How Ethereum’s [ETH] liquidity can help it retain its position in the market

![How Ethereum's [ETH] liquidity can help it retain its position in the market](https://ambcrypto.com/wp-content/uploads/2022/10/roulette-2246562_1280-e1666611014671.jpg)

If you have invested in Ethereum (ETH), you probably want to know how well or badly (relatively) it is currently performing. Perhaps, what you want to know more is what the future has in store for Ethereum. Maybe, the best answers are in its ability to retain value in the form of liquidity.

Here’s AMBCrypto’s Price Prediction for Ethereum (ETH) for 2023-24

Ethereum tops the list of networks with the highest total value locked (TVL). The amount of liquidity locked within a network is a decent measure of the level of faith that investors have in the network. It also underscores the level of utility that the said network can command. The more the value locked, especially during a bear market, the sounder the network is in terms of utility.

According to recent data, Arbitrum and Optimism each have a higher total value locked than Solana. To put it into perspective, both are layer 2 networks that facilitate transactions for the Ethereum mainnet. The fact that two Ethereum L2s have more total value locked each, than a layer 1 network, speaks volumes about Ethereum’s massive lead.

Holy crap! #ethereum layer twos Abritrum and Optimism both have higher total value in defi than #solana! pic.twitter.com/p1D6LKKsxo

— Lark Davis (@TheCryptoLark) October 23, 2022

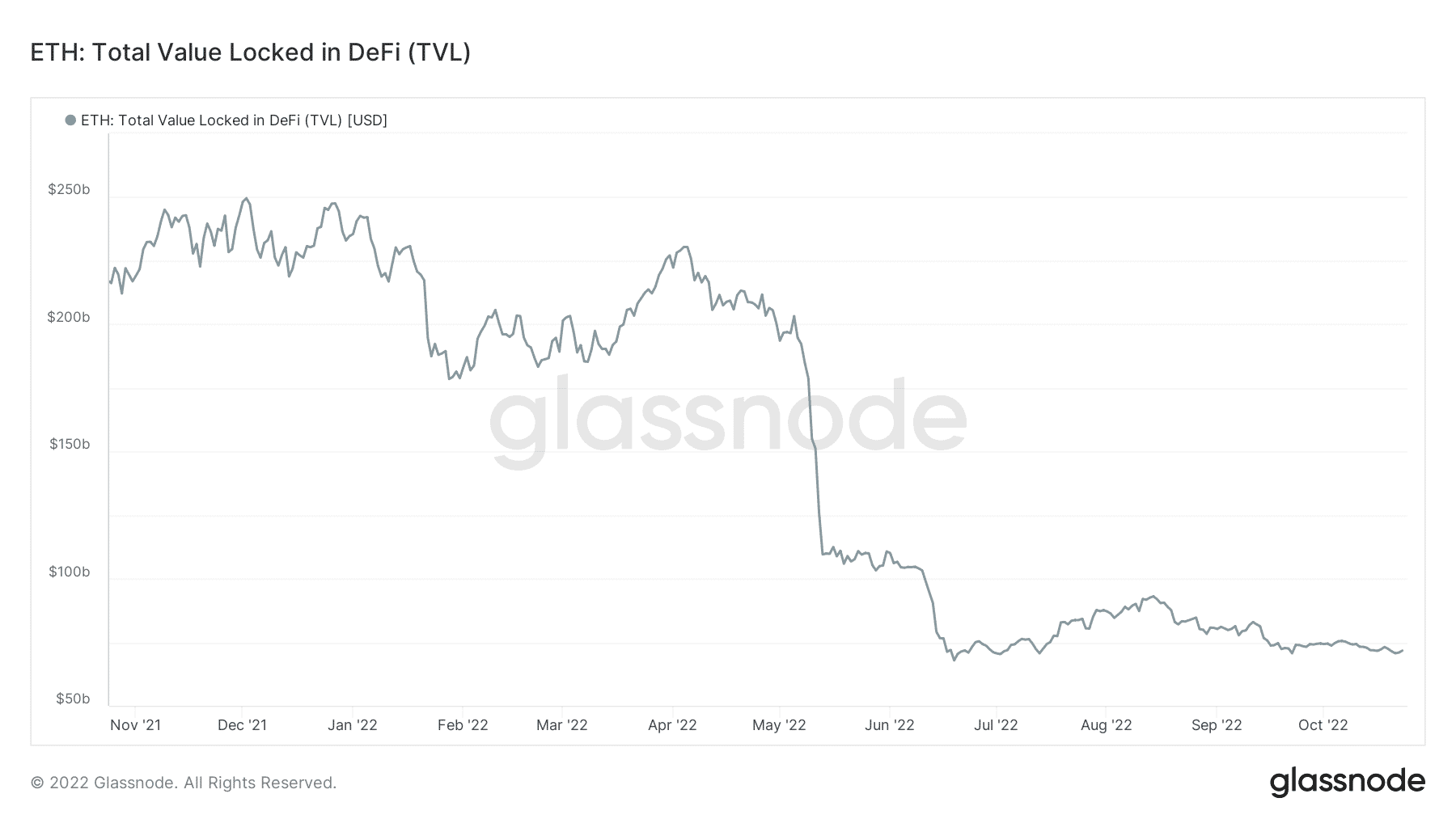

Ethereum, at press time, had a $71.6 billion TVL, close to its 1-year low of $67 million. However, it pales in comparison to the network’s historic ATH of around $249 billion.

The attached chart underscores the bear market’s impact on Ethereum’s TVL. The recovery from June’s lows has been limited, despite the transition to Proof-of-stake. Ergo, chances are that the TVL will improve when the market enters a bullish recovery mode.

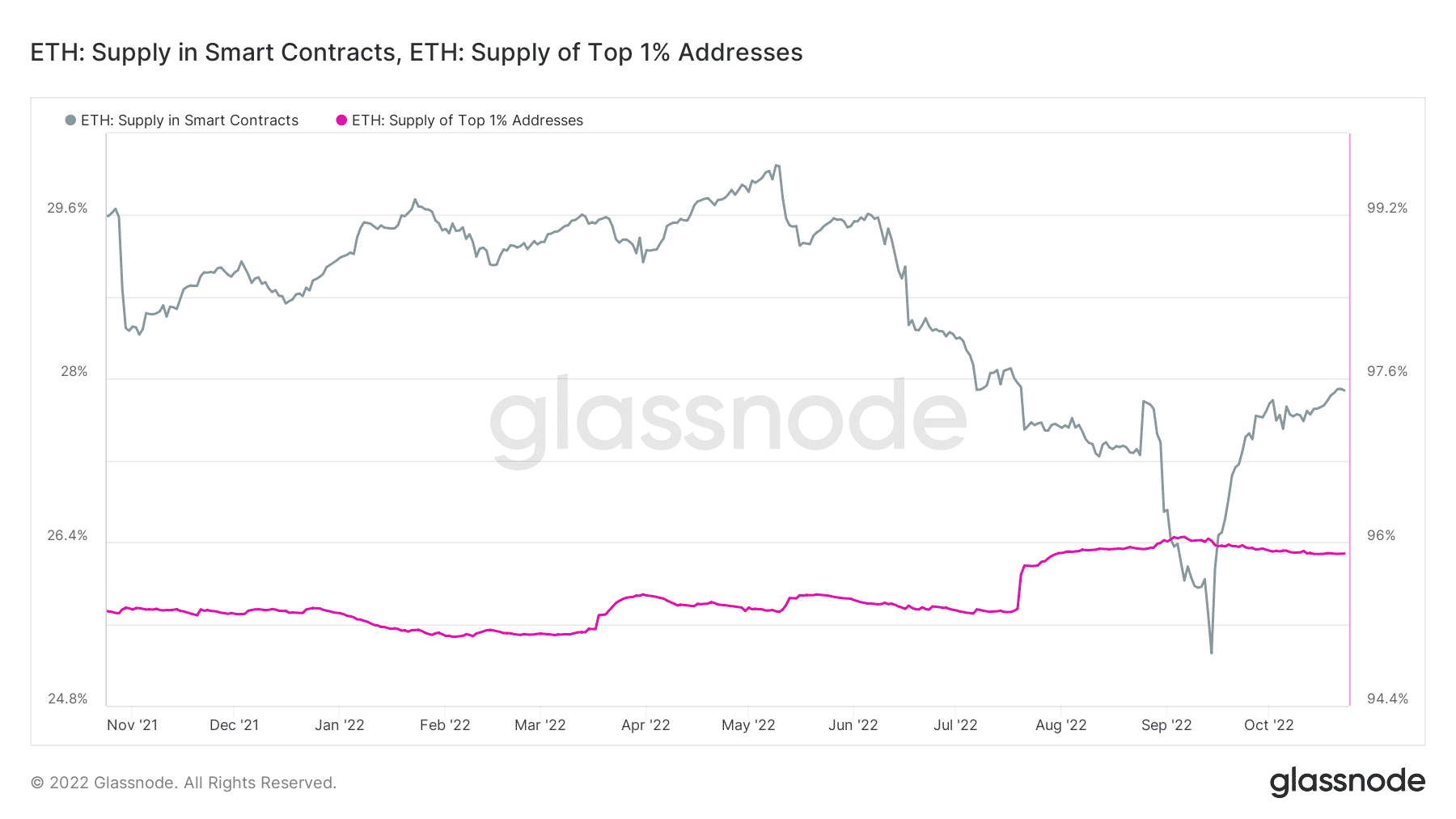

As far as Ethereum utility goes, the network maintained healthy demand for ETH in smart contracts between October 2021 and May 2022. The amount of ETH locked in smart contracts did drop drastically between May 2022 and 14 September, however. This, because DeFi suffered a major shock that spooked investors and recovery did not commence until after the PoS merge.

Amid the turmoil, large addresses have been accumulating ETH. The supply held by the top 1% bottomed out in Q1 2022. Even so, the same has increased notably over the last few months. What this confirms is that Ethereum whales have been buying the dip.

The capitulation threat

Despite some improvements, the threat of capitulation amid low demand is still live. It remains unclear whether the market will continue to crash, in which case investors might panic sell some more.

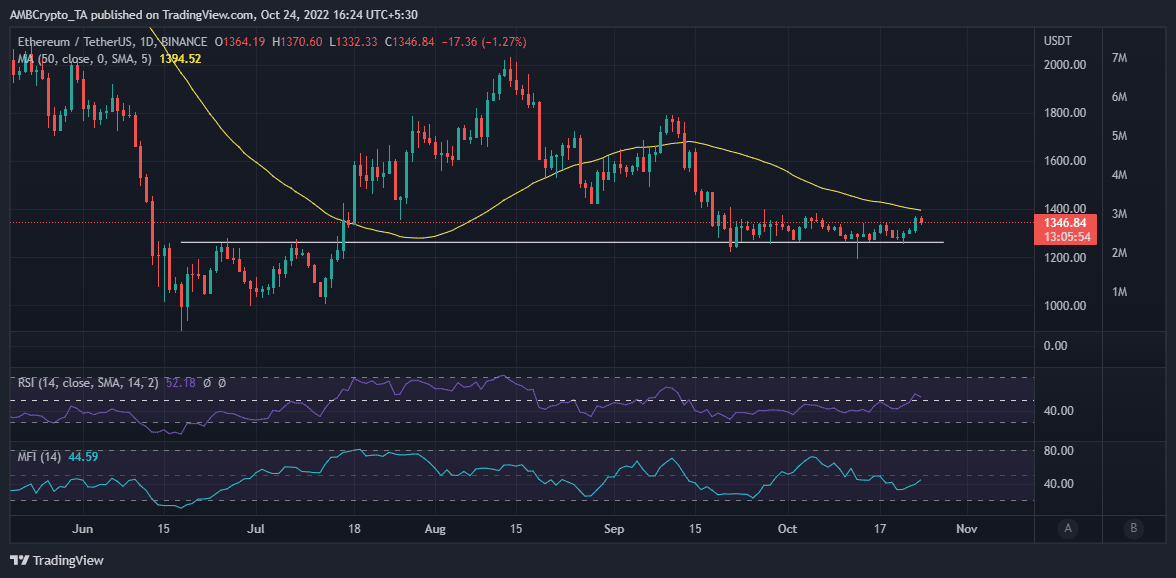

ETH appears to have found short-term support near the $1250 price range while its $1,346 press time price represented a slight premium.

ETH investors should be keen to see if the price will maintain itself above the prevailing short-term support. A drop below this level may lead to sub-$1,000 price levels.

![Ethereum's [ETH] short-term price targets - Is the $2,300 resistance too strong?](https://ambcrypto.com/wp-content/uploads/2025/03/Evans-1-min-400x240.png)