How long will institutions pull the weight of Bitcoin’s price rally?

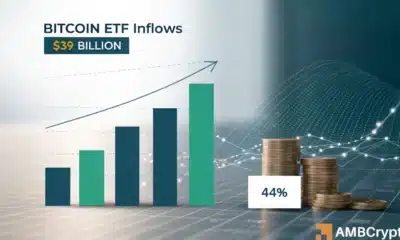

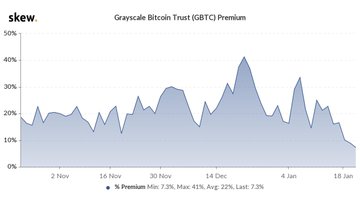

Bitcoin’s range-bound price rally has left many traders waiting for another dip. There have been a few swift recoveries in the current market cycle and institutions have supported the rebound in price, however, the question remains – for how long? When will it be time to book profits on the assets accumulated in the past six to eight months. For Grayscale, the premium on Bitcoin has dropped below 10% and this could be alarming for retail traders, as it signals towards a pause or a much-awaited trend reversal from institutional buyers. It is expected that once the demand is revived, the premium will be back above 10%, however, current data signals the likelihood of a drop in demand. Since active supply is increasing, these two factors signal that the biggest narrative of the season “the institutional buying and accumulation” may slowly be turning cold and coming to a pause.

Source: Twitter

Based on data from the Skew Chart shared above, the premium on GBTC dropped from a height of 40% to less than 10% in less than a month. This drop-in premium is alarming for miners as well, and an increase in selling may increase sell pressure on retail traders and whales. The premium ranged from 20% to 40% for nearly two months before the recent plummet. Grayscale recently added 3544 BTC over the past 24 hours, worth $118 million. In the past 7 days, Grayscale has added 29598 Bitcoin worth about $1 Billion. This may not continue with the same momentum should the selling pressure continue to increase. Additionally, the network momentum is lower than the previous cycles and is also dropping.

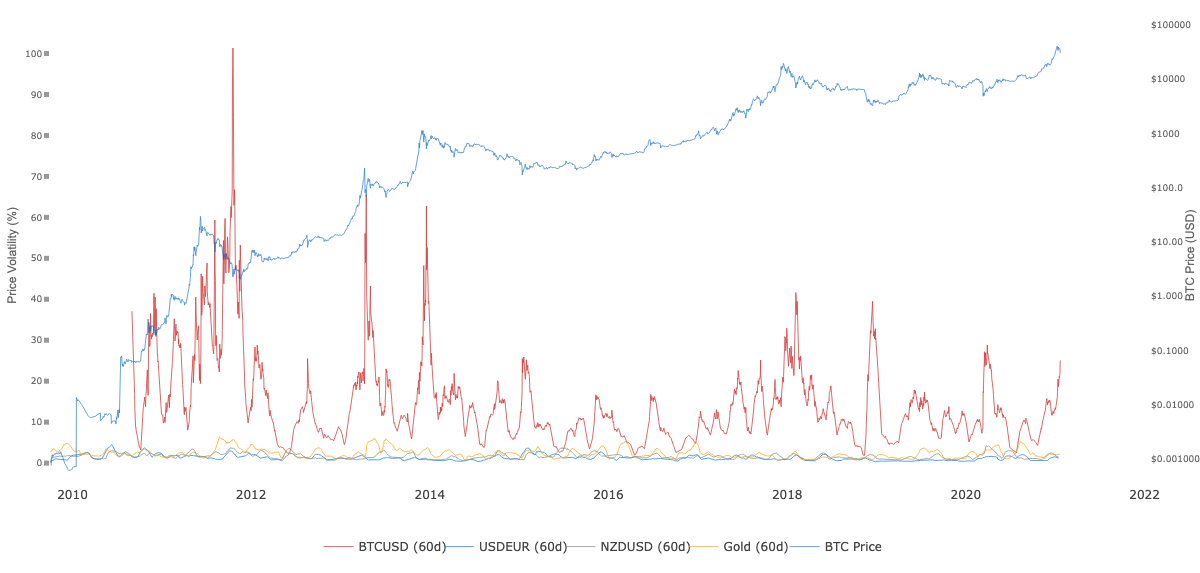

Source: Woobull charts

Momentum and volatility have both dropped for Bitcoin, since hitting the new ATH. More specifically the momentum is 33% in the Bitcoin-USD market. The volatility of altcoins has increased significantly, for most it has led to a recovery in price and lost market capitalization, while for some it remains to be seen. Institutional movements – the buying, selling, and storing Bitcoin away to cold wallets has set the tone for a price rally and increased both the relevance and demand for Bitcoin. Though this may not be sufficient for triggering a price rally, it did support Bitcoin’s price to the new ATH. Institutions may soon change their investment flow into assets with higher returns with a shorter time frame, rather than the long game such as Bitcoin trading.