Injective Protocol: How an INJ pullback could be next as FOMO sets in

– INJ may have hit a local top due to the social volume cluster and network growth divergence.

– The project’s traction had waned from the initial hike.

As with any volatile asset, Injective Protocol [INJ] might experience corrections after significant price gains. The INJ token, which enables developer incentives, staking, and governance on the network, moved from $1.2 in January to $9.21 at press time.

Read Injective Protocol’s [INJ] Price Prediction 2023-2024

Not the best of points to consider

But could the current trend still offer a good buying decision? According to Santiment, INJ was at a level where its price was driven by a position where investors might feel a Fear of Missing Out (FOMO).

In crypto, FOMO is defined as a psychological phenomenon where participants have the urge to jump into a rapidly rising market or asset out of potential gains.

Based on the on-chain platform’s analysis released on 17 April, the 30-day active addresses under Injective rose to a Year-To-Date (YTD) high of 3620.

Active addresses show the number of unique interactions that investors have had with a token. This implies that INJ could boast of healthy network activity.

However, a close assessment of the data showed that the bunch of speculation and transaction around the token only arose again on 28 March.

And since the INJ price had decreased a bit, investors who came late to the rally may have been accompanied by risks of overvaluation.The context of falling delight

Likewise, the social volume was able to rise to a six-month high as a result of the price hike on 14 April. But as of this writing, the metric had waned to a value of 42. Such an instance means that the excitement around the token was at its peak.

However, it could also make a good case for the token to reach a local top. As a matter of fact, the network growth was beginning to feel the impact of the loss of elation.

This was due to the drop in the metric, as shown by on-chain data. A simplification of this position infers that the project has been starved of new addresses. Therefore, it was losing traction, and user adoption could be getting increasingly challenging.

Is your portfolio green? Check the Injective Protocol Profit Calculator

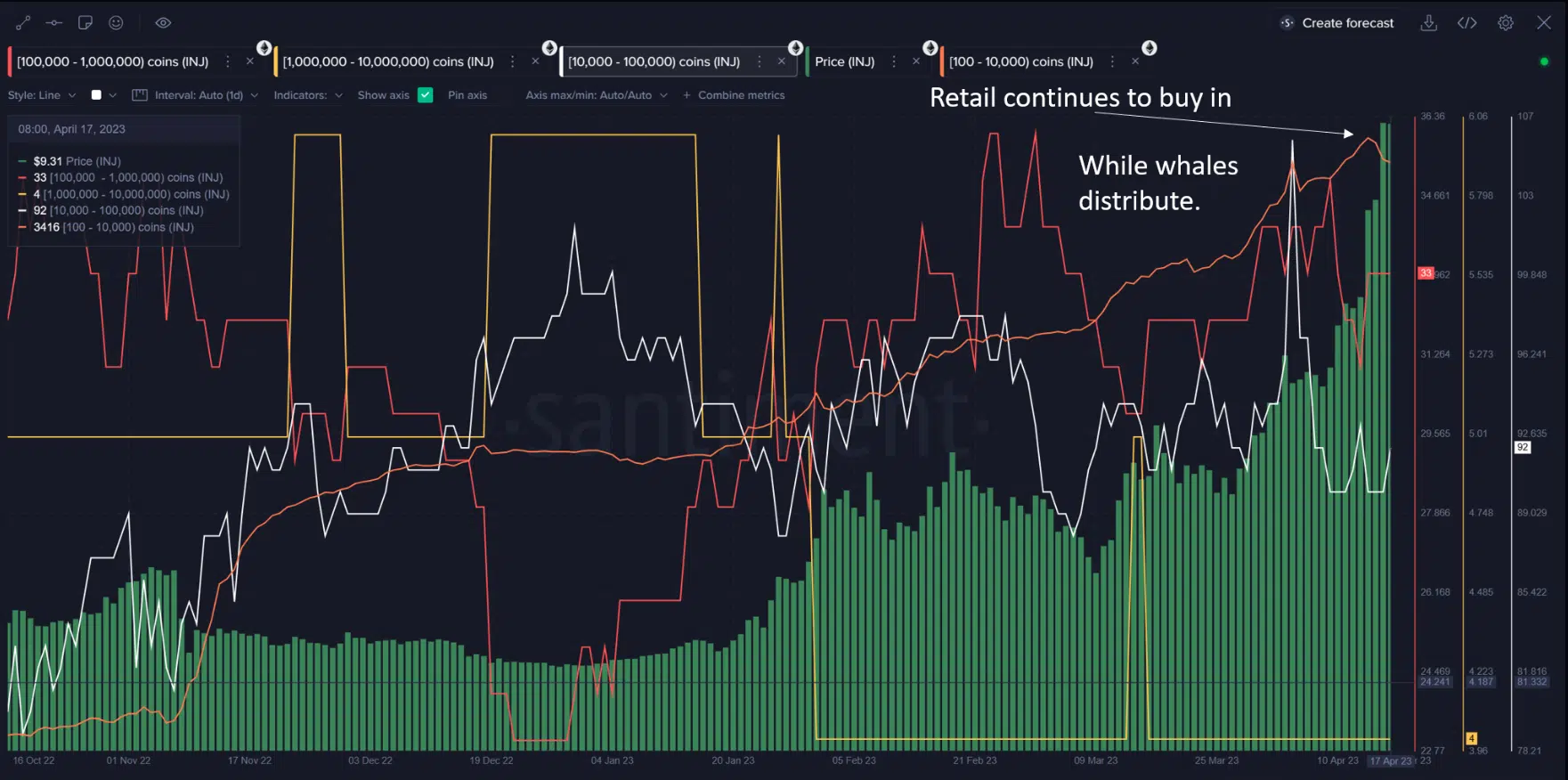

At press time, INJ was in a mangled condition. In the interim, addresses in the retail layer have kept on with the buying spree. Meanwhile, whales, as reported earlier, were engaged in distributing supply and selling.

For what it’s worth, INJ has been able to gain 6.41% in the last 24 hours. The volume also increased by 28%. However, its price still remains on the brink of correction.

![Injective Protocol [INJ] price and active addresses](https://ambcrypto.com/wp-content/uploads/2023/04/Bitcoin-BTC-12.48.20-17-Apr-2023.png.webp)

![Injective Protocol [INJ] social volume and network growth](https://ambcrypto.com/wp-content/uploads/2023/04/Bitcoin-BTC-13.01.07-17-Apr-2023.png.webp)