

Final Thoughts

Initiating a tokenization project involves understanding the fundamentals, choosing the best platform and token standards, consulting with specialists, and keeping up to date to adjust to the blockchain environment.