Institutional interest in Arbitrum rises – Will ARB reap the benefits?

- Franklin Templeton has expanded its tokenized security to Arbitrum.

- An observer sees the move as institutional interest in Arbitrum and Ethereum.

Arbitrum [ARB] has recorded remarkable network growth. In July, it ranked third among Ethereum [ETH] L2s with 35.7 million unique addresses.

But with the latest Franklin Templeton move, more network growth seems likely.

The asset manager has opted to expand its tokenized security on the Arbitrum. This partnership will help accelerate the integration of DeFi (Decentralized Finance) within traditional finance (TradFi).

Commenting on the update, Roger Bayston, Franklin Templeton’s Head of Digital Assets, stated,

‘Expanding into the Arbitrum ecosystem is an important step on our journey to empower our asset management capabilities with blockchain technology,”

Will institutional interest boost ARB?

For perspective, the tokenized securities segment exploded after BlackRock made a bet with its BUIDL debut in early 2024.

At the time of writing, Arbitrum ranked as the fourth-highest network in terms of tokenized securities value, which stood at $10.57 million out of a $1.09 billion market cap.

As a result, Franklin Templeton’s wide usage could further boost ARB’s network and value in the segment.

One market observer, Adriano Feria, claimed the Arbitrum move could also trickle down to ETH.

“Industry leaders are not choosing to build on Ethereum by chance… Institutional interest in ETH will snowball from here.”

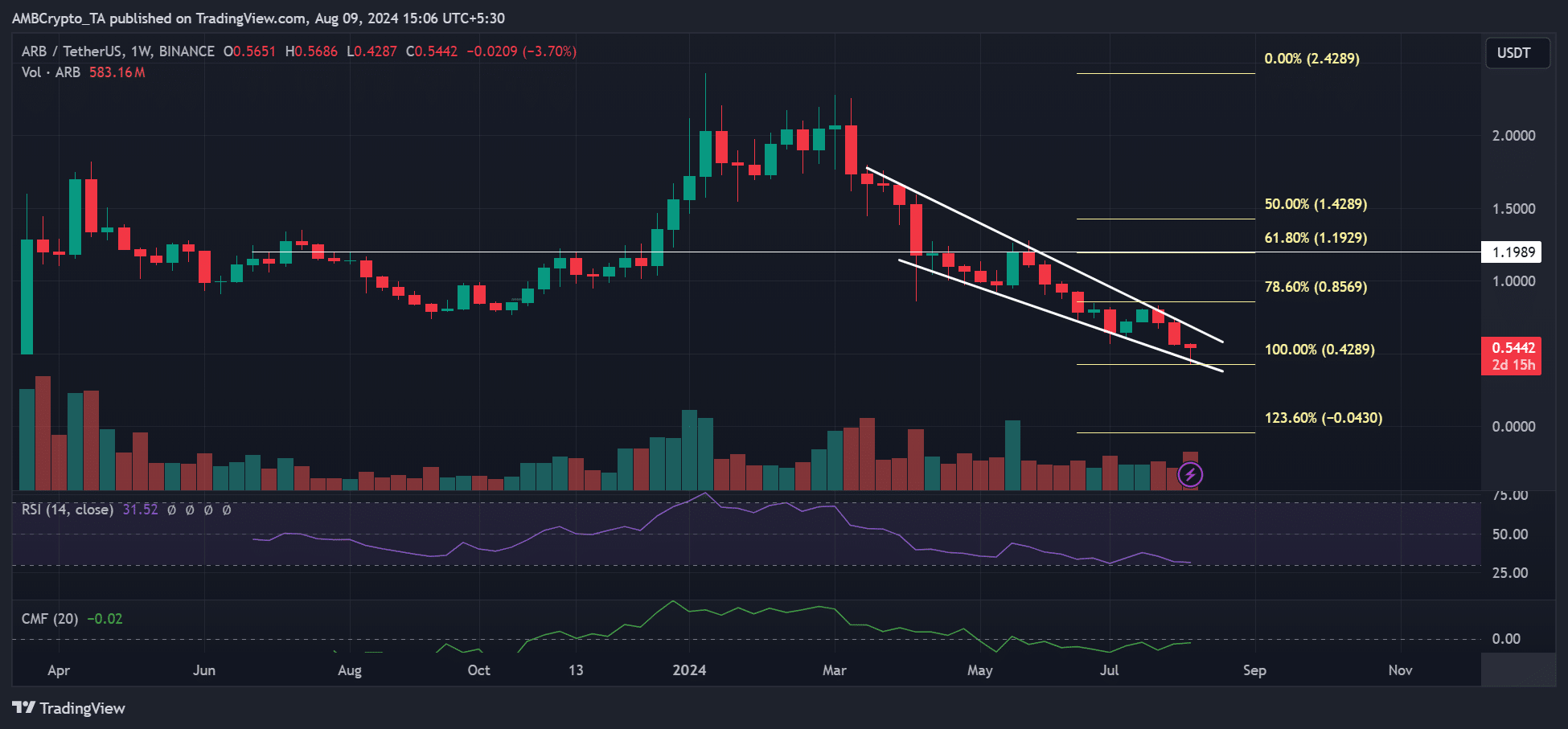

Meanwhile, ARB jumped 14% on the 8th of August, rallying from $0.47 to $0.55. However, the altcoin’s price has been in a downtrend since March.

Over the same period, demand for ARB has remained low, as shown by the downsloping RSI (Relative Strength Index).

The lack of interest dragged ARB 80% lower from its March highs of $2.4 to below $0.5 in August.

Similarly, massive capital outflows over the same period, as shown by the Chaikin Money Flow (CMF) drop.

Despite a recovery from July, inflows haven’t been strong enough to push CMF above the average level and fuel ARB’s price further.

It remains to be seen whether Franklin Templeton will drive more capital inflows and boost ARB’s prospects on the price charts.