Injective secures strategic partnership with Chinese tech giant, but…

- INJ demonstrates relative strength despite the resurgence of bearish expectations.

- Injective secures a new cloud computing partnership with Tencent.

Injective’s native cryptocurrency INJ is likely on short sellers’ radar after the bullish run it has been on. But will it really embark on a sizable retracement or continue on its current trajectory? Recent market observations offer some useful insights for traders to consider.

Is your portfolio green? Check out the Injective Profit Calculator

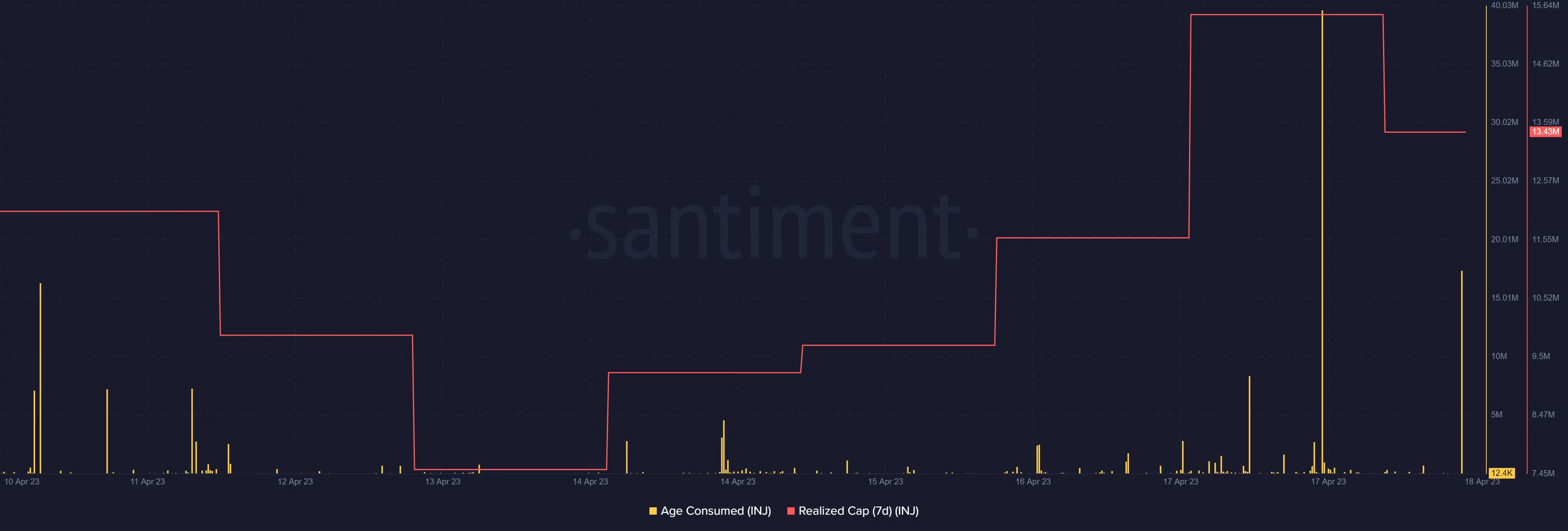

Sell pressure is more likely to manifest especially now that INJ is deep in overbought territory. On a related note, the cryptocurrency’s age-consumed metric registered its highest surge during Monday’s trading session. The second-highest surge occurred in the last 24 hours at press time.

It is also worth noting that INJ’s realized cap metric dropped slightly since the spike in the age-consumed metric. This confirms that a sizable amount of coins that were moved at higher prices were spent. At first glance, it may indicate a resurgence of sell pressure.

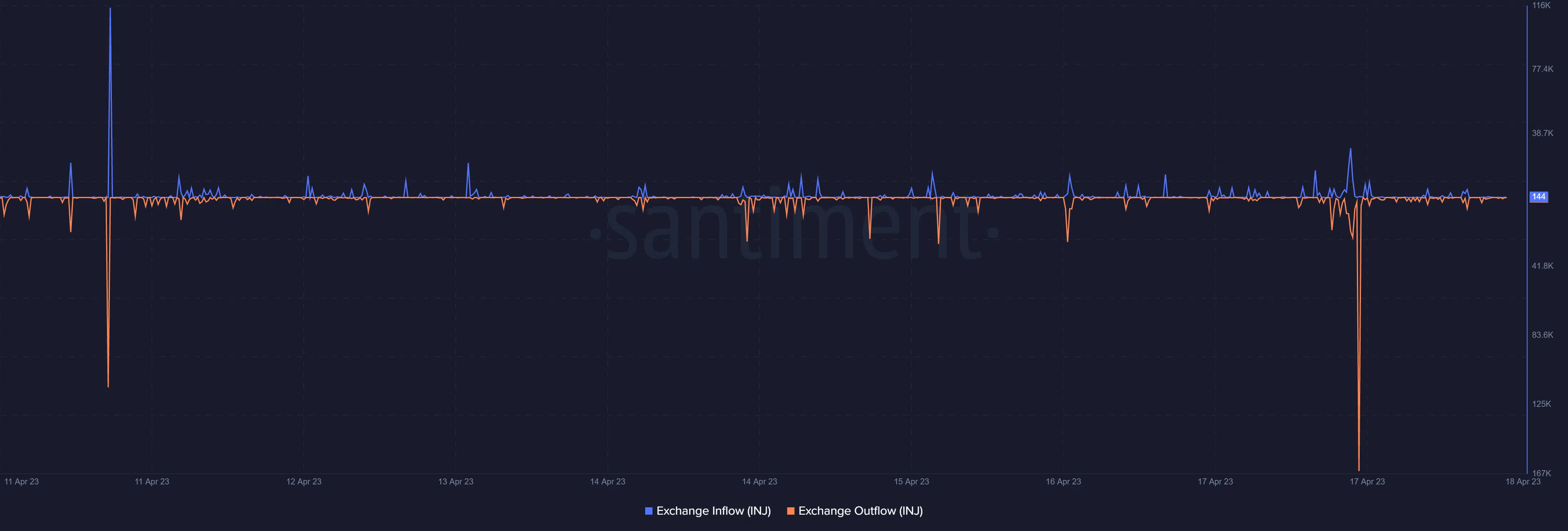

Despite the above findings, INJ exchange flows reveal a different outcome. Exchange inflows confirm a spike, hence denoting a surge in sell pressure.

However, exchange outflows were notably higher than inflows on Monday (17 April), confirming that there was also significant demand that cushioned the price from more downside.

A false positive for the bears?

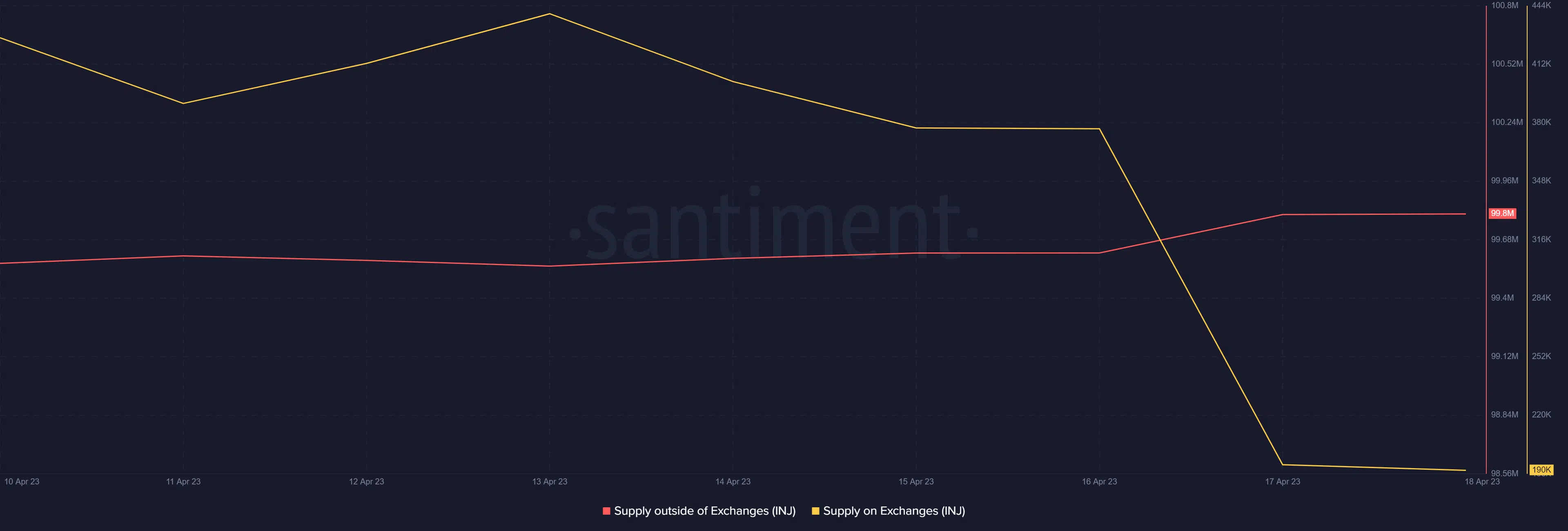

The higher exchange outflows had a clear impact on supply. For example, it triggered a slight uptick in the supply outside of exchanges on Monday, which is a bullish sign. On the other hand, the supply on exchanges, at press time, was at a weekly low.

The hopes of a cool down and potential retracement may end up being delayed given the above expectations.

Recent announcements may also contribute to the delay as they may potentially boost investors’ confidence. Consider this- Injective is looking to take things a notch higher through its new partnership with the Chinese tech giant, Tencent Cloud.

1/ Tencent Cloud is joining forces with @Injective_ to support builders in the Injective ecosystem ?

This collaboration aims to contribute to the growth of the Injective ecosystem, starting with developers in the Injective Global Virtual Hackathon.https://t.co/pb40hYKD4B

— Injective ? (@Injective_) April 17, 2023

Many investors view partnerships between WEB3 projects and traditional companies as a sign of more real-world utility ahead. If the same holds true for Injective, the Tencent partnership will likely fuel more investor confidence.

How many are 1,10,100 INJs worth today?

As far as investor expectations are concerned, accurately timing the next move is likely impossible. But here’s what to consider. INJ’s $9.27 press time price tag is close to the $10 where it will likely experience some resistance based on historic performance.

The market has demonstrated bullish resilience which means investors may retail the bullish bias, hence the potential downside remains limited.

However, the market is still susceptible to unpredictable outcomes that may lend favor to the bulls. Nevertheless, the long-term outlook remains bullish considering Injective’s growth and its developments so far.