How has Ethereum changed since Merge and Shapella?

- About 339,121 ETH coins have exited circulation since the Merge.

- The number of active ETH validators jumped by 58% since the Shapella upgrade.

Ethereum [ETH] has witnessed two major events over the last 15 months — the Merge and the Shapella upgrade — that have fundamentally altered the way the network is run.

However, the ETH fanbase would take a lot of heart from the fact that the impact of these events has been positive, even by conservative estimates.

ETH becomes deflationary

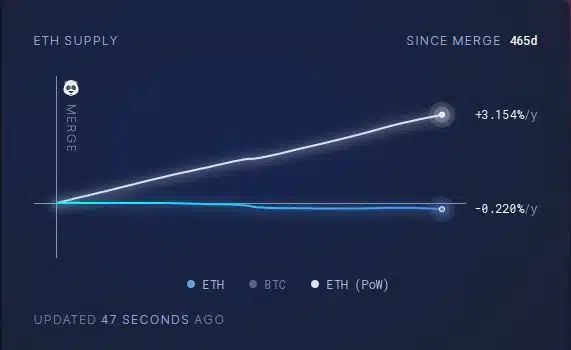

About 339,121 ETH coins have exited circulation since the Merge, with the rate of deflation accelerating significantly in the last quarter of 2023, according to AMBCrypto’s scrutiny of ultrasound money data.

As of this writing, ETH’s total circulating supply was 120.18 million, the lowest since the network transitioned from the proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS).

As analyzed from the graph above, the net supply shrunk at an annual rate of 0.220%. Had the transition not taken place, ETH’s total supply would have increased by more than 4.8 million, with an annual inflation rate of 3.168%.

Typically, a bullish market with high network usage aids deflation and vice versa. This is because a part of the fee charged for validating transactions, called the base fee, is burned and removed from circulation.

Hence, the higher the network activity, the more the deflationary pressure on ETH.

Staking gets a boost

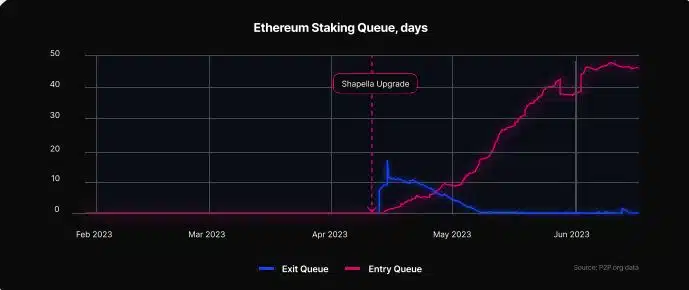

The Shapella upgrade launched earlier in the year, which enabled staking withdrawals, also gave a fillip to ETH staking activity.

As per a report by staking service provider P2P.org, the number of active ETH validators jumped by 58%, equating to $23 billion of new ETH stake.

However, the sharp increase has started to pose new problems for the network.

Is there an overdose?

The staking rewards curve is designed to decrease the yield paid to validators in proportion to increases in the validator count. This is to restrict excess capital inflow and maintain a liquid supply of ETH for use in transactions.

However, emerging DeFi avenues like liquid staking and restaking have increased the potential yield which can be earned by staking ETH. These have boosted capital inflows and the validator count on the network.

Read Ethereum’s [ETH] Price Prediction 2023-24

The growing validator set will degrade network performance at some point and may also make future essential updates more challenging to implement, P2P.org noted in the report.

As of this writing, ETH was holding strong at $2,285, with weekly gains of 5.14%, AMBCrypto spotted using CoinMarketCap’s data.