Analysis

How long will BONK struggle? Watch out for these key levels

BONK’s sentiment is not strongly bullish, and traders need to beware of a potential price reversal toward $0.00002.

- BONK momentum was barely bullish and buying pressure was indecisive.

- The liquidation levels showed that prices could be pulled lower in the coming weeks.

Bonk [BONK] endured a rough week, losing 22% from the high on the 22nd of July, but might be turning a corner. It followed Bitcoin’s [BTC] momentum, but the memecoin has maintained its bullish structure since.

Last weekend, it had broken a key resistance and was set to surge higher

. This did not happen due to BTC and weak BONK bulls. Would this weekend see the past week’s losses reversed?BONK prices likely to rebound

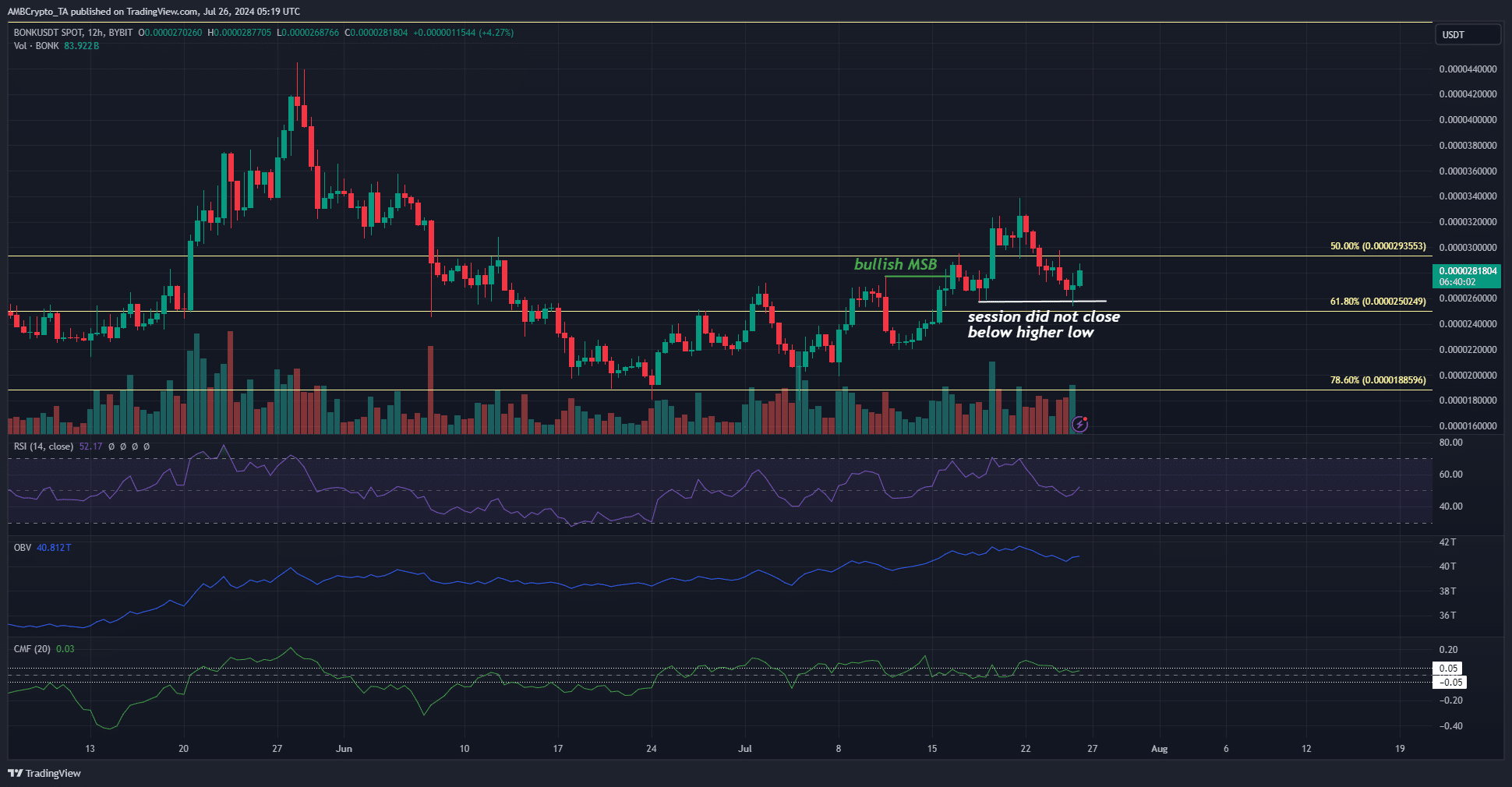

The 12-hour chart showed that the market structure was still bullish. The move past the $0.0000277 was a bullish market structure break. The higher low it set thereafter at $0.0000282 was not broken yet.

A break would be a 12-hour trading session close below this level. Instead, prices have climbed higher from the support level. This could also be because Bitcoin bounced from $64k to $67.1k at press time, a 4.7% rise.

The CMF was at +0.03, showing a lack of significant capital inflows. The RSI was at 52, but the momentum was indecisive. The OBV saw a pullback over the past week but has trended upward in July.

Liquidation heatmap warns of a potential downturn

Source: Hyblock

The $0.000025 liquidity pool was swept and prices have bounced higher. However, there was a larger concentration of liquidity at $0.00002 and $0.000017.

Realistic or not, here’s BONK’s market cap in BTC’s terms

If the market structure turns bearish, these would be the next price targets.

Overall, BONK has a bullish outlook. The indicators were reset to neutral after the losses over the past four days. If Bitcoin faces a reversal in the $69k area, BONK is likely to follow and shed its gains.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.