How will the drop in this metric affect UNI, CAKE, SUSHI, AAVE?

Bitcoin maximalists are currently gaining from the dropping altcoin market capitalization. Another group in on that is DeFi project traders and HODLers. This weekend, the altcoin market capitalization dropped further. In the past 7 days, the altcoin market capitalization has dropped along with a drop in altcoin prices. BNB, ADA, DOGE, XRP, DOT and CRV have dropped and this has increased the accumulation, investment inflow.

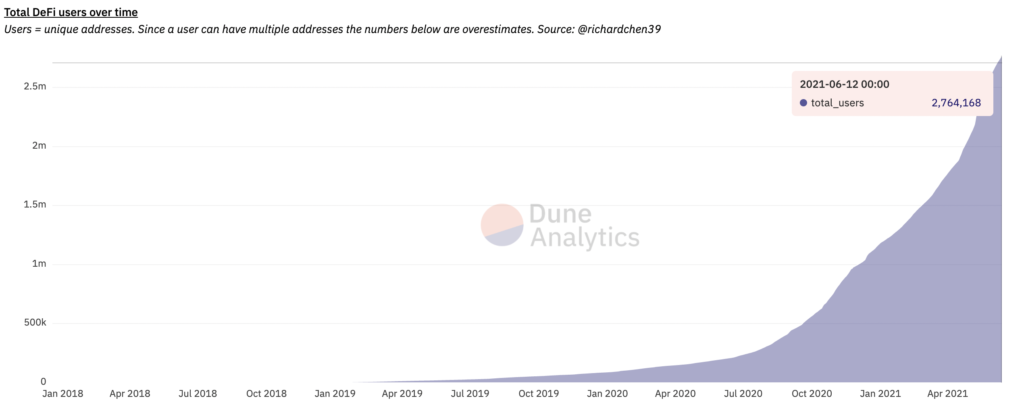

Low marketcap projects have offered high returns over the past 7 days. There are several factors supporting this narrative. Increasing trade volume of DeFi projects has increased in proportion to altcoin market cap. The demand across exchanges has increased and there is an increase in the number of unique wallet addresses and TVL. This may change the narrative of DeFi to bullish.

High market cap projects may lead to the increase in demand and investment inflow proportionate to the interest of their users. The low market cap projects continue to face a correction when traders exit. The drop in altcoin market capitalization has a direct impact on DeFi users.

Source: DuneAnalytics

The diminishing altcoin market capitalization has had a direct impact on the investment inflow, the number of traders and the demand across exchanges. This is bullish for DeFi projects as the rising number of users and the metrics related to number of trades, wallets and users indicate a growing interest, investment, institutional investment inflow and growth in DeFi market capitalization.

With the rise in the number of DeFi projects, there is a surge interest from institutions. With the upcoming biggest smart contract event of the year, it is likely that DeFi projects like UNI, CAKE, SUSHI, AAVE that haven’t rallied in the past 2 weeks would rally following increasing demand and popularity, social media mentions.

When the average price chart of these projects is observed, and they are ranked in accordance to their ranking of growth in Active users, there is a strong correlation between users and market capitalization. AAVE, UNI, SUSHI have ranked the highest. Though ranking does not have a direct correlation with social volume and price, it has increased following drop in altcoin market capitalization. This builds a bullish case for DeFi in the following two weeks.