LDO struggles to rally despite Lido’s growth, more inside

- Lido saw significant TVL growth aided by top layer 2 networks.

- LDO struggled to sustain a rally as exchange flows shifted gears in favor of the bears.

The crypto market has seen a return of volatility in the last few weeks and that means healthy movement in DeFi. Lido Finance [LDO] just released its latest weekly update, which revealed some correlation with the higher volatility.

Is your portfolio green? Check out the Lido Profit Calculator

Lido’s latest update revealed that it was the leading staking platform in terms of net new ETH deposits to the Ethereum [ETH] beacon chain during the week. The growing deposits were a testament to the platform’s continued growth.

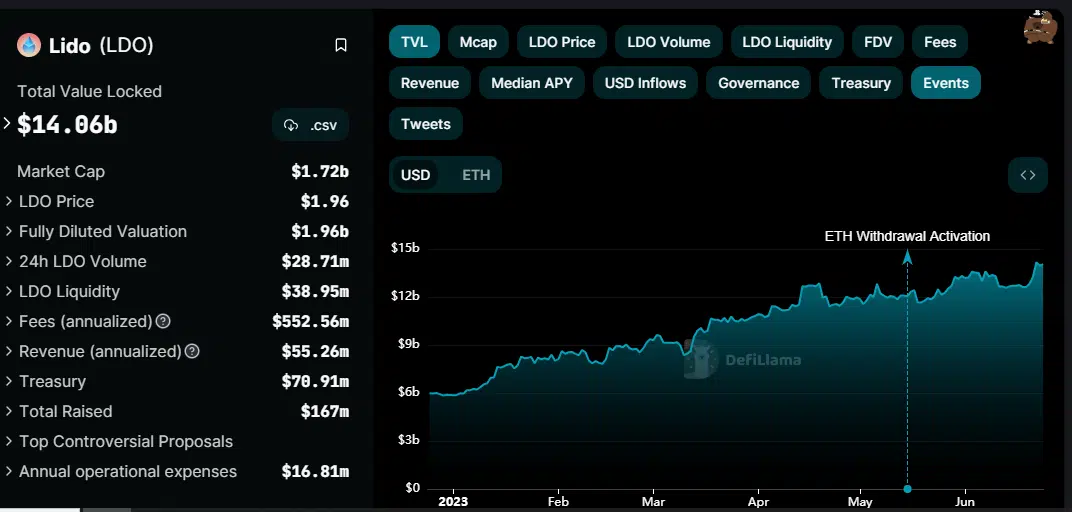

The weekly report also revealed that Lido registered a 12.72% TVL upside from 19 June to 26 June. Lido’s TVL had initially kicked off June with some slippage, but it corrected in the second half of the month. It recently peaked at $14.18 billion.

So, where is most of this growth coming from? According to another Lido update, Ethereum layer 2 networks have been contributing to most of the staked ETH. Since liquid staking generates wstETH, a look at the growth of this token may offer insights into which platforms are contributing the most staked ETH.

The update revealed that Arbitrum [ARB], Optimism [OP], and Polygon [MATIC] were the leaders at 62,994, 40,686 and 4,775 wstETH, respectively.

Is LDO benefitting from Lido’s growth?

LDO has been moving in tandem with the market so far this year. It delivered a bearish performance from the start of June and bottomed out at $1.62 in mid-June. This is the same low range that it achieved in May.

It traded at $1.96 at press time after a healthy run-up in since mid-month.

Once again, LDO’s latest upside reflected the overall market outcome. Nevertheless, it was experiencing some resistance after interacting with the 50-day moving average.

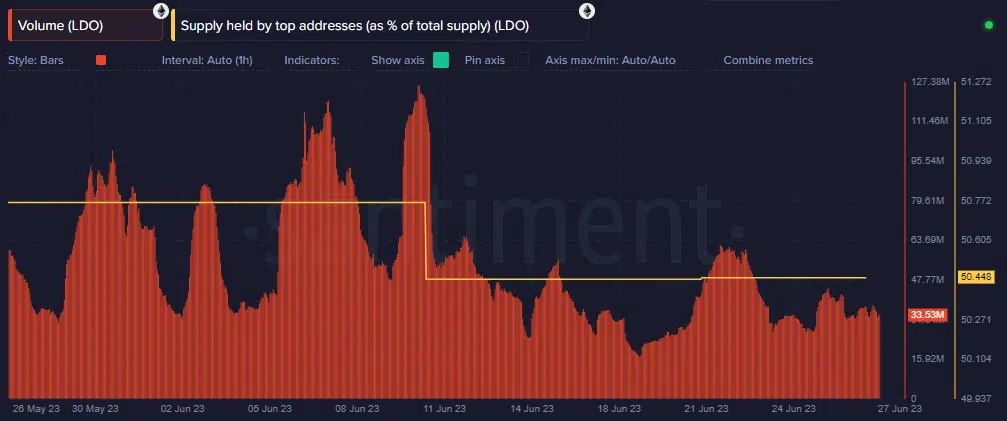

LDO’s on-chain data revealed that the supply held by top addresses dipped slightly on 11 June and was yet to recover at press time .On-chain volume fell to its lowest monthly level on 18 June, but has since recovered significantly.

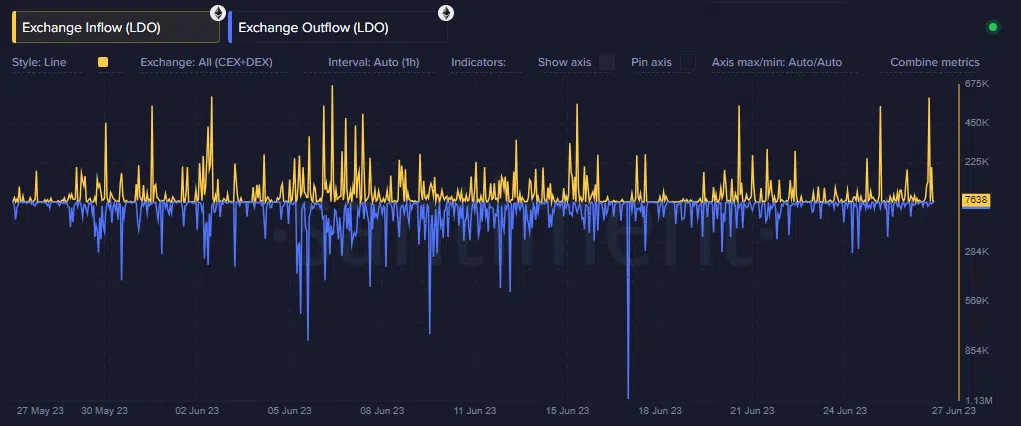

Despite the slight recovery, the volume metric is still near the lower range, hence the lack of confidence. Meanwhile, exchange flows revealed that LDO was experiencing more inflows than outflows at press time.

This meant the price was experiencing more sell pressure than buying pressure.

How many are 1,10,100 LDOs worth today?

The press time exchange flow slowdown reflected the price action outcome. As noted earlier, LDO has been struggling with resistance near the 50-day moving average. This meant that sell pressure was building up as traders geared up to take profit.

However, LDO bulls might still have room for more upside if demand resumes.