How Ethereum’s low volatility has helped whales

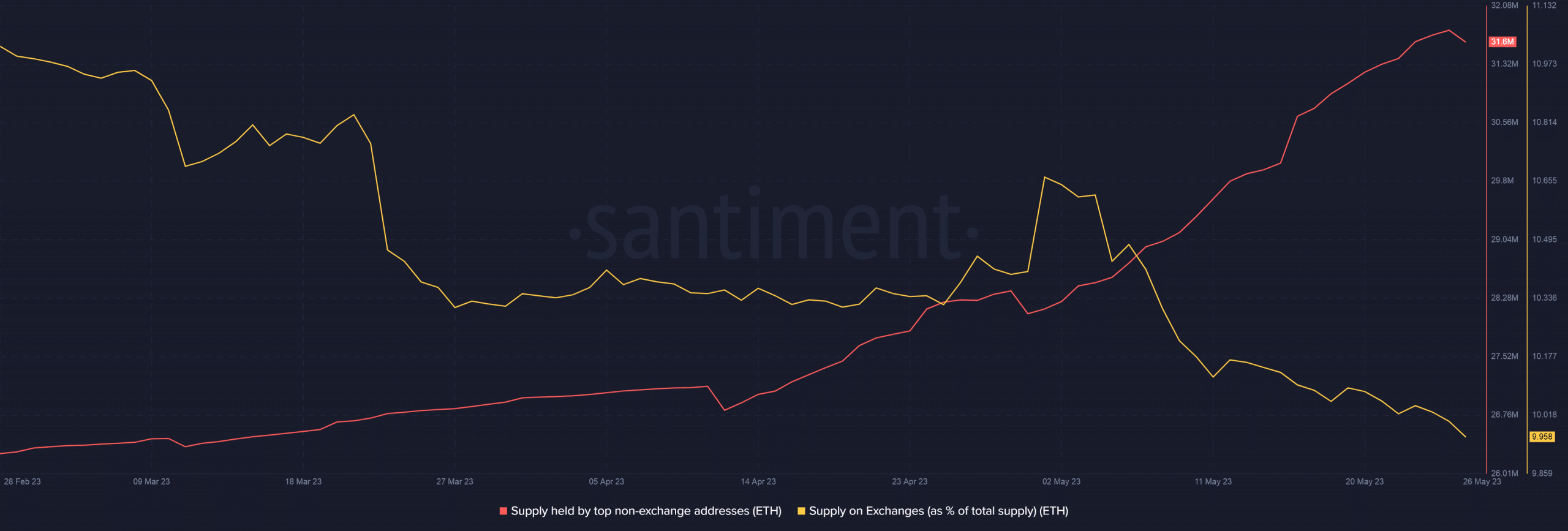

- ETH’s supply on exchanges accounted for less than 10% of the total circulating supply.

- ETH’s 30-day volatility hit its all-time low earlier this week.

Like Bitcoin [BTC] and other major cryptos in the market, the king of alts, Ethereum [ETH], has also entered a period of stagnation of late, disappointing both the bullish and bearish forces of the market.

Is your portfolio green? Check the Ethereum Profit Calculator

ETH has moved in a tight trading range between $1,770-$1,860 in the last two weeks, touching the range highs only once. As a result, ETH’s 30-day volatility hit its all-time low earlier this week, as per on-chain analytics firm IntoTheBlock.

Ethereum's 30-day volatility set a new all-time low this week pic.twitter.com/nIVx8SpDP7

— IntoTheBlock (@intotheblock) May 26, 2023

However, large whale addresses were up to the task and used the low volatility phase to fill up their coffers.

Whales preparing for the next move?

According to IntoTheBlock, Ethereum whales have increased their holdings from 26.5 million in the early months of 2023 to over 30 million as of 22 May, implying that an accumulation phase was underway. While the bullish surge in early 2023 would have enticed investors initially, the tendency has maintained in the ongoing low volatility phase as well.

? Ethereum whales are on the rise! They now hold 30.07 million $ETH, up from 26.56 million $ETH in early 2023. The increasing holdings of addresses holding over 0.1% of the supply suggest ongoing accumulation. Check out the details ? https://t.co/TisVKZ9Qjg#Ethereum #Whales pic.twitter.com/xBP2hgrUBV

— IntoTheBlock (@intotheblock) May 26, 2023

This deduction was supported by additional data from Santiment. ETH supply on exchanges has gone downhill, accounting for less than 10% of the total circulating supply. Moreover, the supply held by top addresses outside exchanges has been on an uptrend. Combining the two metrics, it can be concluded that large addresses have amassed ETH.

Old ETH starts to move

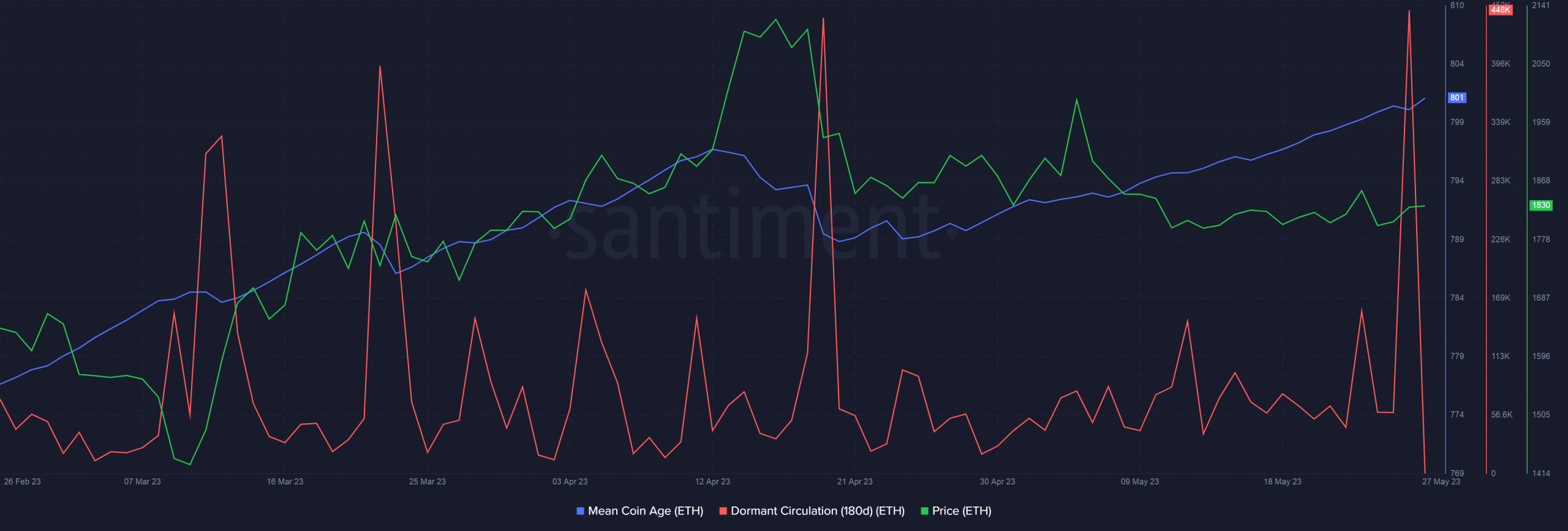

Over the last month, the Mean Coin Age indicator showed an increasing slope, adding support to the network-wide accumulation trend. Mean Coin Age is the average age of all coins on the blockchain, and a growing value indicates that coins are staying in their existing addresses for a longer period of time.

However, the Dormant Circulation indicator revealed that a large number of coins that didn’t move in the last six months, probably acquired after the FTX collapse in November, were transacted in the last 24 hours. Since the price of ETH increased during the process, it was likely that these were buyer dominated transactions.

Read Ethereum’s [ETH] Price Prediction 2023-24

At the time of writing, ETH exchanged hands at $1,829.17, up marginally in the last 24 hours, data from CoinMarketCap revealed. In the futures market, demand for ETH reached an equilibrium as the number of short positions taken for the coin closely mirrored the number of long positions, indicating a lack of distinct buy and sell signals from the market.