How LINK performed after oracle network opened up early access to staking

- Chainlink opened up early access to Chainlink Staking, wherein its users can commit up to 7000 LINK tokens

- LINK’s price continues to go down plunging holders into further losses.

Widely used oracle network Chainlink [LINK] on 15 November opened up early access to the initial beta version of Chainlink Staking (v0.1) in preparation for the launch on the Ethereum mainnet in December 2022.

Read Chainlink’s [LINK] price prediction 2023-2024

In October, Chainlink announced “Chainlink Staking,” which is described as a “cryptoeconomic security mechanism” through which participants can commit their LINK tokens in smart contracts to “back certain performance guarantees around oracle services.”

According to the leading oracle network, making LINK staking possible would enable,

“Chainlink decentralized oracle networks (DONs) to scale to service a broader range of applications and higher value use cases across Web3 and traditional Web2 industries.”

Those granted early access to the beta version of the Chainlink Staking (v0.1) would be allowed to commit up to 7,000 LINK tokens “in a first-come, first-serve manner” until the pool cap is reached.

LINK did what it could

Following the first announcement of Chainlink Staking, LINK attempted a price rally and grew by 24% prior to the collapse of FTX. Per data from CoinMarketCap, the #21 largest cryptocurrency by market capitalization traded for as high as $8.9 as of 8 November.

However, as the rest of the market began capitulating when FTX collapsed, the price of the oracle network plummeted as well. Its price has since fallen by 27% in the past eight days, data from CoinMarketCap showed. As of this writing, LINK traded at $6.52.

At $6.52, LINK traded at its August 2020 level. On a year-to-date basis, the price per LINK has declined by 67%.

With persistent fall in the asset’s price and extenuating market conditions that have made any significant price rally almost impossible, LINK holders in the last year have all held at a loss, data from Santiment revealed.

On-chain data from Santiment showed that LINK’s MVRV ratio has been negative in the last year. Moreover, it has lingered continuously below the mid-0 line since November 2021.

At press time, LINK’s MVRV was -69.53%. This meant that if all holders sold their holdings at the current price, they would all incur losses on their investments.

Down bad

As the rest of the market attempted recovery following the FTX incidence, lack of conviction continued to trail LINK. Its price was up by 3% in the last 24 hours at press time.

However, trading volume declined by 15% within the same period. This showed that investors harbored low conviction of any continued price rally in the short term.

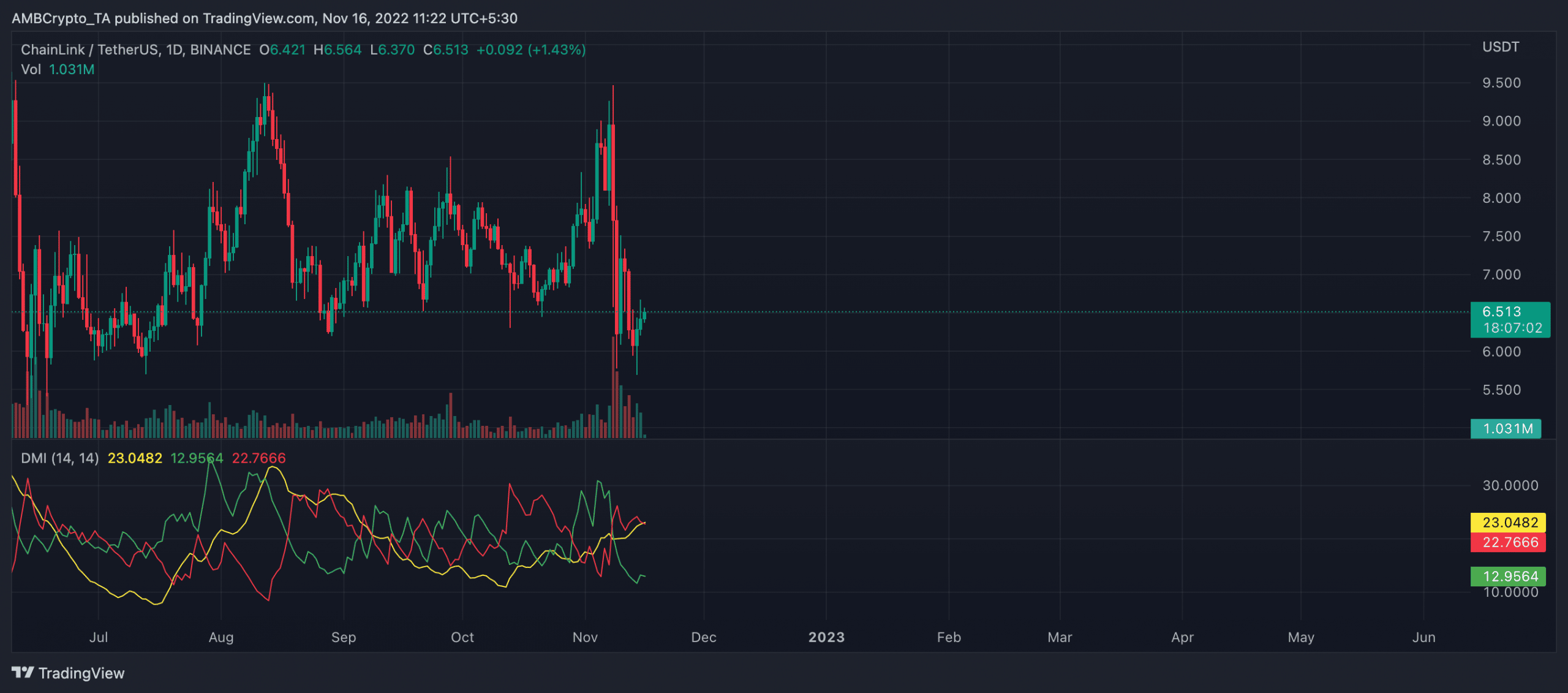

On a daily chart, sellers had control of the LINK market. This was confirmed by the asset’s Directional Movement Index (DMI) position. At press time, the sellers’ strength (red) at 22.76 was solidly above the buyers’ (green) at 12.95.