Injective’s road ahead: THIS key level holds the secrets to INJ’s next moves

- INJ broke out of a descending channel, surpassing $20, and may rally towards new all-time highs.

- Despite bearish signals, INJ’s recent price action hinted at a potential surprise rally.

Injective [INJ] has captured attention with its recent market activity, particularly after breaking out of a prolonged downtrend.

The price of INJ has been moving within a descending channel since early 2024, consistently encountering resistance at the upper boundary.

However, in August, INJ managed to break out of this channel, moving past the $20 mark after finding strong support in the $12-$14 range.

This breakout led to a sharp rally, pushing the price up to around $44, signaling a potential bullish reversal from its previous downward trend.

Market analysts have been closely watching INJ’s performance, particularly after its recent breakout. According to a post by World of Charts on X (formerly Twitter),

“OverAll Consolidating In Descending Channel Recently Breaks Key Resistance Expecting Move Towards Trendline And If INJ Managed To Break Channel’s Trendline Then We Can Move Towards New Ath In Coming Weeks.”

This statement suggests that the recent breakout could lead to further upward movement, possibly driving INJ to new all-time highs in the near future.

Current market performance

As of this writing, INJ was trading at $18.23 with a 24-hour trading volume of $123,273,162. This represented a slight decline of 1.31% in the past 24 hours, per Coingecko.

Despite the minor setback, the market sentiment around INJ remained focused on its potential to surge, especially after bouncing off a crucial support level at $14.24.

This level has shown strong buying interest, setting the stage for a possible move towards higher resistance zones.

The next major resistance levels to watch are within the $32.50-$35.00 range. If INJ continues to recover and manages to break through this resistance, it could open the door for further gains.

However, it is important to monitor the support level at $17.67, just below the current trading price, to gauge whether the recent bounce can sustain momentum or if there is a risk of further downside.

Bearish signals dominate, but…

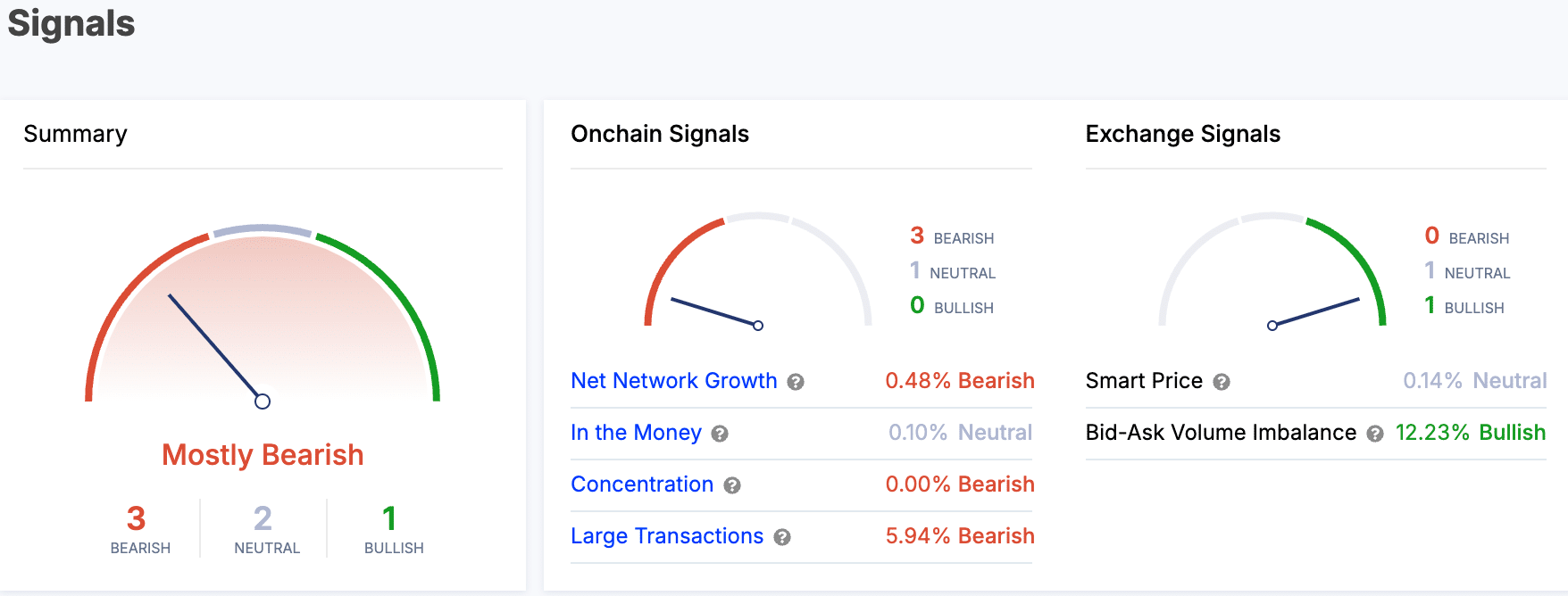

Despite the potential for a surge, the overall sentiment from on-chain and exchange signals for INJ remained mostly bearish.

According to the latest IntoTheBlock data, four out of six indicators were bearish, while two were neutral.

The Net Network Growth was slightly bearish at 0.48%, and Large Transactions were showing a strong bearish signal at 5.94%.

The “In the Money” remained neutral at 0.10%, indicating that there isn’t a strong bullish or bearish bias in terms of the number of profitable transactions.

On the exchange side, the Bid-Ask Volume Imbalance stood at -22.01%, signaling significant selling pressure compared to buying interest.

Realistic or not, here’s INJ’s market cap in BTC’s terms

Additionally, the Smart Price indicator remained neutral, showing no clear directional bias at this time.

Finally, the recent price action in INJ suggested the potential for a substantial upward move if the current momentum continues.