How will SEC charges against Terraform Labs affect LUNC and other cryptos

- The SEC has charged Terraform Labs and Do Kwon with Fraud.

- The SEC has also claimed that UST and LUNC are securities.

The FTX controversy and the Terraform catastrophe rocked the entire crypto sector to its foundations. The SEC recently disclosed that it was suing Terraform Labs and Do Kwon.

Is this new information affecting the struggling USTC and LUNC in any way? In addition, could the outcome of this recent litigation have repercussions for other cryptocurrencies?

Read Terra Luna Classic [LUNC] Price Prediction 2023-24

SEC initiates charges against Terraform and Do Kwon

The Security Exchange Commission (SEC) announced fraud charges against Do Kwon and Terraform Labs in a blog post dated 16 February.

Do Kwon is accused by the SEC of masterminding a multibillion-dollar fraud, as detailed in the suit. The complaint also made clear that the SEC deemed Luna (LUNC) Terra USD (UST) to be a security.

While the SEC has taken firm action against Terraform and its co-founder for fraud, its stance on LUNC and USTC has sparked concerns about setting a dangerous precedent for other cryptocurrencies.

Risk of dangerous precedence for cryptocurrencies?

After the UST lost its peg in 2021, Terraform was accused of manipulating the peg by having a third party purchase the asset. In addition, the lawsuit hinged on the central argument that UST is security due to its ties to Anchor.

This part of the suit could have implications for other cryptocurrencies. Based on the SEC’s findings, USTC and LUNC are considered unregistered securities. This is because Anchor was promoted as a lucrative investment opportunity.

Even if it’s about time that Terraform and Do Kwon were sued, the SEC’s efforts to classify LUNC and USTC as securities have left the cryptocurrency industry in a bind.

The SEC’s case against Ripple and XRP boils down to this: XRP is a security, and a victory against Terraform might give the SEC a precedent, a dangerous one at that, to use against Ripple and other cryptocurrencies.

Key metrics point to USTC and LUNC failings

Since losing its peg in May, USTC, the stablecoin issued by Terraform, has not recovered, according to statistics from CoinMarketCap.

Compared to the $0.03 that was available the day before, it was trading for about $0.02 as of this writing. Furthermore, within the last 24 hours, it had lost more than 6% of its market capitalization.

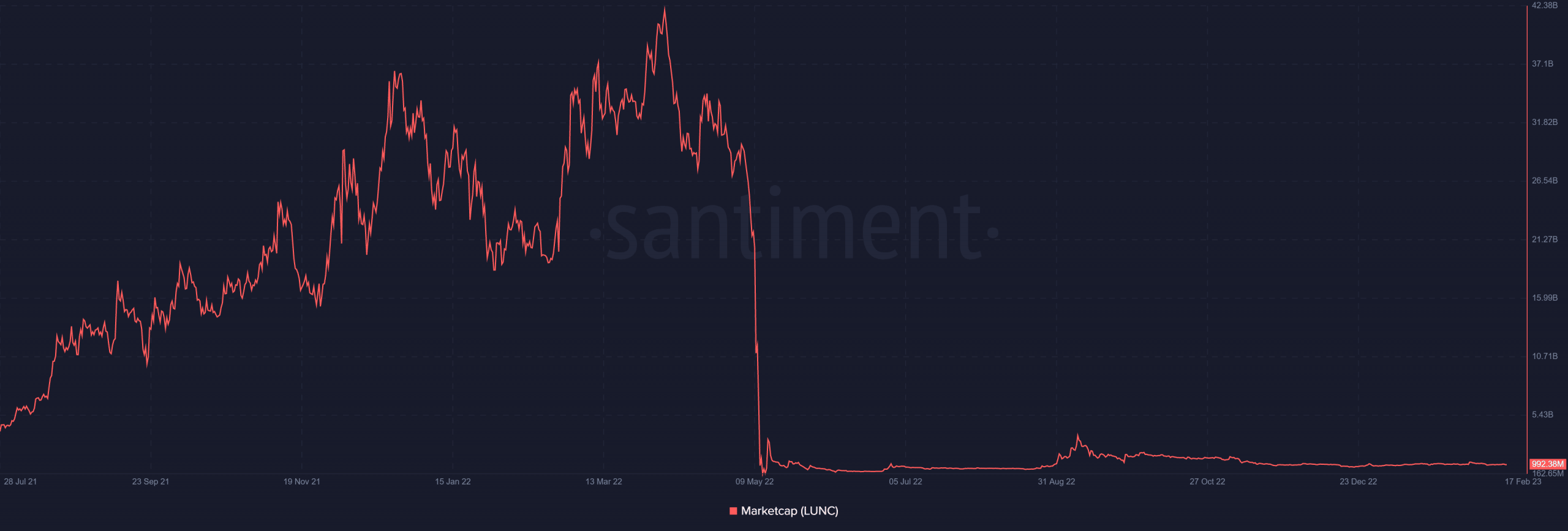

According to Santiment statistics, the market capitalization of Luna (LUNC) had drastically decreased. This is expected, given that it lost significant value following its downfall. Its market cap was over $36 billion at its peak, but as of this writing, it was only worth $993.25 million.

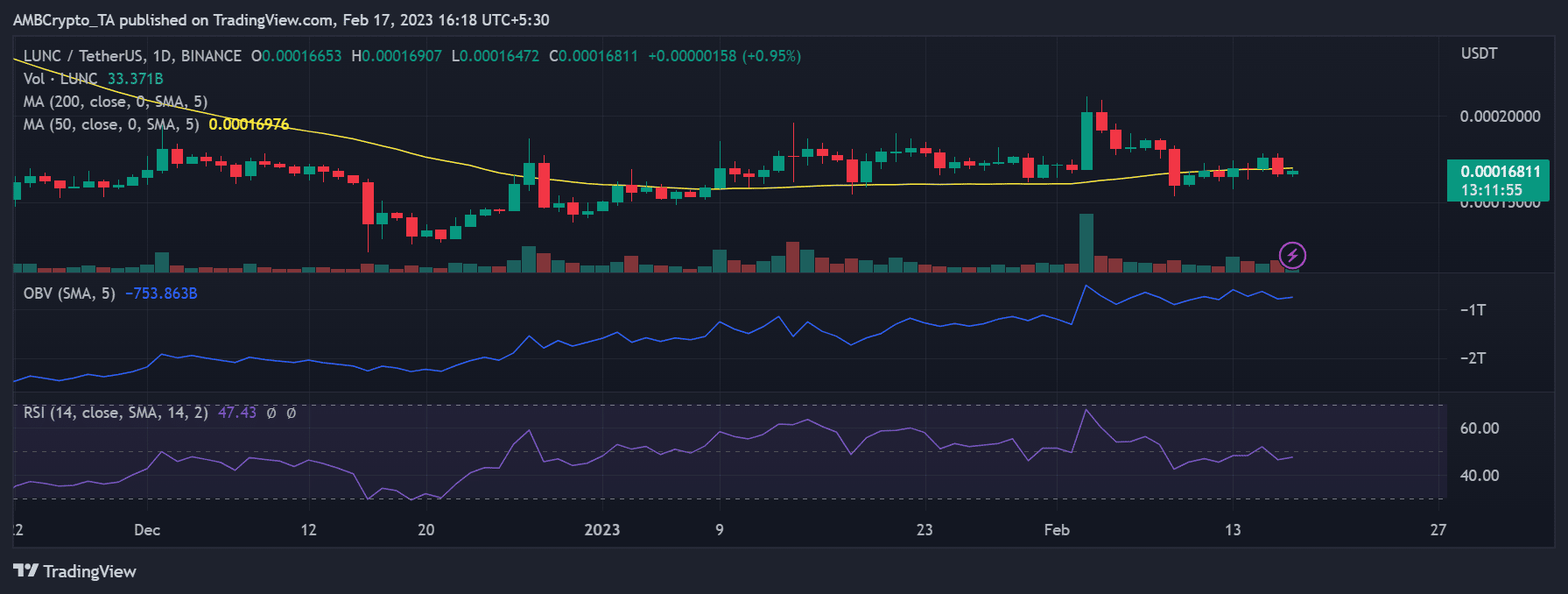

When viewed on a daily timeframe, LUNC lost 5.24% of its value on 16 February.

It was trading at about 0.00016 as of this writing and had gained less than 1%. Additionally, the RSI indicated that it had fallen below the neutral line. It was clear from this that the asset had entered a bear trend.

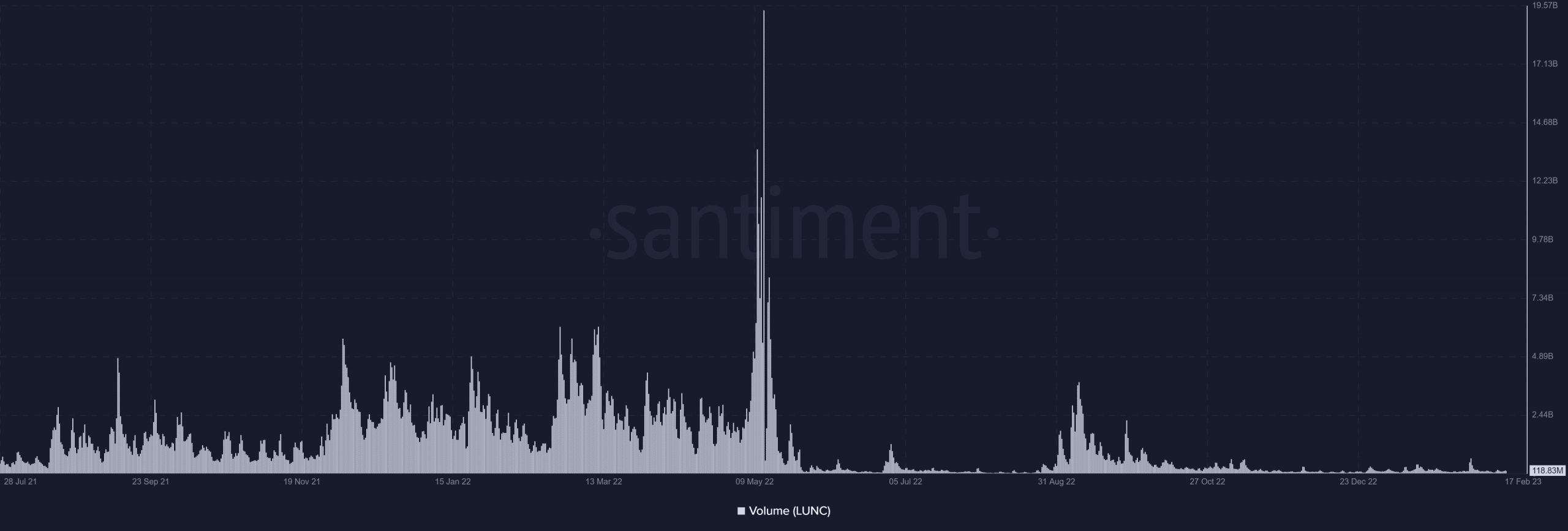

Additionally, more warning flags for LUNC could be identified while looking at the volume metric. For example, analyzing the volume data on Santiment revealed a dramatic drop in volume. It meant that the asset had been witnessing a low level of interaction.

How much are 1,10,100 LUNCs worth today?

The wait begins

In the following months, we will learn more about the case’s genuine nature. The crypto community as a whole might support the prosecution of Terraform, but the case brought against the company’s assets will be the one being watched.

Unfortunately, concern and skepticism have increased, which might derail any attempts to revive the Terra project—bad news for holders and hopefuls.