How Ethereum remains profitable even as prices stagnate

- ETH price has spent the last few months within the $1800 and $2,000 price ranges.

- Despite this, the majority of its investors continue to hold at a profit.

In the last month, the price of leading altcoin Ethereum [ETH] has lingered between $1800 and $2,000. While its price faces significant resistance at $1,900, ETH remains a profitable investment for many holders, on-chain data shows.

Read Ethereum’s [ETH] Price Prediction 2023-24

According to a recent tweet from on-chain analytics platform IntoTheBlock, 64% of current ETH holders hold at a profit. Above 50%, this showed that most ETH holders are currently experiencing a gain in the value of their holdings.

63.9% of ETH holders are currently in profit.

The bubbles below show important potential resistance/support levels for $ETH. smaller bubbles are easier to surpass when price starts moving. pic.twitter.com/guf4n5PKKH— IntoTheBlock (@intotheblock) July 31, 2023

ETH bag-holders have a reason to smile

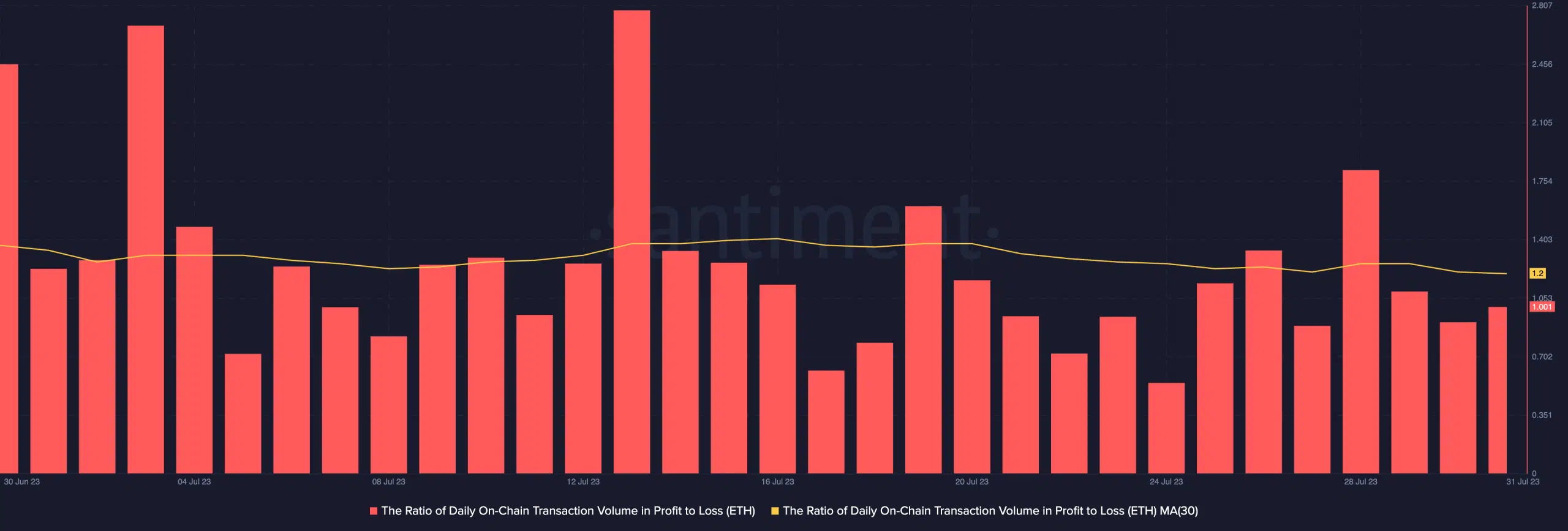

Despite the coin’s sideways movements, transactions involving ETH have mostly returned profits, data from Santiment revealed. A look at the ratio of daily on-chain transaction volume in profit to loss confirmed this.

This metric shows the ratio between transaction volume in profit and transaction volume in loss. When it returns a positive value, profit-taking transactions exceed loss-taking ones. Conversely, when the metric is negative, it suggests that losses overwhelm profits during a specified time frame.

On a 30-day moving average, ETH’s ratio of daily on-chain transaction volume in profit to loss has remained positive. At press time, this stood at 1.2, meaning ETH profit-taking transactions happened almost twice as fast as loss-taking transactions.

How much are 1,10,100 ETHs worth today

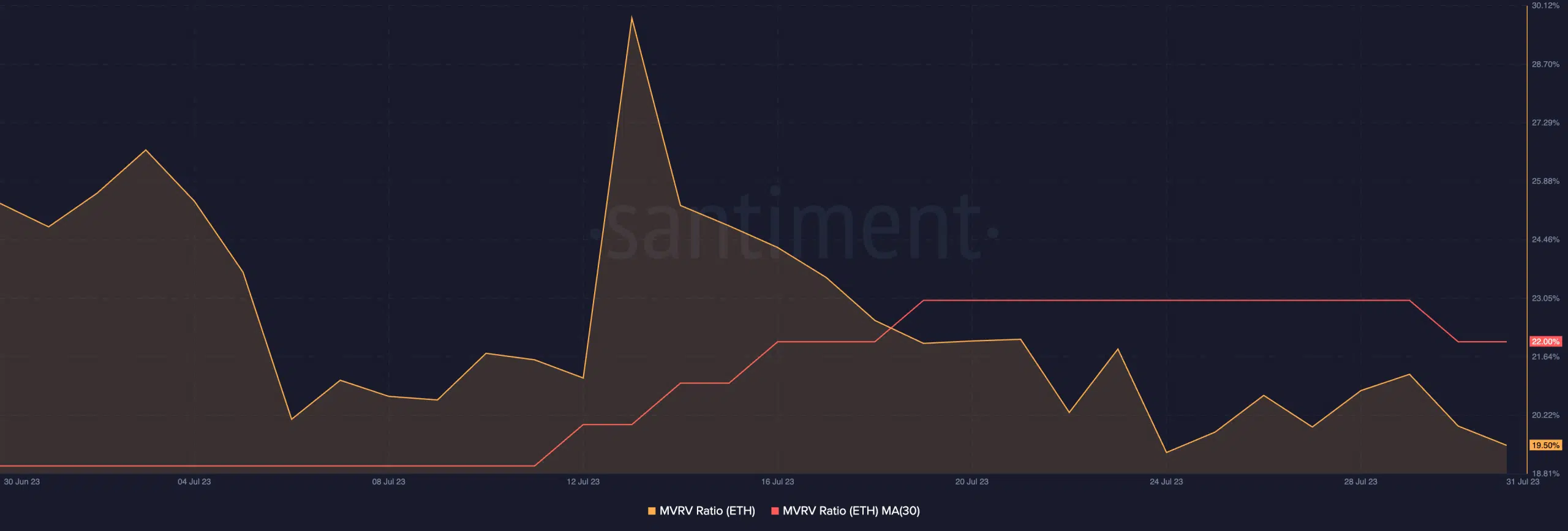

Likewise, ETH’s Market Value to Realized Value ratio (MVRV) remains above the zero line. This metric track whether an asset is overvalued or undervalued. It shows the ratio between the current price and the average price of every coin/token acquired.

The more the ratio increases, the more people will be willing to sell as the potential profits increase. At 22% on a 30-day moving average, more traders might be willing to let go of their ETH holdings to book gains.

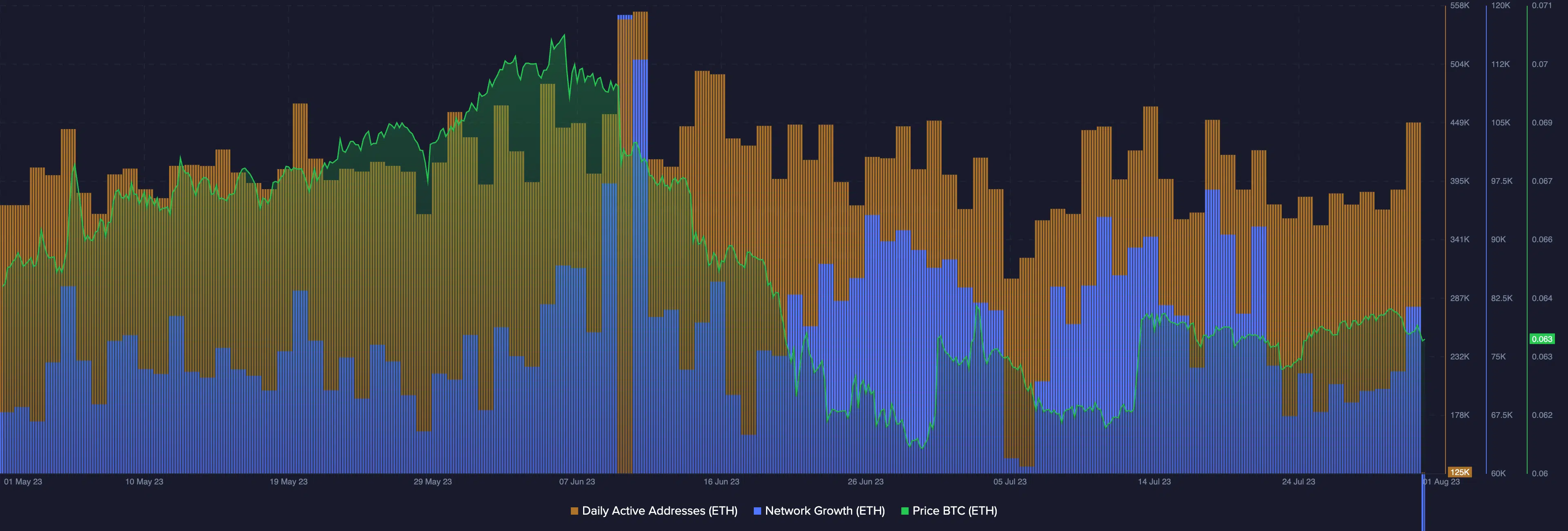

As profitable transactions count rally, ETH has seen a significant uptick in network activity, data from Santiment revealed. According to the data provider, “Ethereum’s market price has gained +4.9% against Bitcoin over the past month, and rebounding network growth has had a lot to do with this.”

To end July’s trading session, ETH recorded a two-week high of 450,000 daily active address count during the intraday trading session on 31 July. On the same day, over 80,000 new addresses were created to trade the altcoin. This represented the highest daily count in the last ten days, data from Santiment revealed.