Interest in digital assets unabated with multiple weeks of consecutive inflows: Report

- Digital asset investment products logged the fourth week of consecutive inflows last week.

- There has been a significant increase in investments in short-bitcoin, indicating that a substantial number of investors remain uncertain about the future trajectory of the market.

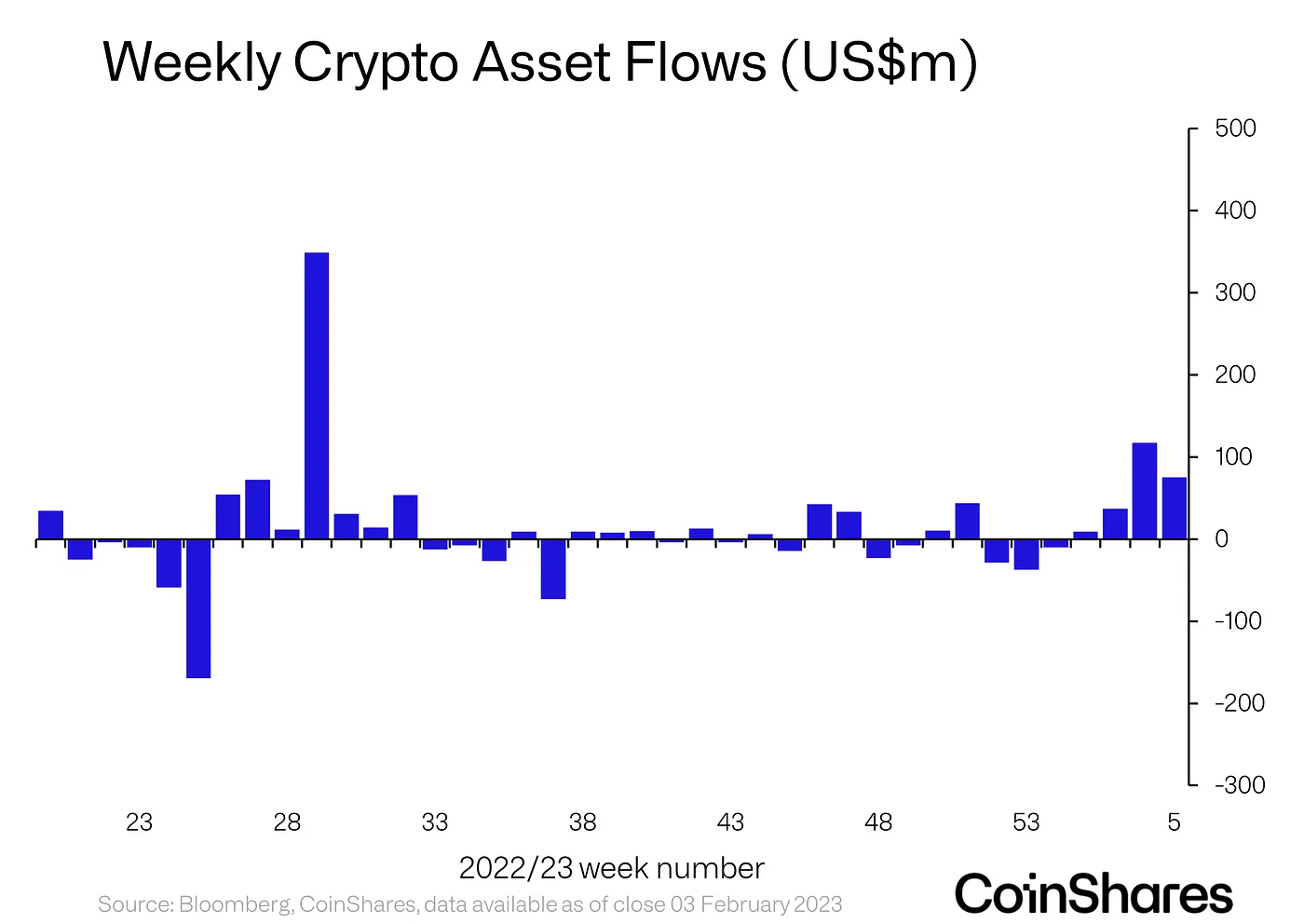

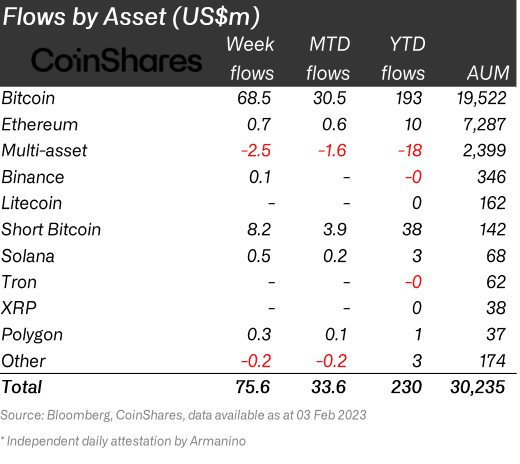

Inflows into digital asset investment products totaled $76 million last week, bringing the fourth consecutive week of inflows to $230 million, CoinShares found in a report on 6 February.

Last week’s inflow represented a 35% decline from the $117 million recorded in inflows the previous week.

Coinshares noted that the consistent increase in inflows into digital assets marked a distinct shift in investor sentiment for the start of 2023. It said:

“Digital asset investment products saw inflows totaling US$76m last week, the 4th consecutive week of inflows with year-to-date inflows now at US$230m, highlighting a decisive change in investor sentiment for the beginning of 2023.”

“Put your money where your mouth is,” Bitcoin says

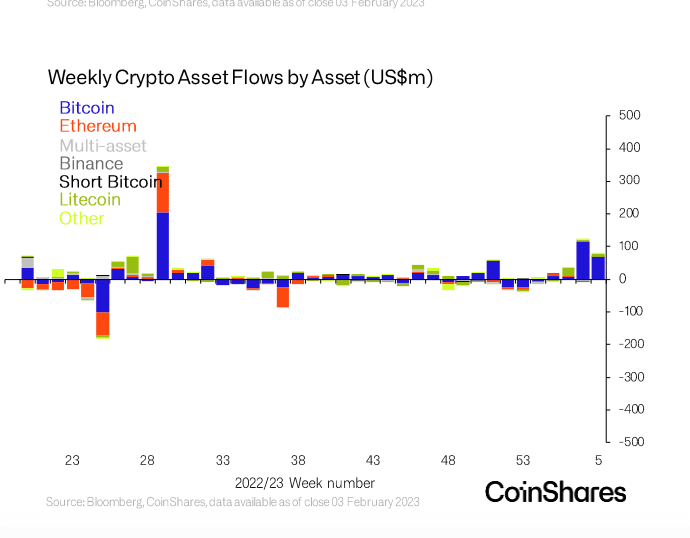

According to Coinshares, investors mostly directed their attention towards Bitcoin [BTC] during the week, with inflows totaling $69 million. This accounted for 90% of the total inflows recorded last week.

Coinshares found that a substantial interest in BTC was predominantly observed in the US, Canada, and Germany, with inflows of $38 million, $25 million, and $24 million, respectively.

While BTC remained the primary focus, inflows into short-Bitcoin reached $8.2 million during the same time frame. Coinshares opined that this meant that the market remained unsure of a continued rally in BTC’s price.

“The rest of the inflows were from short-Bitcoin, which totaled US$8.2m over the same period, highlighting opinion remains divided over the sustainability of this rally.”

Despite being relatively small compared to the long-Bitcoin inflows, the inflows into short-Bitcoin accumulated to $38 million over the past three weeks and comprised 26% of the total assets under management. Nevertheless, the short-Bitcoin trade had yet to be successful year-to-date, with the total short-Bitcoin assets under management declining by 9.2%.

The altcoins did their part

Per Coinshares, Ethereum [ETH] saw only $700,000 of inflows last week, despite the improving clarity around making previously staked ETH coins available with the scheduled Shanghai upgrade.

Other altcoins, such as Solana [SOL], Cardano [ADA], and Polygon [MATIC], also saw minor inflows of $500,000, $600,000, and $300,000, respectively.