How Kraken emerged as an oasis of growth in 2023

- Traders started to give preference to Kraken after the legal action on Coinbase and Binance.

- Kraken was the third-largest crypto exchange globally in terms of trading volume.

Regulatory hostilities have left centralized crypto exchanges (CEXs) in the U.S. high and dry, with big players like Binance.US and Coinbase grappling with depleting crypto liquidity.

Is your portfolio green? Check out the Bitcoin Profit Calculator

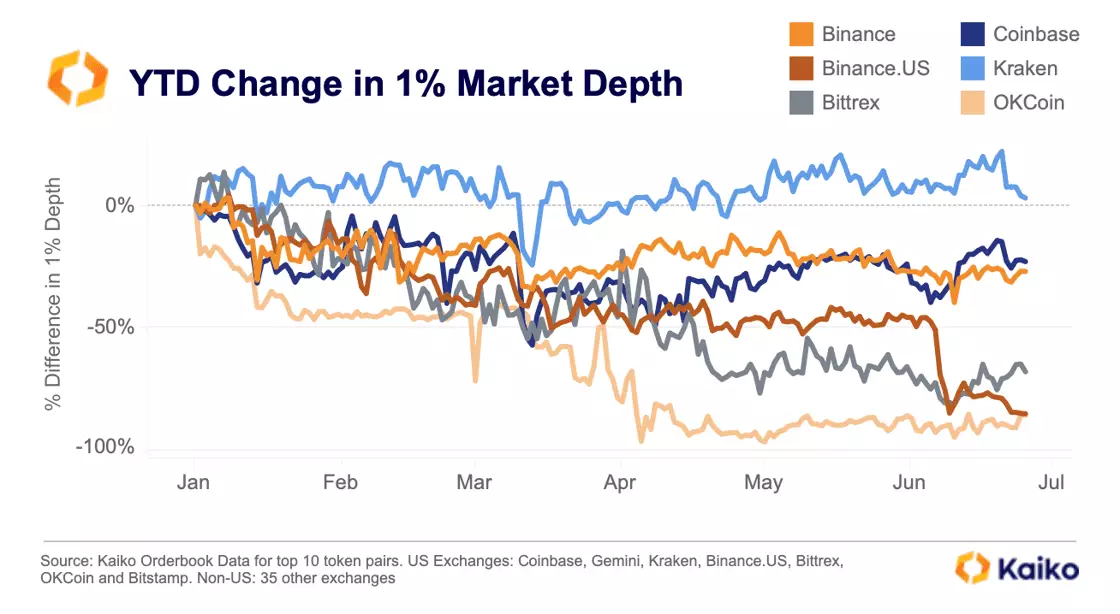

However, a ray of light has emerged amidst these gloomy state of affairs. Kraken, the second largest crypto exchange in the U.S., was the only trading platform that saw its market depth increase on a year-to-date (YTD) basis, according to a report by digital assets data provider Kaiko.

Kraken beats rivals

Market depth is an exchange’s ability to absorb relatively large market orders without materially affecting the asset’s price. Simply put, it is a measure of liquidity present on the platform. As evident in the graph below, Kraken outperformed its rivals in the U.S. market.

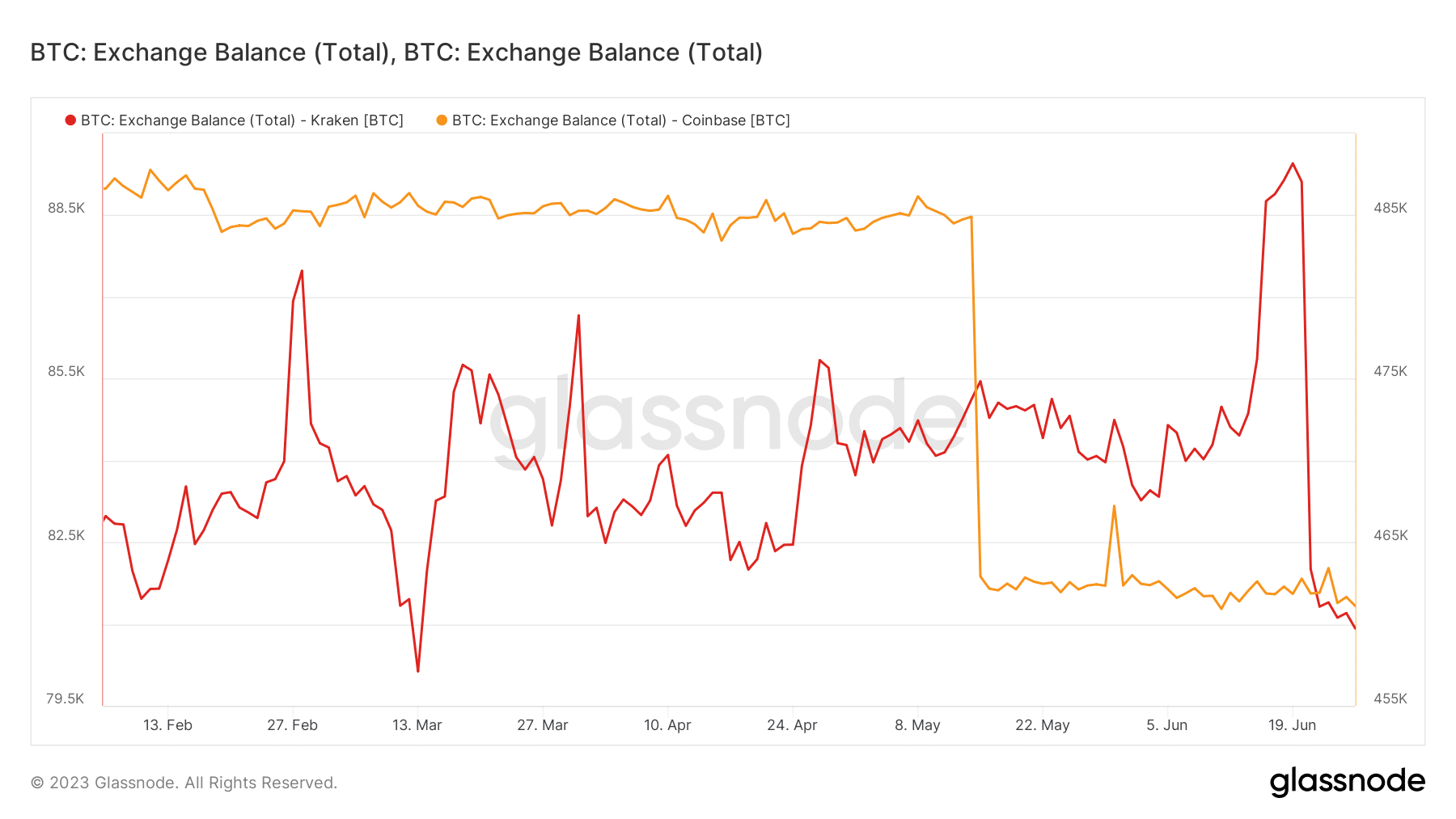

This could also be gauged by comparing the supply of Bitcoin [BTC] on different U.S.-based exchanges. While BTC on Coinbase saw a steep drop in May and then plateaued in June, the balance on Kraken was on the rise.

This indicated that traders gave preference to Kraken after the legal action on Coinbase.

Trading volume surges

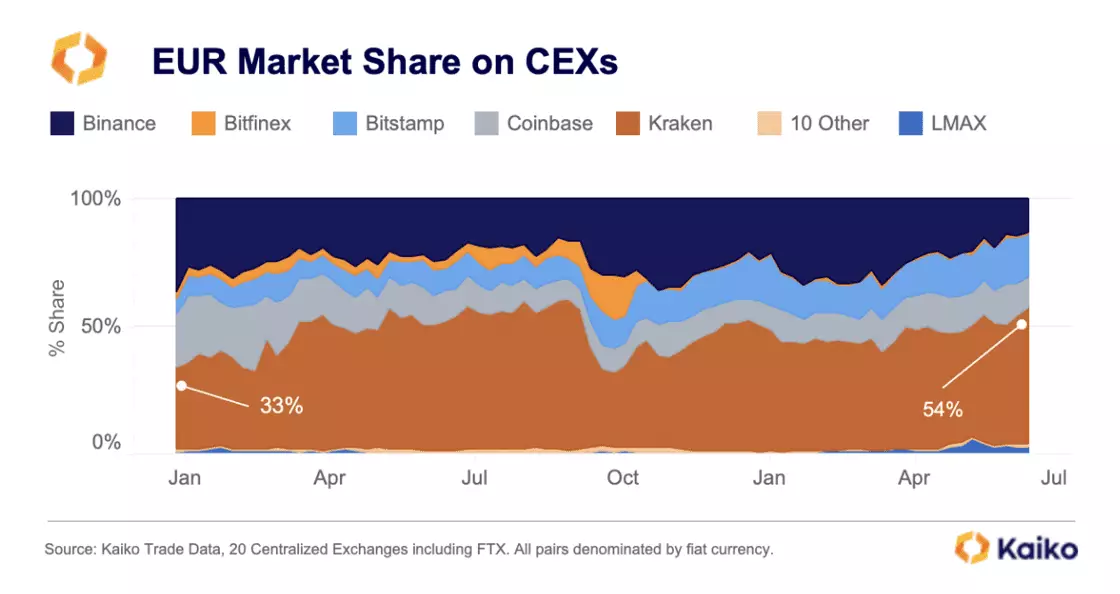

Even in the European market, Kraken succeeded in expanding its market share of trading volume, from 33% at the beginning of the year to 54% at the time of writing. A large part of Kraken’s market share was coming at the expense of Binance and Coinbase, as per Kaiko.

What seemed to work in Kraken’s favor was the relatively less regulatory pressure. Unlike Coinbase and Binance.US, it avoided the wrath of the U.S. authorities, with no serious legal actions taken against the exchange in Q2 2023.

Having said that, it should be recalled that Kraken had to cease its Ethereum [ETH] staking program in February after a charge by the SEC.

Read Bitcoin’s [BTC] Price Prediction 2023-24

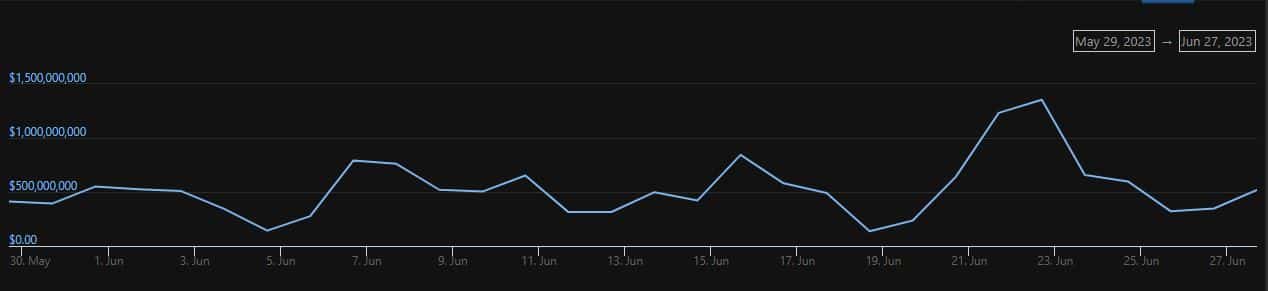

The impact was visible in its overall spot volumes as well. On June 22, Kraken’s daily volume reached a three-month high according to CoinGecko, as investors started transferring BTC in droves to profit from the latest market rally.

Kraken was the third-largest crypto exchange globally in terms of trading volume, settling trades worth more than $492 million in the last 24 hours.