How will these 2 features for Chainlink affect traders’ returns?

Chainlink connects enterprises with blockchain, giving the world a real use case of hybrid smart contracts for both DeFi and institutions. At a time when most DeFi and smart contract applications exist without users and use-cases, LINK differentiates itself, both in application and as a rewarding DeFi project to HODL/ invest in.

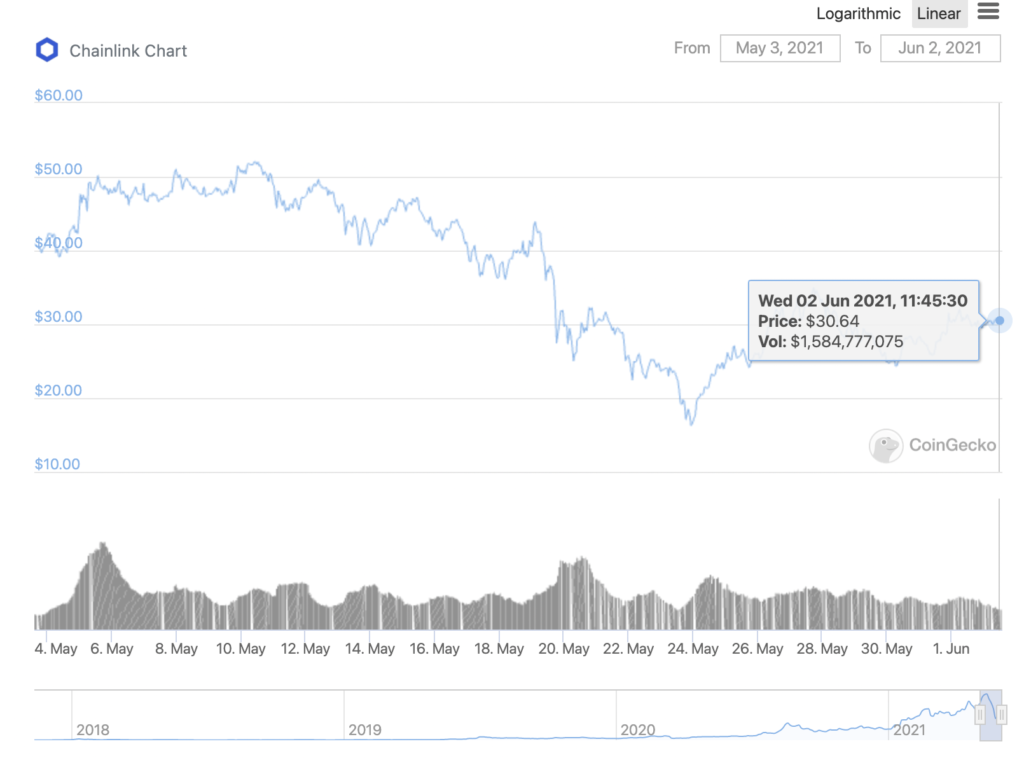

The price was at the $31 level and the market capitalization was at $31 Billion. Accelerated by decentralized services, driving demand in users across several chains, Chainlink provides institutions access to the DeFi ecosystem. LINK is largely concentrated in large investors’ both institutional and retail, wallets. Currently, the concentration is 78%; of this, more than half of the investors are profitable, despite price being below $50.

LINK price chart | Source: CoinGecko

Additionally, LINK has recovered from the recent drop to the $17.51 level, leading the way for DeFi projects during its recovery. LINK’s future is inevitably a multi-chain one, with two key nuances. A power law distribution between chains, and increased but concentrated adoption to specific environments.

Currently, the demand across exchanges is steady, supporting the bullish narrative and confidence remained high. The second nuance is that most chains are likely to be L2 rollups that store data on L1 shards anchored to Ethereum. This is supported by the increasing network activity and number of traders on the network. Over $4.36 Billion worth of transactions were supported by the LINK network in the past week.

LINK’s price has remained independent of other smart chain network’s popularity, however social media mentions and social volume have a direct impact on price. In the past, the peaks in price have coincided with the increased social volume immediately before or after an update or major roll-out. The launch of LINK’s multi-chain future is likely to trigger higher social volume, paving the way for a rally to the $50 level in the following two weeks, based on similar events and occurrences in the past.

The percentage of LINK in traders’ portfolios is likely to determine their profitability from LINK’s rally. Given that LINK has rallied following drops in BTC’s price, the current rangebound price action makes it ideal for LINK to have an extended rally, and a sustainable one, offering high short-term ROI to traders.