ICP’s road to $20 depends on altcoin hitting THESE milestones

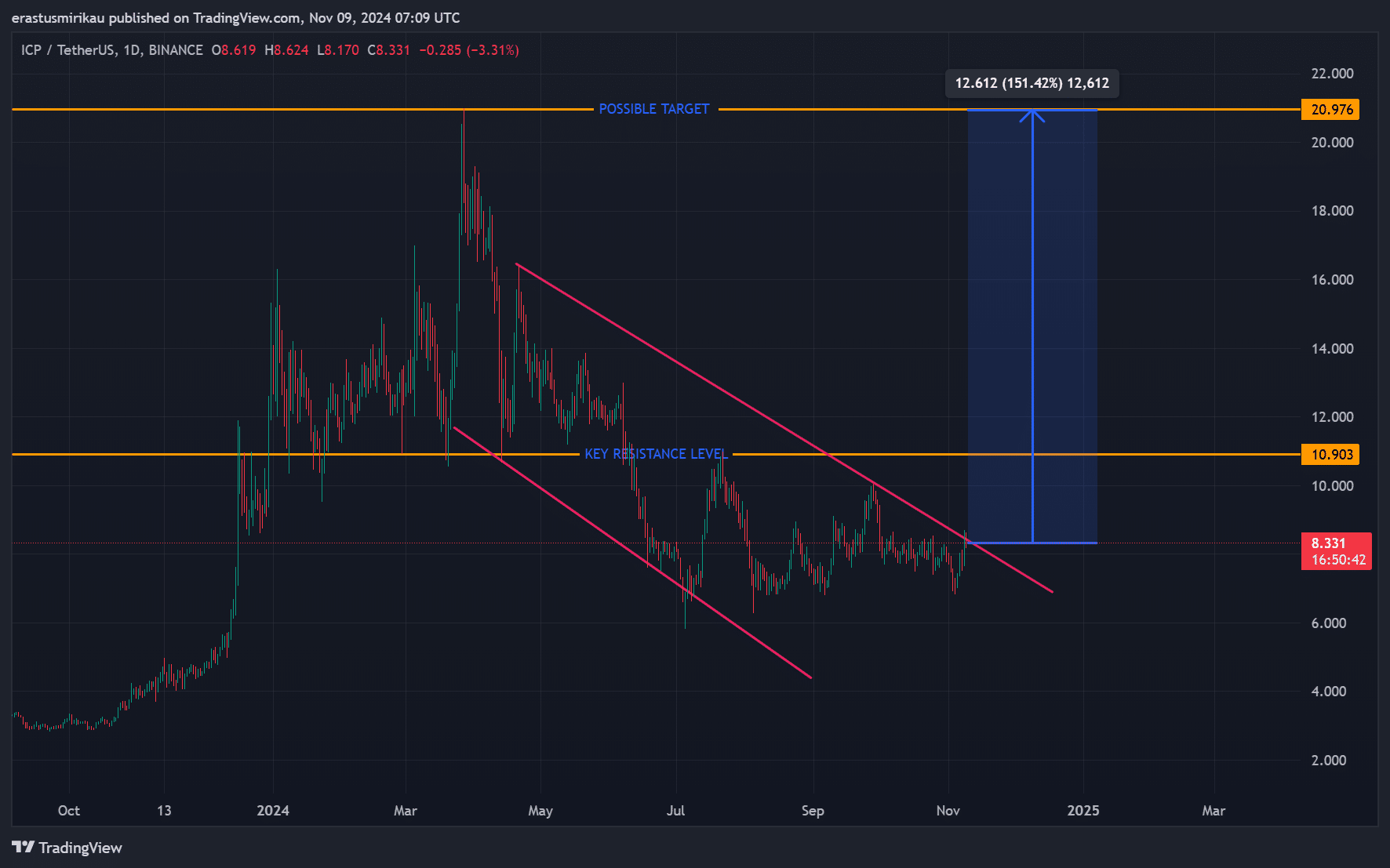

- ICP formed a bullish pennant pattern, with the critical resistance level at $10.90

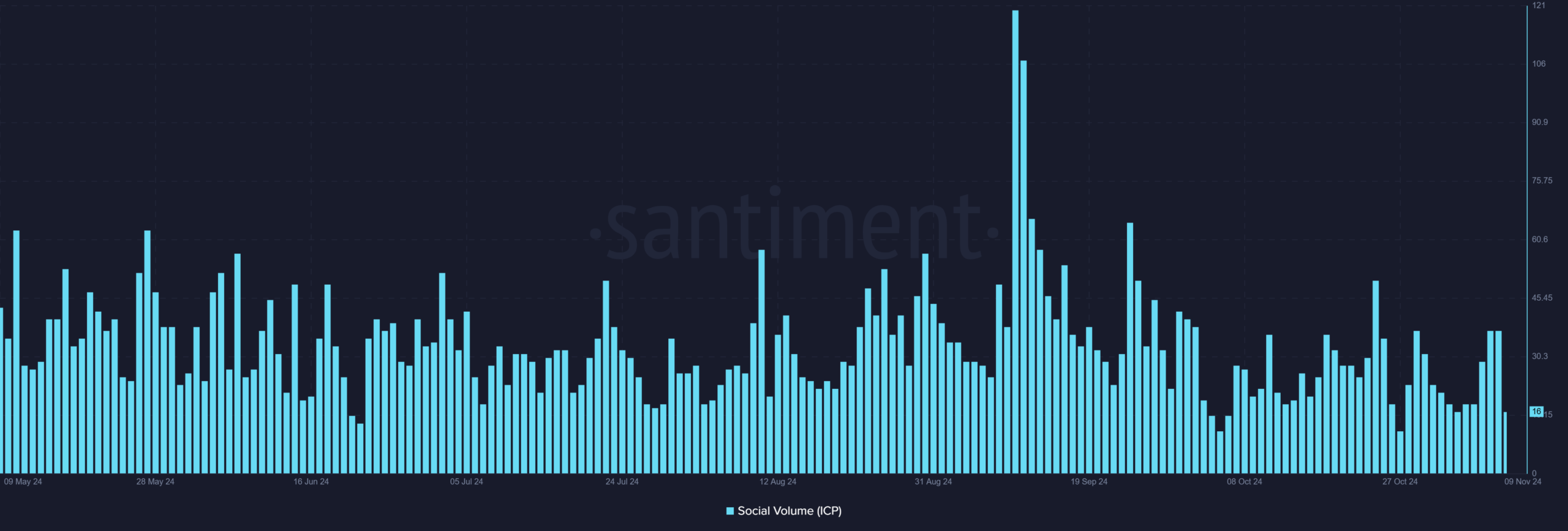

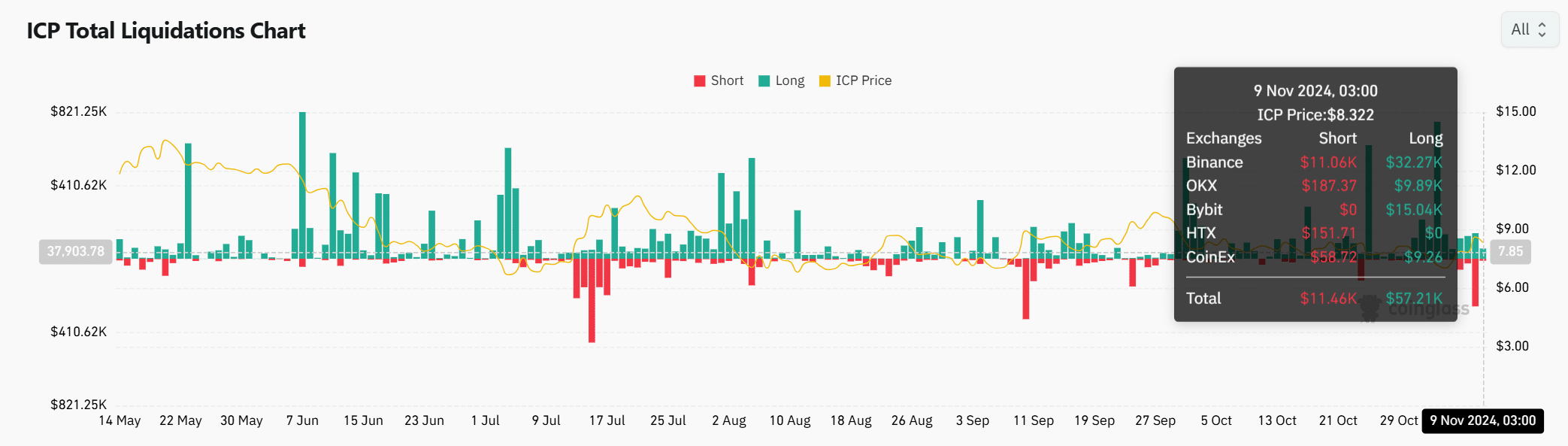

- Steady social volume and bullish liquidation trends underlined growing interest and positive sentiment in ICP

After months of consolidation, Internet Computer Protocol [ICP] could be poised for a significant bullish breakout. Trading at $8.35 and up by 8.29% at press time, ICP seemed to form a bullish pennant pattern on the charts. This is a structure that often signals potential for upward movement.

Therefore, a successful breakout could propel ICP towards the $20-mark, offering compelling buying opportunities for investors seeking bullish momentum. However, whether it can maintain this trajectory remains a critical question.

Can ICP overcome its key resistance to hit new highs?

At press time, ICP was facing a pivotal resistance level around $10.90 – A point it has struggled to breach in the past. A breakout above this level could potentially unlock a path towards the $20 target. However, this resistance remains a significant hurdle as it could dampen bullish enthusiasm if ICP fails to clear it and hold a position above it.

Therefore, the altcoin’s ability to overcome this barrier will likely determine its next phase. If ICP manages to break through with strong volume, it could attract renewed interest – Igniting more buying pressure.

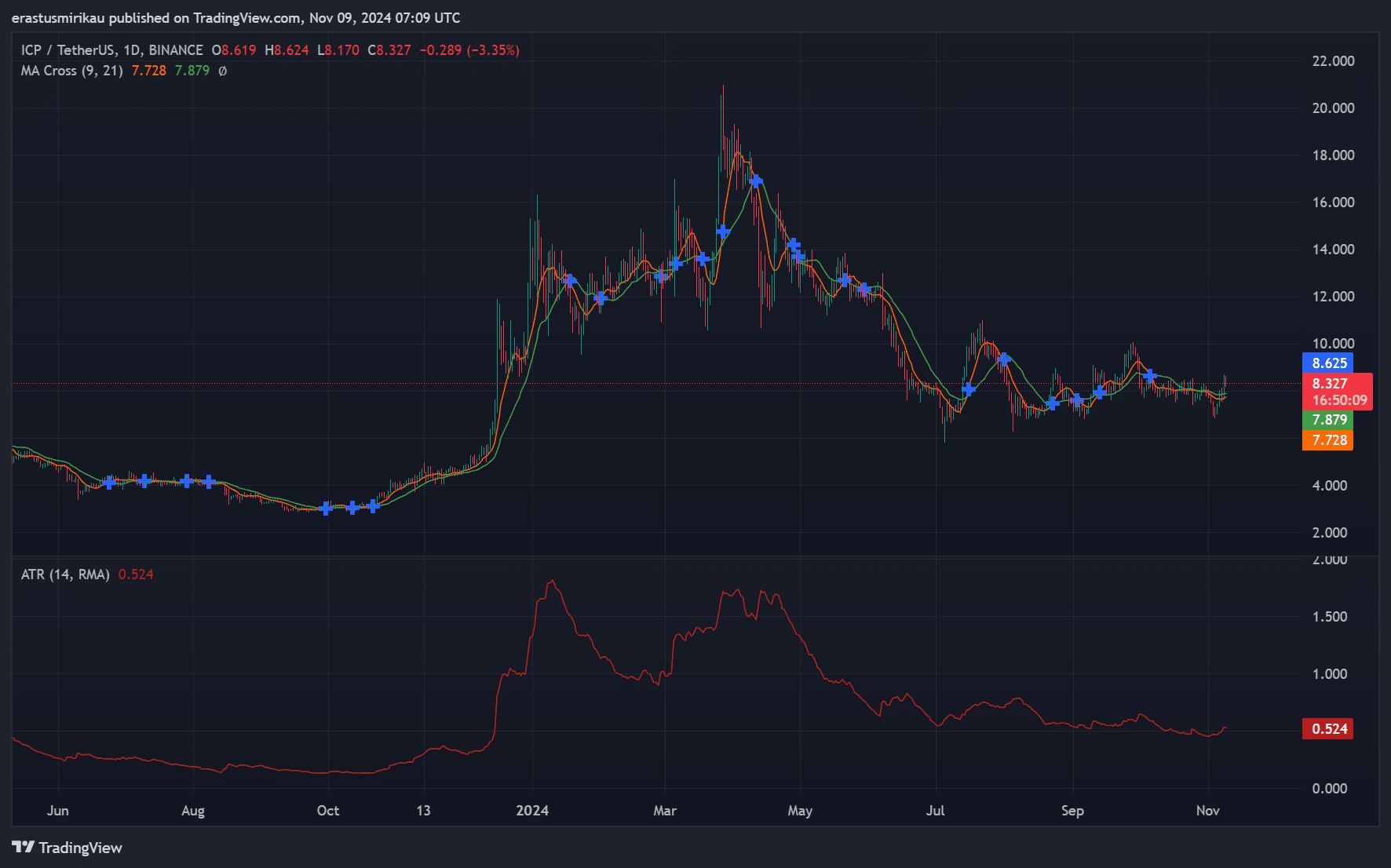

Technical indicators suggest potential for upward movement

When examining the technical indicators, promising signs could be seen on the charts. For example, the recent moving average (MA) cross on the daily chart indicated a shift in the short-term trend, signaling potential support in ICP’s press time range. At the time of writing, the price was trading above both the 9-day and 21-day moving averages, providing a solid base for further upside.

Additionally, the Average True Range (ATR) stood at 0.524, suggesting a low volatility environment. Consequently, this stability could set the stage for a breakout. Especially as low volatility often precedes sharp moves in either direction. Therefore, these indicators collectively painted a picture of underlying strength.

ICP’s social volume sees modest hike

Liquidations reveal investor sentiment

In terms of liquidations, ICP recently saw $57.21k in long positions closed, while short liquidations amounted to $11.46k. This imbalance is a sign of bullish sentiment among traders, as more capital is flowing into long positions.

However, significant price dips could trigger further liquidations, causing volatility. Therefore, monitoring liquidation trends will be crucial as it may indicate whether bullish sentiment is sustainable or if market corrections are on the horizon.

Read Internet Computer’s [ICP] Price Prediction 2024-25

Conclusively, ICP appeared to be primed for a breakout at press time, with strong technical indicators, steady social interest, and bullish liquidation trends in its favour.

If it successfully clears the $10.90 resistance, a rally towards $20 is likely. Investors should prepare for potential gains as the coin shows strong signs of entering a bullish phase in the coming days.