How SushiSwap’s new Reddit move may impact the protocol

- SushiSwap gets help from popular subreddit to incentivize users on its platform

- SUSHI’s price fell as whales lost interest

Even though DEXs have gained popularity after FTX’s collapse, the competition within the sector has increased too. SushiSwap is one of the DEXs that has struggled to outperform its competitors during this period. However, to improve its protocol experience further and attract more users, the DEX has now partnered with one of the largest crypto-subreddits.

Is your portfolio green? Check out the Sushi Profit Calculator

The subreddit goes under the name of r/CryptoCurrency and has 6.1 million users. This subreddit has a native token known as MOON, which is used to reward users based on their activity and Reddit karma. The subreddit has joined the Sushi double onsen program which incentivizes SushiSwap users with additional MOON on top of current rewards and fees.

This move has impacted the SushiSwap protocol positively and helped it gain a huge number of daily active users. In fact, according to Artemiz’s data, over the past week, the number of active addresses on the SushiSwap network increased by 41.2%.

At press time, the overall number of active addresses on the SushiSwap network was as high as 13,113.

Due to high activity on the protocol, gas usage on the network also increased. The high gas usage helped improve the overall revenue generated by the SushiSwap protocol.

Additionally, according to Token Terminal, the revenue generated by SushiSwap appreciated by 22.1% in the last 30 days alone.

Now, even though the protocol recorded positive updates in multiple areas, it is still vulnerable to high slippage trades which could impact the protocol negatively.

Not all good news

Overall, SushiSwap witnessed improvements in many areas. However, the same could not be said for the SUSHI token. Over the past month, the price of the token has fallen by 12.51%.

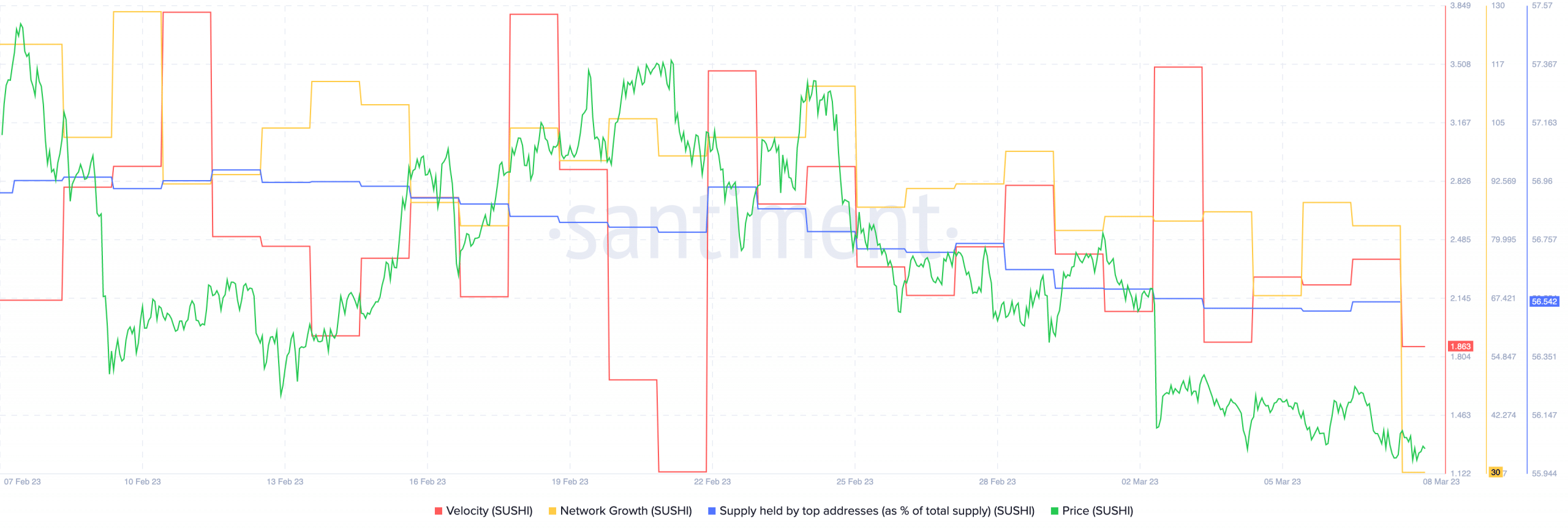

Whales started to lose interest in the token over the same period. A decline in whale interest could have played a role in the falling prices of the token.

Realistic or not, here’s SUSHI market cap in BTC’s terms

Additionally, the velocity of the token declined as well. A decline in velocity implies that the frequency with which SUSHI is being traded has fallen. Coupled with that, the network growth of SUSHI also fell, implying that new addresses aren’t showing interest in the token.

At press time, it is uncertain if improvements on the SushiSwap protocol will directly impact SUSHI.