How Litecoin has grown in strength since 2019 halving

- Litecoin’s transaction volume and hash rate have spiked over the years.

- LTC has been bearish since the halving, denying whales the chance to lock in gains.

Litecoin [LTC], also popularly referred to as “Digital Silver,” embarked on a new path of growth and adoption as it completed the all-important halving event. The quadrennial occurrence that cut miners’ block reward by half raised hopes of increased demand for the now scarcer LTC.

Is your portfolio green? Check out the Litecoin Profit Calculator

Comparison with 2019

LTC has come a long way since the last halving on 5 August 2019. In a post on social platform X, the network’s official handle drew a comparison between the network’s transaction volume in 2019 to the press time levels. The data revealed a whopping 5x jump.

#FlashbackFriday: Comparing Litecoin to the time of the last #Litecoin halving in 2019 $LTC ⚡ pic.twitter.com/lD5ZMd7z4T

— Litecoin (@litecoin) August 11, 2023

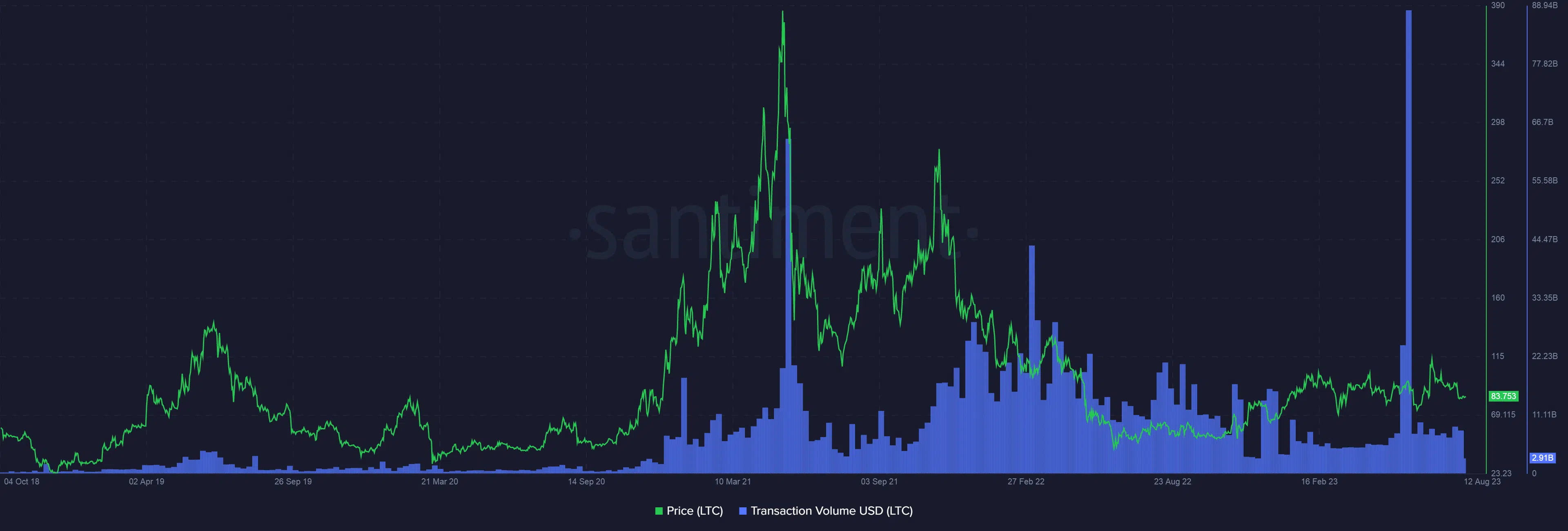

The findings were backed up by popular on-chain research firm Santiment. Following the 2019 halving, the volume of LTC coins flowing on the network on a daily basis decreased dramatically.

However, since then, LTC braved the peaks and troughs of the volatile crypto market and gained wider mainstream adoption. As a result, the transaction volume spiked over the years.

Needless to say, the current levels pale in comparison to the highs seen during the 2021 bull market, when double-digit billion figures were getting logged on a daily basis.

Jump in hash rate

The rise in transaction volume stemmed from an increase in overall transaction count, meaning that more people were interested in buying and selling LTC. Naturally, to trade more LTC, mining activity needs to be amped up to keep pace with the demand.

Consequently, another important variable, the hash rate, also rose exponentially since the last halving.

Data from Coinwarz highlighted that the hash rate jumped from an average of 300 TeraHashes per second (TH/s) in the halving year to nearly 783 TH/s at the time of writing.

Whales looking for the high tide

Large investors were bagging LTC in bulk leading up to the halving. This was evidenced both by an increase in the supply of the user cohort and the spike in whale transactions.

However, the post-halving scenario was dull as most of these players didn’t find a big reason to offload their bags.

How much are 1,10,100 LTCs worth today?

LTC has been in the grip of bears since the halving event. Contrary to the hype, the coin shred 10% of its value until press time, when it was traded at $83.70, as per CoinMarketCap.

It remains to be seen how long the LTC whales will play a waiting game.