Will BNB dApps be enough to drive ecosystem growth

- BNB’s DeSoc dApps performed relatively well on the network.

- BNB’s price fell, however selling pressure remained high.

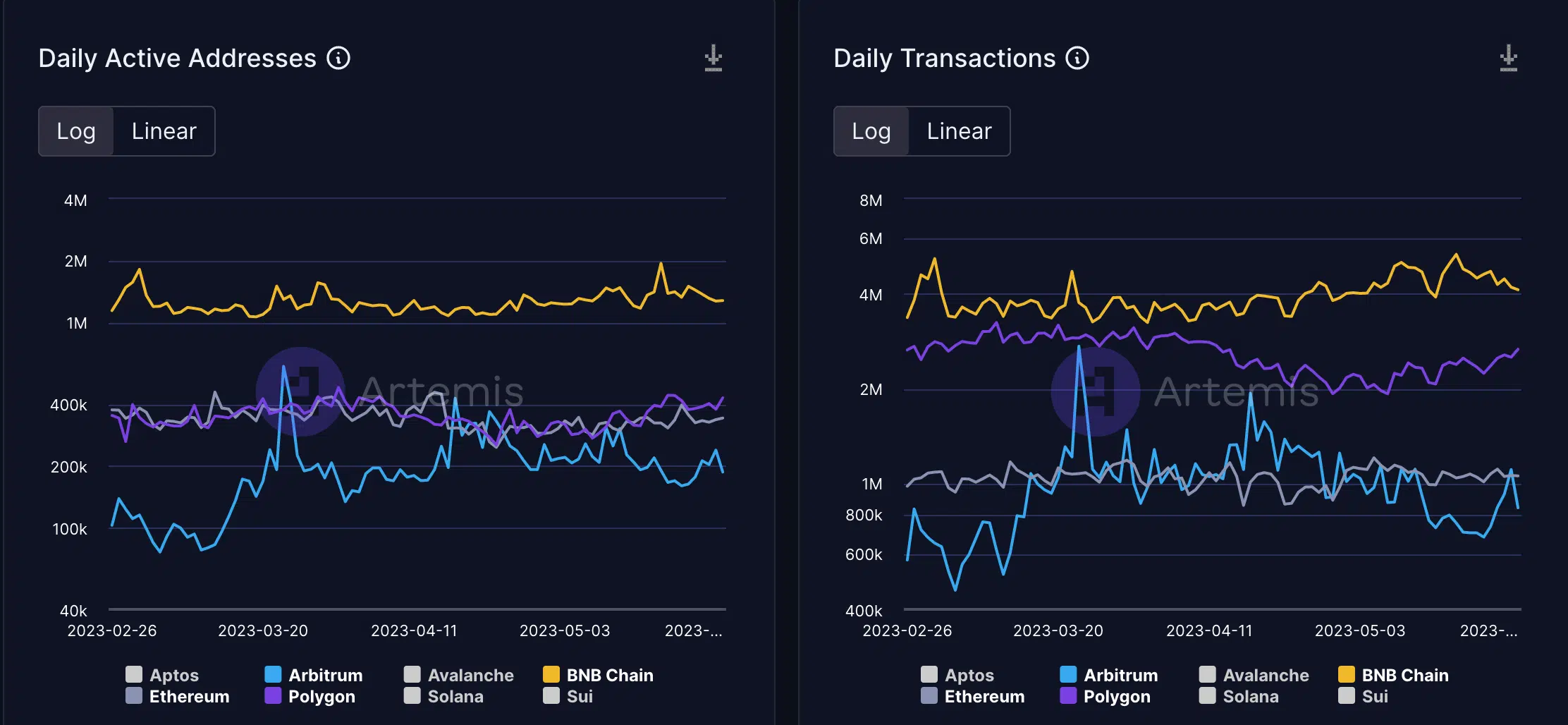

The BNB chain has retained its dominance as the network with the highest number of daily active addresses for quite some time. One of the main reasons for BNB’s popularity would be the success of its dApps and ecosystem.

Is your portfolio green? Check out the Binance Profit Calculator

Binance: Getting more social

Throughout the first quarter of the year, BNB Chain pursued a proactive approach to allocating financial and human resources within its ecosystem. The BNB Chain maintained its presence in the areas of decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming finance (GameFi).

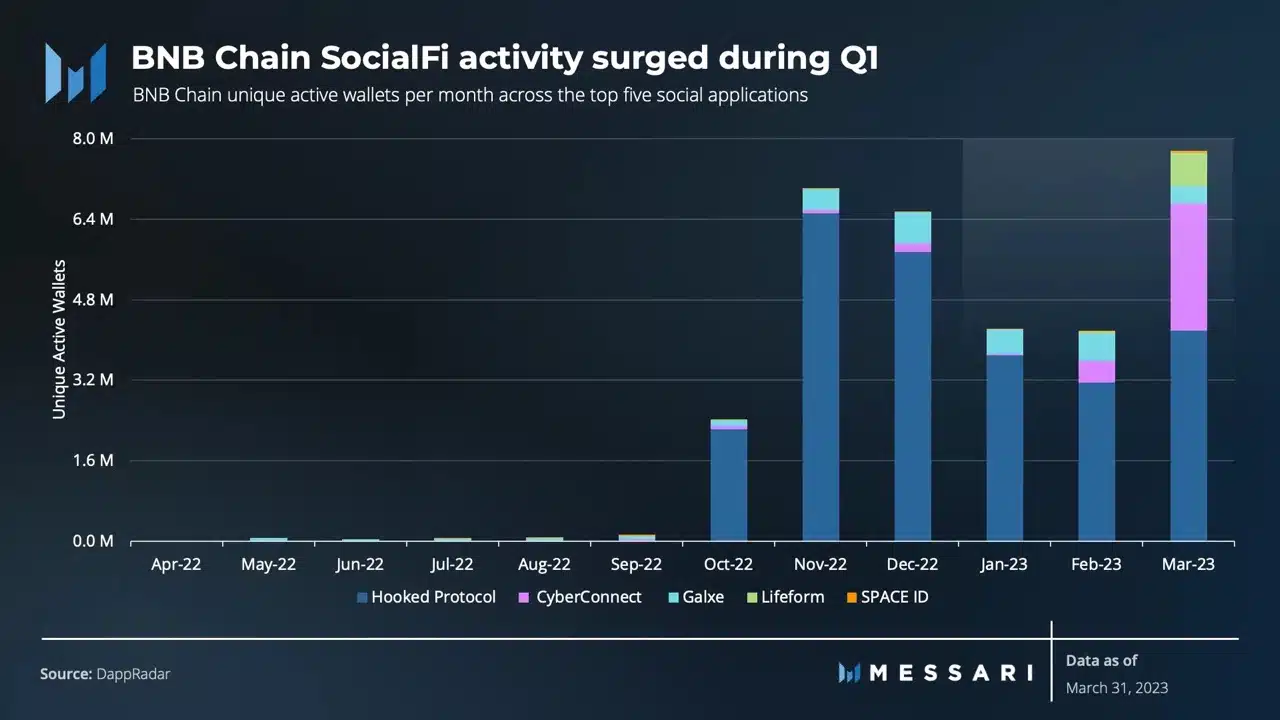

Nonetheless, the most notable increase in network activity quarter-over-quarter stemmed from its diverse range of applications, particularly within the realm of SocialFi, also known as DeSoc dApps.

For context, DeSoc dApps, short for Decentralized Social dApps, refers to decentralized applications built on blockchain platforms that aim to provide social networking or social media functionalities. These dApps utilize the principles of decentralization to enable users to connect, interact, and share content without relying on centralized intermediaries or platforms.

During the first quarter of 2023, dApps like CyberConnectHQ achieved an average of 30,000 Unique Active Wallets.

Due to the surge in interest in DeSoc dApps, overall daily active addresses rose. In terms of transactions and activity, BNB continued to maintain its dominance over other protocols.

DEXes get hexed

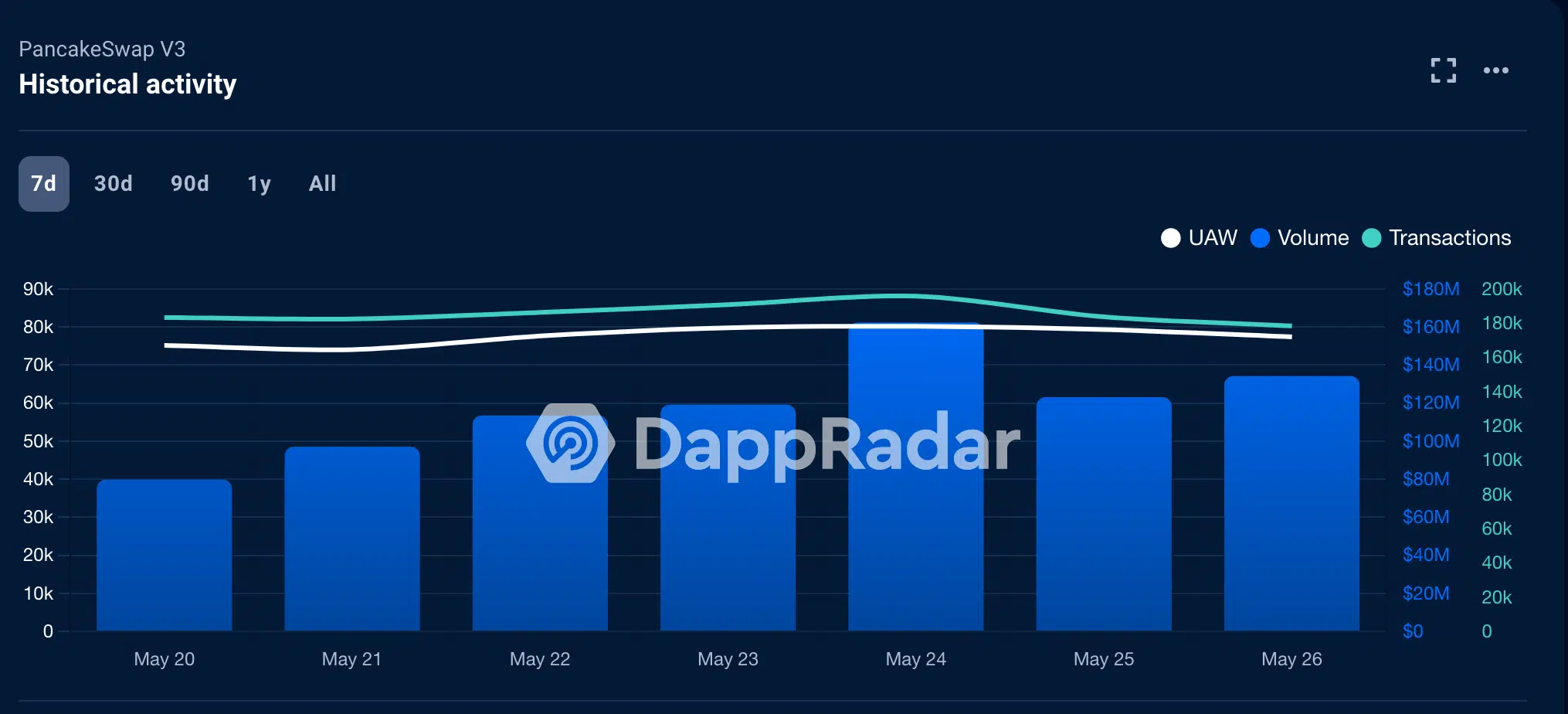

However, the state of BNB in the DeFi sector wasn’t up to the mark. Since the beginning of the year, the chain’s TVL declined steadily. One reason for this could be the performance of the DEXes.

The most prominent DEX on the BNB network, PancakeSwap [CAKE], witnessed a massive decline in unique active wallets on the network over the last week. As a result, the volume of transactions occurring on the network fell by 3.48% in the same period.

Realistic or not, here’s BNB’s market cap in BTC’s terms

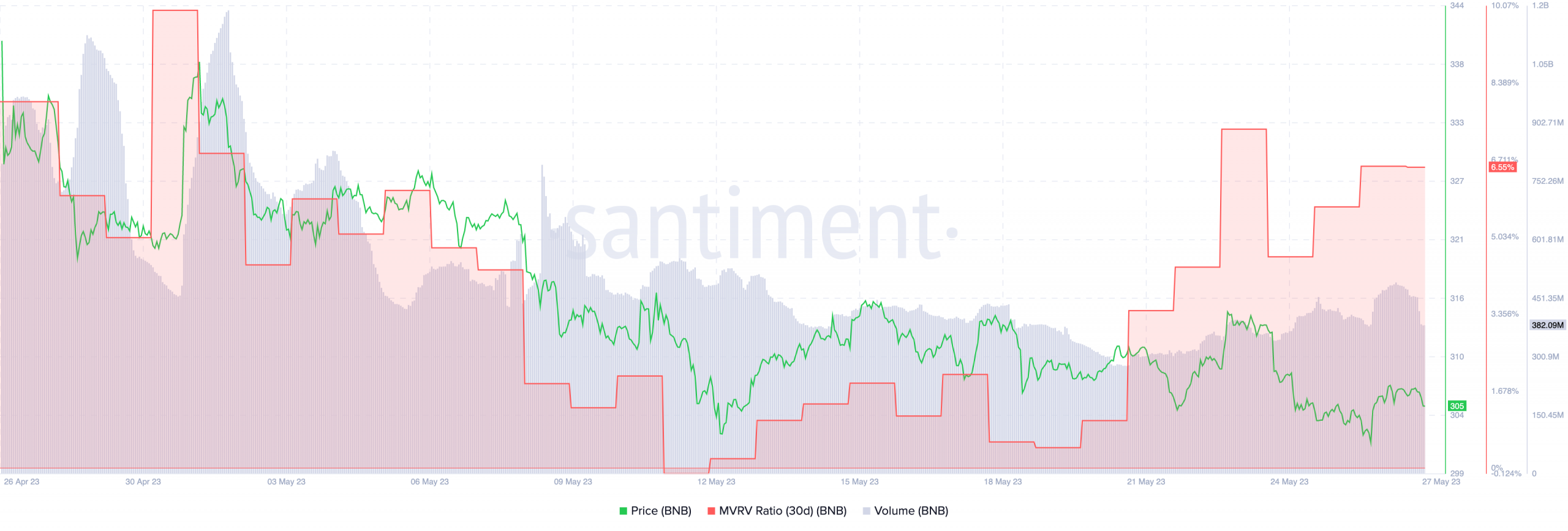

Coming to the BNB token, at press time, it was trading at $305.62. Its price declined materially in tandem with its trading volume over the course of the last 30 days. However, despite the declining price, the MVRV ratio of BNB remained high.

This indicated that most addresses holding BNB were still profitable, and could be incentivized to sell their holdings for a profit in the future.